Vietnam Government Bond Blockchain Networks: Transforming Finance

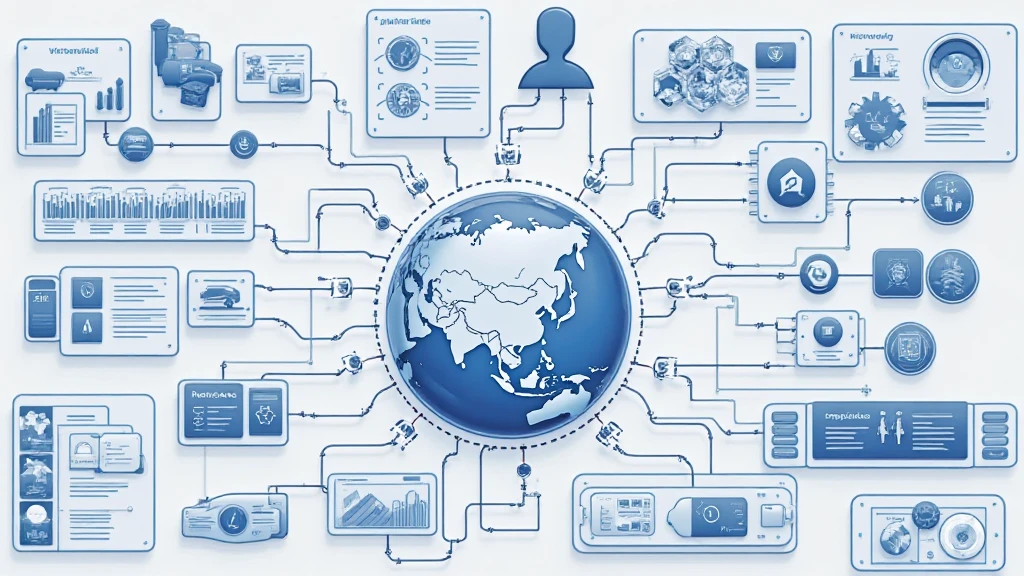

In 2024, the global economy faced significant challenges, with an estimated $4.1 billion lost due to vulnerabilities in traditional financial systems. As the world pivots toward more secure and efficient solutions, Vietnam stands at the forefront with its government bond blockchain networks. This innovative approach not only enhances transparency but also improves user trust in government securities. In this article, we’ll explore the intricacies of these blockchain networks, their implications on Vietnam’s financial landscape, and how they can serve as a model for other nations.

The Rise of Blockchain in Vietnam’s Financial Sector

Vietnam’s financial sector has been experiencing a surge in technology adoption. The growth rate of Vietnamese users embracing digital financial solutions is around 75%, highlighting a significant shift toward modern solutions. The integration of blockchain technology into government bonds is a monumental step in making transactions more secure. Let’s break down some of the key components:

- Security: The use of tiêu chuẩn an ninh blockchain (blockchain security standards) protects sensitive financial information against fraud and hacking.

- Efficiency: Blockchain networks reduce transaction times from days to a matter of minutes, which is critical in financial markets.

- Transparency: All transactions on the blockchain are recorded immutably, which increases accountability and reduces corruption risks.

How Vietnam’s Blockchain Networks Operate

The implementation of blockchain in government bonds functions similarly to a digital ledger. Here’s how it works:

- Each bond issue is represented as a token on the blockchain, allowing for instant verification and validation.

- Investors can buy and sell these tokens in real-time, providing liquidity and reducing reliance on intermediaries.

- Smart contracts are utilized to automate payment processes, ensuring timely and accurate transactions.

A Case Study: The First Blockchain-Based Government Bond in Vietnam

In early 2024, the Vietnamese government launched its first blockchain-based bond, successfully raising 500 billion VND within hours. The success of this initial offering demonstrated the viability of blockchain in public finance and attracted interest from both domestic and international investors. According to reports, more than 60% of participants were new investors, showcasing a growing appetite for digital assets in Vietnam.

| Year | Amount Raised (VND) | Number of Investors |

|---|---|---|

| 2024 | 500 Billion | Over 200 |

Challenges and Considerations in Adopting Blockchain

While the benefits of blockchain are immense, there are several challenges facing its adoption in Vietnam, including:

- Regulatory Framework: A comprehensive regulatory framework is necessary for the legal acceptance of blockchain-based bonds.

- Public Awareness: Increased education and understanding of blockchain technology among the populace are essential for widespread adoption.

- Technology Infrastructure: Upgrades to current technological infrastructures may be required to support blockchain networks.

The Future Outlook for Vietnam’s Blockchain Networks

The potential for blockchain technology in Vietnam’s finance sector is immense. Industry experts predict that by 2025, blockchain will facilitate up to 40% of all government bond transactions. With Vietnam focusing on increasing its funding through more digital channels, blockchain represents a significant opportunity for growth.

Moreover, as global interest in blockchain continues to rise, Vietnam could lead the charge in setting new standards for tiêu chuẩn an ninh blockchain. By becoming a hub for blockchain innovations, Vietnam could attract foreign investments and strengthen its economy.

The Role of Local Institutions

Local banks and financial institutions in Vietnam are beginning to recognize the importance of joining the blockchain revolution. Cooperative efforts between government authorities and financial sector players are vital for successful implementation. Here are steps being taken:

- Partnerships with tech companies to develop blockchain solutions tailored for Vietnamese markets.

- Investment in education and training programs to enhance understanding of blockchain in finance.

Conclusion: A Bright Future Ahead

In conclusion, the use of blockchain networks for government bonds in Vietnam signifies a transformative shift in how financial transactions can be secured and conducted. This technology not only brings enhanced security and efficiency but also aligns with Vietnam’s broader goal of integrating digital solutions across various sectors. By embracing blockchain, Vietnam is not just modernizing its financial systems but setting a benchmark for other developing nations as they too look to adopt digital innovations. This evolution is clearly a pivotal moment in Vietnam’s financial trajectory, and the world is watching closely.

Through these advancements, Vietnam is poised to revolutionize its bond market and enhance its standing in the global financial landscape. Whether you are a local investor or international stakeholder, keeping an eye on Vietnam’s blockchain initiatives could prove beneficial.

For more insights into the evolving landscape of cryptocurrency and financial technology, visit cryptocoinnewstoday.

Author: Dr. Nguyen Anh Tuan – A blockchain technology expert with over 15 published papers in the field and a known contributor to multiple projects focusing on digital asset security.