Exploring Vietnam’s CBDC and Stablecoins Landscape

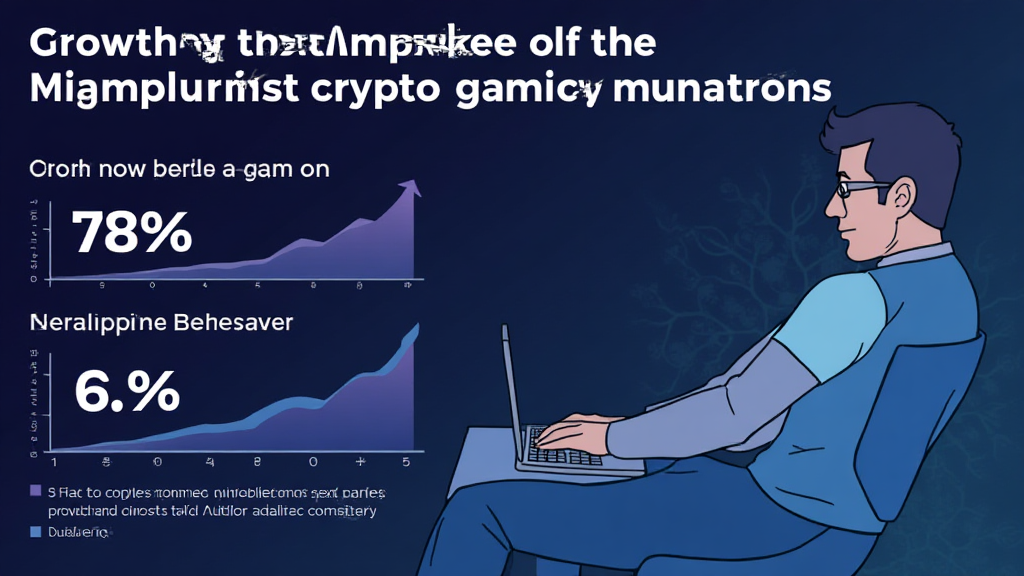

In recent years, Vietnam has seen a significant shift towards the adoption of digital currencies, primarily driven by the potential of Central Bank Digital Currencies (CBDCs) and stablecoins. With a population increasingly engaged in digital commerce, this trend presents both opportunities and challenges. As of 2024, Vietnam’s digital payment sector is projected to reach $15 billion, with a growth rate of 20% annually. This substantial figure raises critical questions about the future of finance in the region.

Understanding CBDCs: A New Era for Vietnam

The State Bank of Vietnam (SBV) has been exploring the implementation of a CBDC as a response to growing digital transactions. A CBDC represents a digital form of a nation’s fiat currency, fully regulated and under the control of the central bank. The primary objectives of introducing a CBDC in Vietnam include enhancing payment efficiency, reducing transaction costs, and ensuring financial inclusivity.

Trust and Security in CBDC Implementation

- Consumer Trust: Building consumer confidence in digital currencies is paramount. In a survey conducted by Statista, 60% of Vietnamese respondents expressed concerns about the security of digital currencies.

- Regulations: Regulatory frameworks are essential for safeguarding users. Key institutions will need to establish tiêu chuẩn an ninh blockchain to foster trust in the new system.

- Technological Infrastructure: Robust technological underpinnings must be in place to support CBDC transactions, ensuring scalability and security.

Stablecoins: Bridging the Gap in Digital Transactions

Stablecoins provide a solution to the volatility often associated with cryptocurrencies. Pegged to stable assets, they offer the reliability that consumers and businesses need. In Vietnam, the rise of stablecoins is evident as businesses increasingly adopt them for everyday transactions.

Benefits of Stablecoins in Vietnam

- Price Stability: Stablecoins significantly reduce the risk of price fluctuations, making them suitable for merchants.

- Fast Transactions: Transactions using stablecoins can be settled within minutes, providing a competitive edge in the fast-paced digital economy.

- Reduced Costs: By eliminating intermediaries, stablecoin transactions can dramatically lower costs for users.

The Role of the Vietnamese Government in Digital Currency Adoption

The Vietnamese government has taken a proactive approach to digital currency regulation. The SBV is conducting pilot programs to assess the feasibility of a nationwide CBDC. This involvement is crucial for cải thiện hệ thống thanh toán and ensuring compliance with international standards.

Regulatory Challenges Ahead

- Legal Framework: Establishing a well-defined legal framework is crucial for the success of CBDCs and stablecoins, but currently, the regulatory environment remains ambiguous.

- International Collaboration: Vietnam’s regulation should align with international best practices to facilitate cross-border transactions.

- Consumer Protection: Striking a balance between innovation and consumer protection will be a challenge for regulators.

Market Trends and Predictions for 2025

Looking ahead, Vietnam’s digital currency market is expected to flourish. Industry analysts project that by 2025, the number of crypto users in Vietnam could rise to 20 million, a testament to the growing acceptance of digital assets.

Key Considerations for Stakeholders

- Investment Opportunities: With more businesses exploring blockchain applications, investment potential is significant.

- Educational Initiatives: Educating the public about digital currencies will be essential in overcoming skepticism and improving adoption rates.

- Technological Innovations: Advancements in blockchain technology will continue to shape the landscape, providing opportunities for growth.

Conclusion: The Future of CBDCs and Stablecoins in Vietnam

The journey towards implementing CBDCs and stablecoins in Vietnam is filled with potential yet fraught with challenges. Understanding the state of the market and the regulatory landscape will be crucial for stakeholders aiming to leverage these innovations effectively. As the nation embraces this digital revolution, the role of blockchain technology will be more prominent than ever, paving the way for a more inclusive financial system.

As Vietnam progresses towards a digital economic model, the synergy between CBDCs and stablecoins will undoubtedly play a pivotal role in shaping the financial future of the country.

For more insights on the evolving landscape of cryptocurrencies, visit cryptocoinnewstoday.

Written by Viet Nguyen, a blockchain expert with over 10 published papers in the fintech space, and has led multiple audits for well-known blockchain projects.