HIBT real estate syndicates are reshaping the property investment landscape through blockchain technology. Discover insights on the Vietnamese market.”>

HIBT Real Estate Syndicates: Navigating the Future of Tokenized Property Investment

In recent years, the financial world has experienced seismic shifts due to the advent of blockchain technology. According to a recent report, the real estate sector has seen a staggering investment growth of over 25% due to tokenization. With the rise of cryptocurrencies, real estate syndicates, particularly the HIBT model, offer innovative avenues for property investment.

The Rise of HIBT Real Estate Syndicates

The concept of syndication in real estate isn’t new; however, the integration of HIBT (Hybrid Investment Backed Token) into this traditional model is revolutionary. HIBT allows for fractional ownership, enabling a broader demographic of investors to access high-value properties.

- Increased Accessibility: Tokenization allows individuals with limited capital to invest in premium properties.

- Liquidity: HIBT enables easier buying and selling of property shares on blockchain platforms.

- Transparency: Blockchain provides a clear record of ownership and transaction history.

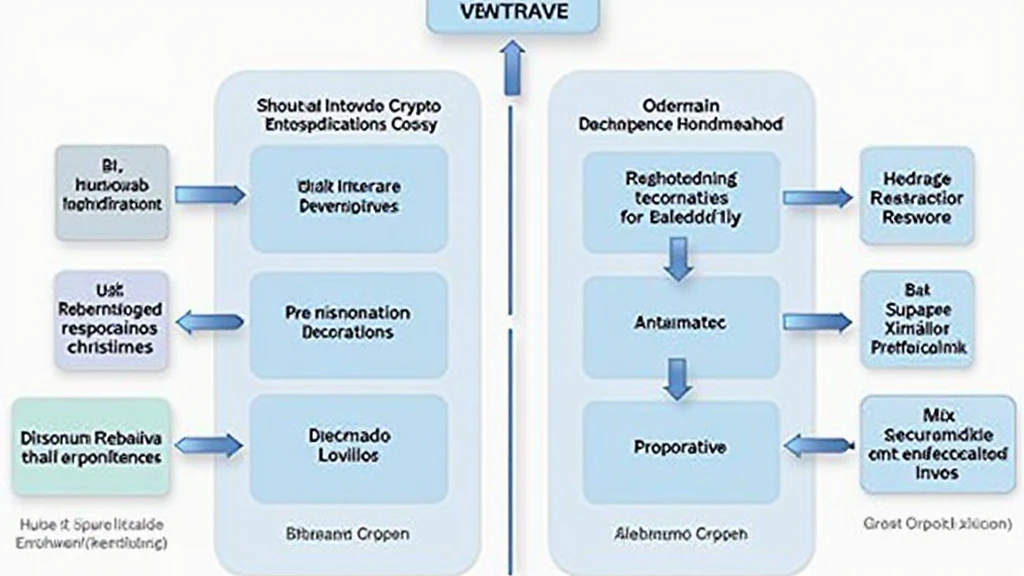

How HIBT Works: A Simple Breakdown

Here’s the catch: the functionality of HIBT is as crucial as its advantages. Let’s break it down.

Investors purchase HIBT tokens representing a share in a real estate asset. These tokens are secured by the actual property, effectively minimizing risks. Furthermore, smart contracts facilitate automated transactions, ensuring compliance and security.

1. Understanding Tokenization

Tokenization turns physical assets into digital tokens. In real estate, this means each property can be divided into multiple shares, represented as HIBT tokens. This process allows investors from various backgrounds to own portions of desirable real estate, democratizing access to wealth-building assets.

2. The Role of Smart Contracts

Smart contracts are essential in the HIBT ecosystem. They govern the terms of investment, ensuring a secure environment for all participants. For instance, they can automate the distribution of rental income directly to token holders, enhancing trust and efficiency.

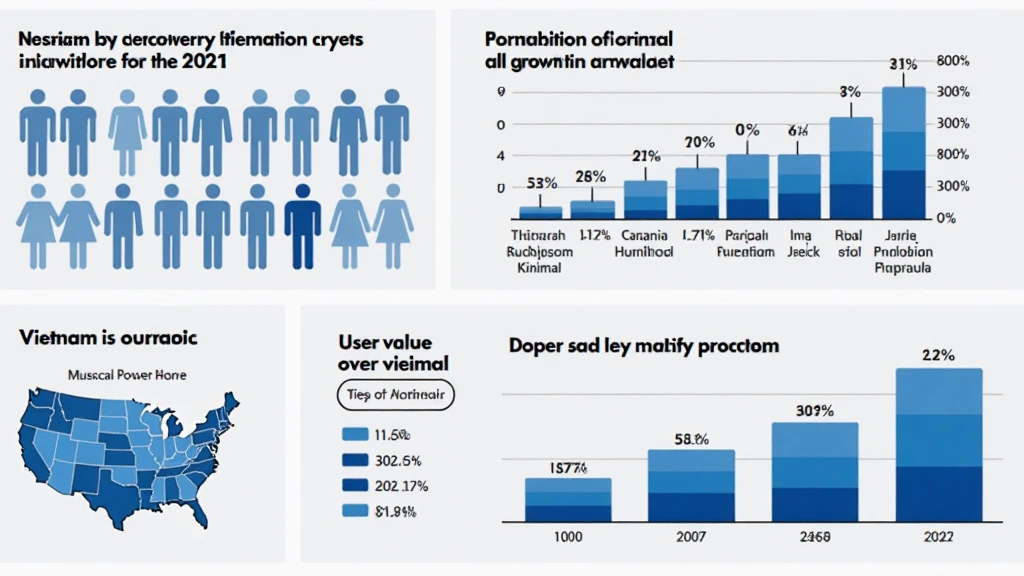

The Vietnamese Market: A Growing Demand for HIBT

Vietnam’s real estate market is on the rise, with a growth rate forecasted to reach 8% annually. The country’s rapid urbanization and burgeoning middle class are key drivers.

Key Insights

- Urbanization: As more people move to urban centers, the demand for housing explodes.

- Investors Seeking Security: The interest in blockchain technology is growing, driving demand for secure and transparent investment options.

- Government Support: Policymakers recognize the value of real estate tokenization.

Benefits of HIBT Real Estate Syndicates

When it comes to traditional real estate investments, the barriers to entry can be high. HIBT offers multiple distinct advantages:

- Enhanced Security: By complying with tiêu chuẩn an ninh blockchain regulations, HIBT ensures that investors’ assets are secure.

- Diversification: Investors can easily diversify their portfolios by investing in multiple properties through HIBT tokens.

- Reduced Costs: The use of blockchain technology can streamline operations, cutting down on administrative costs.

Challenges and Considerations

Although HIBT represents a significant advancement in property investment, there are challenges to be aware of:

- Regulatory Landscape: The legal status of tokenized assets varies by jurisdiction, necessitating thorough compliance checks.

- Market Volatility: The value of tokens can fluctuate significantly based on external market conditions.

- Technical Barriers: Investors may require some technical knowledge to navigate blockchain platforms.

Future Trends: HIBT and the Global Market

Looking forward, the HIBT model is expected to gain traction not only in Vietnam but also across Asia. According to market analysts at Chainalysis, the global market for tokenized real estate is set to surpass $1 trillion by 2030.

1. Cryptocurrency Integration

The increasing acceptance of cryptocurrencies in real estate transactions paves the way for more investors to enter the market, enhancing liquidity.

2. Enhanced Consumer Education

As more educational resources become available, the understanding of how HIBT and tokenized investments work will be greatly improved.

Conclusion: Embracing the Future of Real Estate Investment

As we navigate the future, the integration of HIBT real estate syndicates into the real estate market opens numerous opportunities for both seasoned investors and newcomers. With innovations transforming property investment, now is the time to explore how HIBT can work for you. A shift in the investment paradigm is inevitable, where traditional methods must coexist with new, technologically advanced solutions.

For anyone looking to invest strategically in real estate, consider diving into the potential of HIBT real estate syndicates. Visit HIBT.com for more insights on tokenized investments.