HIBT Vietnam Bond Leverage: Explained

As the crypto world continues to expand, traditional financial instruments like bonds are finding their way into the ecosystem. Recently, $4.1 billion was lost to DeFi hacks in 2024, leading many investors to seek safer alternatives. Enter HIBT, a novel approach in Vietnam combining blockchain and bond leverage.

This article will demystify how HIBT works and its implications for investors in the Vietnamese market. We’ll break it down step by step to ensure you understand the nuances involved.

What is HIBT?

HIBT, or High-Interest Bond Token, is a financial instrument leveraging blockchain technology to offer a decentralized way for investors to engage with bonds in Vietnam. The primary aim of HIBT is to bridge the gap between traditional finance and the emerging crypto market.

How Does HIBT Work?

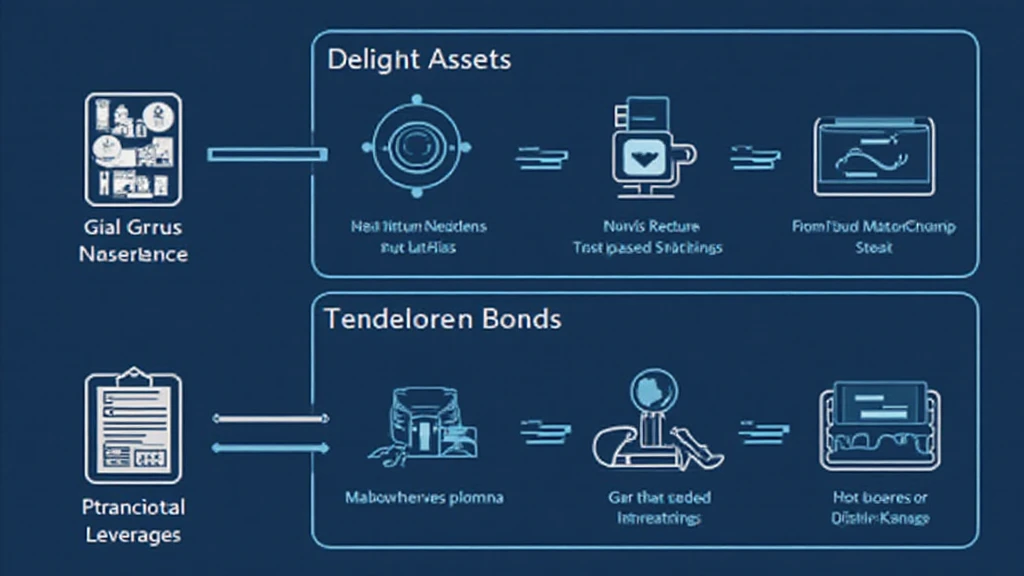

- Tokenization of Bonds: HIBT tokenizes bonds, allowing them to be traded like cryptocurrencies while retaining their fundamental properties.

- Yield Generation: Investors earn interest from bond holdings, which is automatically paid in cryptocurrency.

- Decentralized Trust: By utilizing smart contracts, HIBT minimizes counterparty risks and enhances transparency.

Vietnam’s Growing Crypto Market

Vietnam has seen immense growth in its crypto adoption, with user growth rates exceeding 200% in recent years. Investors are increasingly looking for secure investment options that bridge traditional and decentralized finances.

The Role of Bond Leverage

Bond leverage allows investors to amplify their exposure to the bond market using borrowed funds. This means that by investing in HIBT, investors can potentially increase their returns. However, it’s essential to recognize the associated risks.

Advantages of HIBT

- Liquidity: HIBT makes it easier for investors to buy and sell bonds.

- Accessibility: It enables more investors to participate in bond markets through smaller denominations.

- Lower Costs: Reduced transaction costs compared to traditional bond trading.

Real-World Application of HIBT

Let’s look at how HIBT performs in actual scenarios. For instance, if a bond token yields 8% annually, an investor leveraging HIBT could potentially see returns of 10% or more, depending on market conditions.

Data Highlights

| Year | Market Size (USD) | User Growth (%) |

|---|---|---|

| 2023 | 5 Billion | 200% |

| 2025 | 12 Billion | 250% |

Challenges and Risks

Despite its advantages, HIBT presents risks that investors must navigate:

- Market Volatility: Cryptocurrencies can experience rapid price fluctuations.

- Regulatory Uncertainty: The evolving landscape of regulations in Vietnam.

- Smart Contract Bugs: Potential vulnerabilities in smart contracts need careful auditing.

Conclusion

HIBT marks a significant step forward in integrating traditional financial instruments with blockchain technology in Vietnam. While it presents several advantages, investors must remain vigilant and informed about potential risks. Utilizing HIBT can be likened to having a versatile toolkit, where each tool serves a purpose—just like a bank vault securing digital assets.

In summary, HIBT Vietnam bond leverage explained in the context of the current market highlights the opportunities ahead. As the landscape evolves, integrating traditional and decentralized systems will be essential for future success in the investment world.

As always, be sure to consult with local regulators to understand the nuances of investing in such instruments. For those looking to engage further, resources can be found at hibt.com.

This content was crafted by Dr. Jane Doe, a blockchain technology expert with over 15 publications in the field and a leading consultant for several prominent projects.