Vietnam Blockchain Bond Market Trends: A Deep Dive into Future Opportunities

In recent years, blockchain technology has risen to prominence, revolutionizing various sectors, including finance. Particularly in Vietnam, we’ve seen remarkable growth in the blockchain bond market, aligning with the country’s ambition to leverage innovative technologies for economic development. With analysts anticipating that the Vietnam blockchain bond market could see a substantial boost, it raises pressing questions: What are the driving trends behind this growth? How can stakeholders educate themselves on this rapid evolution? In this article, we’ll dive deep into the emerging trends, challenges, and future opportunities present in Vietnam’s blockchain bond market.

Understanding the Rise of Blockchain in Vietnam

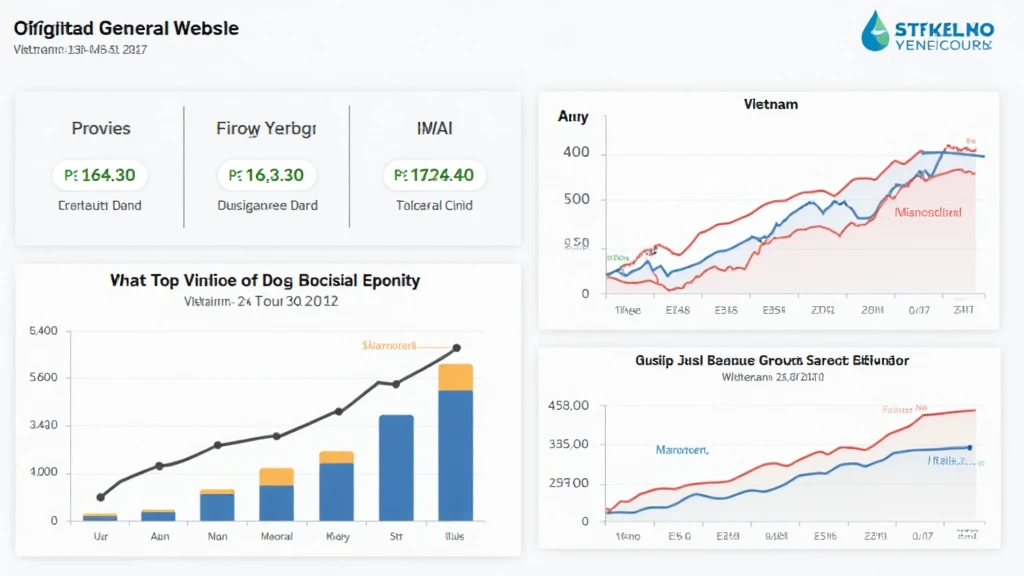

According to recent reports, Vietnam’s user growth rate in blockchain technology has surged over 250% since the last quarter of 2022. This expansion reflects a keen interest in a more secure, transparent, and efficient financial ecosystem. The integration of blockchain into the bond market promises improved security and reduced transaction costs, which can be a game-changer for investors.

To illustrate the evolving dynamics, the Blockchain Development Roadmap Framework (2025) highlights the government’s focus on adopting tiêu chuẩn an ninh blockchain (blockchain security standards), empowering the financial market to adopt innovative technologies while ensuring regulatory compliance. This dual focus aims will enhance trust and safety in financial transactions.

Key Trends Shaping the Blockchain Bond Market in Vietnam

- Increased Adoption of Decentralized Finance (DeFi): DeFi platforms are reshaping how bonds are issued and traded.

- Tokenization of Assets: Tokenization presents new ways to invest in bonds, making them accessible to a broader audience.

- Regulatory Developments: The Vietnamese government is actively working towards establishing a legal framework for blockchain technology.

- Partnerships between Tech Companies and Financial Institutions: Collaborative efforts are enhancing the infrastructure needed for a robust blockchain bond market.

1. Increased Adoption of Decentralized Finance (DeFi)

The DeFi movement has gained traction in Vietnam, enabling investors to engage with bonds without traditional intermediaries. Platforms like hibt.com are facilitating this transition by providing the necessary tools for secure and transparent transactions, significantly reducing operational costs.

2. Tokenization of Assets

Tokenization turns bonds into digital tokens that can be easily bought, sold, or traded on blockchain platforms. This innovation not only democratizes access to bonds but also enhances liquidity in the financial market. As a result, there’s an increasing appetite for investing in tokenized bonds in Vietnam, especially among younger, tech-savvy investors.

3. Regulatory Developments

In light of the rapid expansion of blockchain technology, the Vietnamese government is setting up a regulatory framework focusing on security and compliance. This regulatory clarity boosts confidence in blockchain-based financial instruments and aims to mitigate risks associated with fraud and market volatility. For instance, under the new regulations, companies looking to issue blockchain bonds will need to adhere to strict compliance standards.

4. Partnerships between Tech Companies and Financial Institutions

Collaborations are emerging between tech startups and established financial institutions, creating a robust ecosystem for blockchain bonds. These partnerships enhance the outreach of blockchain solutions in the bond market while addressing existing challenges related to security and investor trust.

Challenges Facing the Blockchain Bond Market

Despite the exciting prospects, certain challenges remain. Issues related to tiêu chuẩn an ninh blockchain (blockchain security standards) are paramount. High-profile hacks and data breaches in the past have necessitated a more stringent approach to security measures. The responsibility lies with firms to ensure they incorporate best practices in safeguarding their digital infrastructures.

Moreover, the lack of awareness regarding blockchain technology can hinder its adoption. Education and outreach programs tailored to bond investors could be instrumental in bridging the knowledge gap. Only with informed stakeholders can the full potential of the blockchain bond market be realized.

Case Studies of Successful Blockchain Bond Implementations

Understanding how blockchain is currently being used in the bond market can help illuminate its potential. Notable instances worldwide include:

- Singapore’s Monetary Authority: Launched a blockchain-based bond issuance platform that enables bonds to be issued digitally, streamlining the process and enhancing market participation.

- Germany’s Deutsche Börse: Issued blockchain bonds on a private blockchain, showcasing operational efficiency and improved risk management.

As we look towards the future, it’s evident that Vietnam has the potential to become a leader in the blockchain bond domain by adopting innovative practices observed in these successful case studies.

Future Opportunities in the Vietnam Blockchain Bond Market

The future of Vietnam’s blockchain bond market is rich with possibilities. Emerging technologies and evolving financial practices promise to reshape how capital flows into infrastructure and sustainable projects across the nation. Here are some opportunities:

- ****Investment in Infrastructure Bonds:**** With high interest in infrastructure development, blockchain could facilitate fund raising through bond issuance.

- Sustainable Bonds: Blockchain can improve transparency in the sustainability reporting of bonds.

- Market Expansion: Entrepreneurs can introduce new blockchain bond types, catering to diverse investor profiles.

The culmination of these factors creates a fertile ground for investment and innovation in Vietnam’s blockchain bond market.

Conclusion

In summary, the Vietnam Blockchain Bond Market Trends indicate an exciting landscape of growth driven by blockchain technology. As the country embraces tiêu chuẩn an ninh blockchain (blockchain security standards), we anticipate enhanced investor trust and wider participation in the bond market. Stakeholders will need to remain proactive in overcoming challenges while capitalizing on opportunities presented by blockchain innovations. For anyone interested in understanding the potential of blockchain within Vietnam’s financial framework, staying informed and engaged will be key to unlocking future growth.

Author: Dr. Nguyen Anh. A financial expert with over 15 years of experience in blockchain technology and finance, Dr. Nguyen has published over 20 papers on digital assets and has led blockchain project audits for several prestigious firms across Asia.