Introduction: The Rise of Digital Tokenization in Vietnam

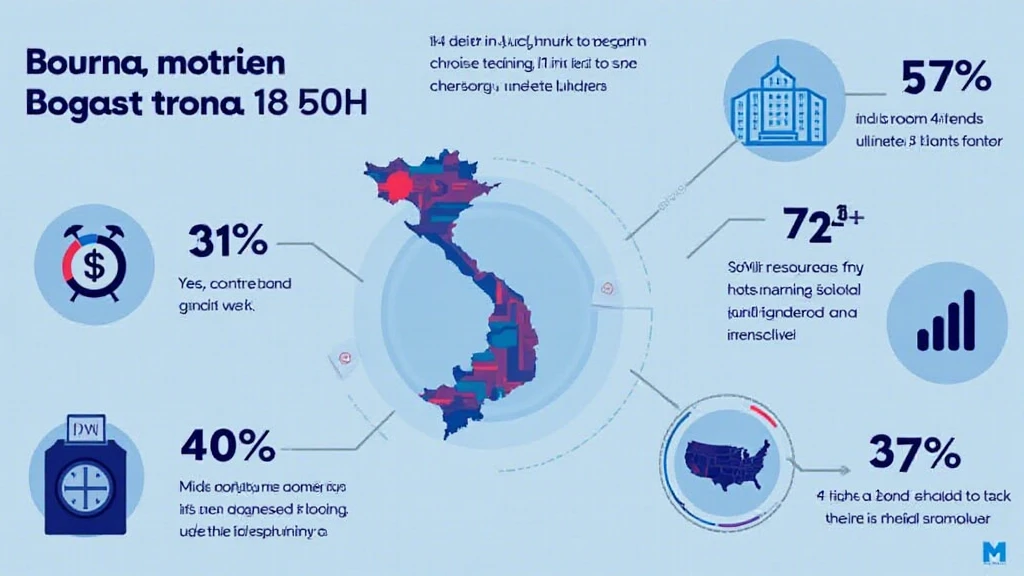

With the surge in blockchain adoption globally, Vietnam is rapidly embracing digital tokenization for government bonds. The concept stems from the need for efficient, transparent, and secure financial transactions in an evolving economy. In 2023 alone, Vietnam’s digital asset market saw a staggering growth rate of 350%, indicating a burgeoning interest in the intersection of traditional finance and blockchain technology.

In light of recent trends, the question arises: What does digital tokenization mean for the Vietnamese economy and its investors?

Understanding Digital Tokenization and Its Benefits

Digital tokenization refers to the process of converting assets into digital tokens on a blockchain. This innovation offers several advantages:

- Enhanced Security: By utilizing tiêu chuẩn an ninh blockchain, the risk of fraud is significantly minimized.

- Increased Liquidity: Tokenized assets can be traded on various platforms, providing investors with more opportunities to buy and sell.

- Cost Efficiency: The elimination of intermediaries reduces transaction costs considerably.

As Vietnam looks to integrate blockchain technology in its financial systems, understanding these benefits becomes critical for both investors and policymakers.

The Current State of Vietnam’s Government Bond Market

Vietnam’s government bond market is one of the most dynamic in Southeast Asia, with total outstanding bonds reaching approximately $59 billion in 2023. In efforts to further stimulate this market, the Vietnamese government aims to introduce digital tokenization for bonds, which could enhance investor confidence and attract foreign investments.

Here’s where things get interesting: Experts predict that the adoption of digital tokens in Vietnam’s government bonds could double the market size by 2025.

How Digital Tokenization Works for Government Bonds

The process of applying digital tokenization to government bonds in Vietnam involves several key steps:

- Issuance: The government issues bonds in the form of digital tokens on a blockchain network.

- Smart Contracts: These tokens are governed by smart contracts, ensuring automatic compliance to regulations and terms.

- Trading: Investors can trade these tokens on blockchain platforms, thereby enhancing liquidity.

For example, consider a scenario similar to how traditional bonds are issued but with a digital twist—investors purchase bonds via a decentralized exchange, experiencing immediate settlement.

The Prospects of Digital Tokenization for Investors

Investors stand to gain significantly from the implementation of digital tokenization:

- Access to New Markets: Small investors can now participate in government bonds, previously accessible mostly to institutional players.

- Transparent Transactions: Blockchain technology ensures all transactions are public and immutable, enhancing trust.

- Faster Settlements: The reliance on blockchain allows for real-time settlement, as opposed to the multi-day waits associated with traditional bonds.

In the near future, Vietnam could be a leader in offering blockchain-based investment opportunities.

Real-World Applications and Innovations

Various initiatives globally offer insights into how digital tokenization can succeed. Countries like Singapore have already rolled out tokenized bond offerings, yielding remarkable results. For instance, the Monetary Authority of Singapore issued a $450 million tokenized bond with successfully reduced transaction times and costs.

With such examples in mind, Vietnam can adopt similar frameworks tailored to its unique market requirements. By 2025, tokenized bonds could become a mainstream investment product in Vietnam.

Challenges and Considerations in Implementing Digital Tokenization

Despite significant benefits, several hurdles need to be addressed:

- Regulatory Compliance: Establishing a clear legal framework for digital tokens is vital.

- Market Education: Investors need to understand how tokenization works and its potential risks.

- Technology Infrastructure: Developing robust technology platforms is crucial for seamless operations.

Addressing these challenges requires collaborative efforts among stakeholders in Vietnam’s financial sector.

Conclusion: The Future of Vietnam’s Financial Landscape

As the Vietnamese government explores the tokenization of bonds, potential for economic growth and improved security will follow. Embracing innovations such as digital tokenization aligns Vietnam with global financial trends, ultimately benefiting investors and the economy alike.

In summary, digital tokenization of government bonds in Vietnam can set the stage for a financially inclusive, efficient, and transparent future.

For the latest insights into cryptocurrency and blockchain adoption in Vietnam, keep following cryptocoinnewstoday.

Author: Dr. Nguyen Minh, a blockchain technology expert, has published over 15 papers on digital assets and has led audits for notable projects in the region.