Introduction

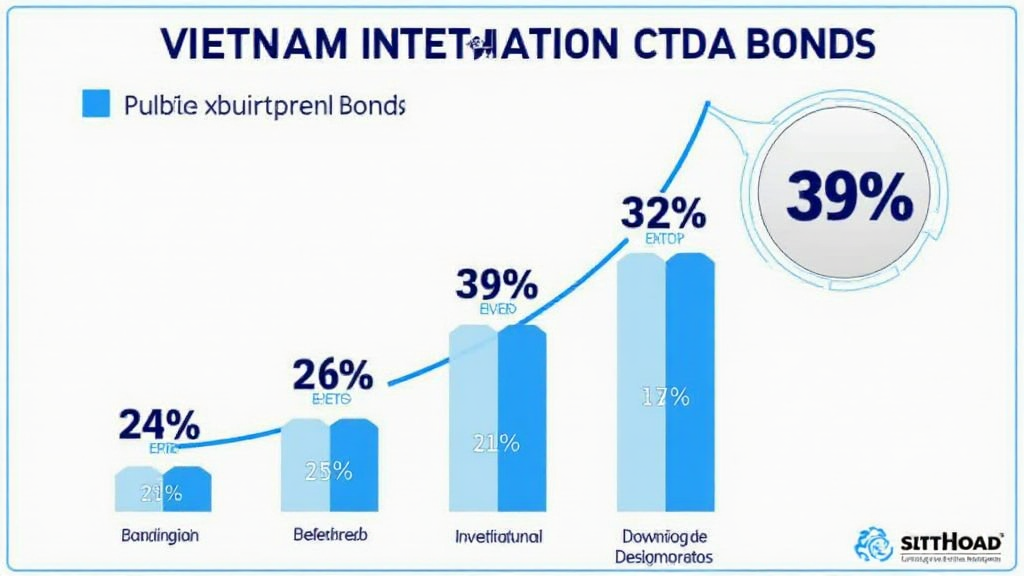

With Vietnam’s rapidly expanding digital economy and a significant rise in the number of cryptocurrency users, the term Vietnam institutional crypto bonds has emerged as a pivotal concept in the evolving landscape of finance. As reported by hibt.com, Vietnam’s user growth rate in cryptocurrency investment was approximately 46% in 2023.

This article delves into the mechanics, benefits, and potential implications of institutional crypto bonds in Vietnam’s financial sector. By the end, we aim to equip readers with a comprehensive understanding of this emerging financial instrument.

Understanding Institutional Crypto Bonds

Institutional crypto bonds are debt securities issued by institutions, allowing them to raise capital in cryptocurrency. These bonds typically offer a fixed interest rate and provide investors with predictable income over time. While traditional bonds are regulated and backed by governments, crypto bonds operate within a more decentralized framework.

Let’s break it down further:

- Liquidity: Crypto bonds can be traded on various cryptocurrency exchanges, making them more liquid than traditional bonds.

- Decentralization: Unlike traditional bonds, which rely on centralized banks, crypto bonds leverage blockchain technology, enhancing transparency.

- Smart Contracts: Many institutional crypto bonds utilize smart contracts to automate enforcement of the bond terms.

The Legal Framework in Vietnam

In Vietnam, the legal framework regarding cryptocurrencies is still developing. Current regulations primarily focus on preventing fraud and ensuring security. The introduction of institutional crypto bonds will necessitate further regulatory clarity.

It is essential to note that tiêu chuẩn an ninh blockchain (blockchain security standards) will need to evolve to ensure the safety of these financial instruments.

Potential Benefits of Institutional Crypto Bonds

Here’s what makes institutional crypto bonds attractive:

- Diverse Investment Opportunities: Investors can diversify their portfolios with crypto bonds, spreading risk across traditional and digital assets.

- Higher Yield: Compared to traditional bonds, crypto bonds can offer higher yield rates due to market demand and the innovative nature of cryptocurrency.

- Growing Acceptance: Institutional bonds signal a shift towards cryptocurrency acceptance in mainstream finance.

Challenges to Overcome

Despite the potential advantages, some challenges remain:

- Regulatory Uncertainty: Investors face risks associated with regulatory changes in the crypto landscape.

- Market Volatility: The crypto market is prone to fluctuations, which could affect bond values.

- Security Concerns: Even with blockchain’s security, there might still be risks of hacks and fraud.

The Future of Vietnam’s Crypto Bonds Market

As Vietnam seeks to enhance its position as a leading digital economy in the ASEAN region, the introduction of institutional crypto bonds could be a game-changer.

According to a report by hibt.com, the demand for cryptocurrency assets among institutional investors is on the rise, suggesting that Vietnam could be at the forefront of this financial shift.

Conclusion

With the potential for significant growth and the evolving nature of institutional crypto bonds, Vietnam’s financial landscape is on the cusp of transformative change. Stakeholders must remain vigilant about the regulatory environment and market trends. We anticipate that as Vietnam institutional crypto bonds gain traction, they will play a pivotal role in shaping the future of digital finance.

Expert Author: Dr. Nguyen Van An is a recognized expert in blockchain finance, having authored over 30 research papers in the field and led major projects on smart contract audits. He is a prominent voice in advocating for blockchain education across Southeast Asia.