Introduction to HIBT Crypto Futures Strategies

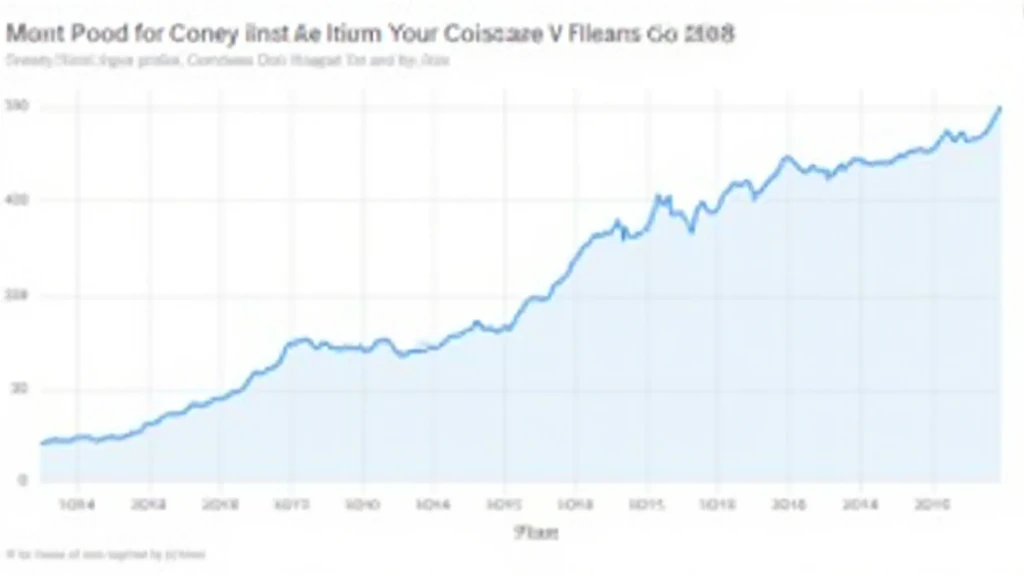

In the fast-paced world of cryptocurrency, strategic trading can be the key to success. With the market evolving continuously, understanding how to navigate crypto futures is crucial for traders looking to maximize their investments. Did you know that in 2024 alone, the crypto market faced losses amounting to $4.1 billion due to DeFi hacks? This indicates a pressing need for robust trading strategies that can safeguard investments while capitalizing on market fluctuations.

In this article, we will delve deep into the intricacies of HIBT crypto futures strategies, exploring fundamental concepts, risks involved, and advanced techniques that can help you capitalize on the cryptocurrency market’s volatility. We aim to provide valuable insights, especially for individuals looking to invest in HIBT (High-Volume Index-Based Trading) futures in Vietnam, where interest in cryptocurrency is surging.

Understanding Crypto Futures

Crypto futures are financial contracts that oblige the buyer to purchase, and the seller to sell, an asset at a predetermined future date and price. This derivative market provides opportunities for profit both in bullish and bearish conditions. For instance, traders can speculate on the future price of Bitcoin or Ethereum, benefitting regardless of market direction.

Here are key elements of crypto futures:

- Leverage: Futures trading allows traders to use leverage, meaning they can control a larger position with a relatively smaller amount of capital.

- Hedging: Investors can hedge their spot market positions by taking opposite positions in futures, ensuring protection against market volatility.

- Speculation: Traders can also utilize futures for speculation, betting on future price movements to generate profits.

The Mechanism Behind HIBT Futures Strategies

Historical Volatility: Understanding price fluctuations is essential in formulating HIBT crypto futures strategies. A trader must observe historical price charts to gain insights into past performance, which can guide future trading decisions.

Market Sentiment: Employing market sentiment analysis, including news cycles and social media trends, can aid in predicting future price movements. This new information often affects market volatility, making it essential for traders to stay updated.

When intertwining these mechanisms with futures strategies, consider the following:

- Short Selling: If market sentiment predicts a downturn, traders may short sell futures contracts, profiting from falling prices.

- Long Positions: Conversely, if optimistic volume increases, traders might buy futures, anticipating price rises.

Formulating Effective HIBT Futures Strategies

The cornerstone of successful trading in crypto futures is detailed strategy formulation. Here, we break down several effective strategies one can adopt for HIBT crypto futures:

- Trend Following: Identifying a trend and aligning trades with that trend can often lead to significant gains. Consider robust indicators like moving averages to confirm market direction.

- Arbitrage: Capitalize on price discrepancies across different exchanges. This often requires swift execution to benefit from transient price differences.

- Laddering Strategy: Gradually enter positions at different price levels can mitigate risks associated with market volatility.

- Stop-Loss Parameters: Employ stop-loss orders strategically to minimize losses. Placing them intelligently alongside market data analysis can enhance risk management.

The Importance of Risk Management in HIBT Crypto Futures

Risk management is a fundamental principle in trading. No matter how effective a strategy may be, unforeseen market conditions can lead to significant losses without proper precautions in place.

Here are some risk management practices specific to HIBT futures trading:

- Position Sizing: Determine the correct position size based on your risk tolerance levels. This will prevent overexposure to market volatility.

- Diversification: Explore a range of crypto assets rather than concentrating positions solely on one asset. This spreads risk across various potential market impacts.

- Continuous Monitoring: Regularly review and adjust your strategies based on market conditions. Continuous engagement with news and trends may fine-tune your approach.

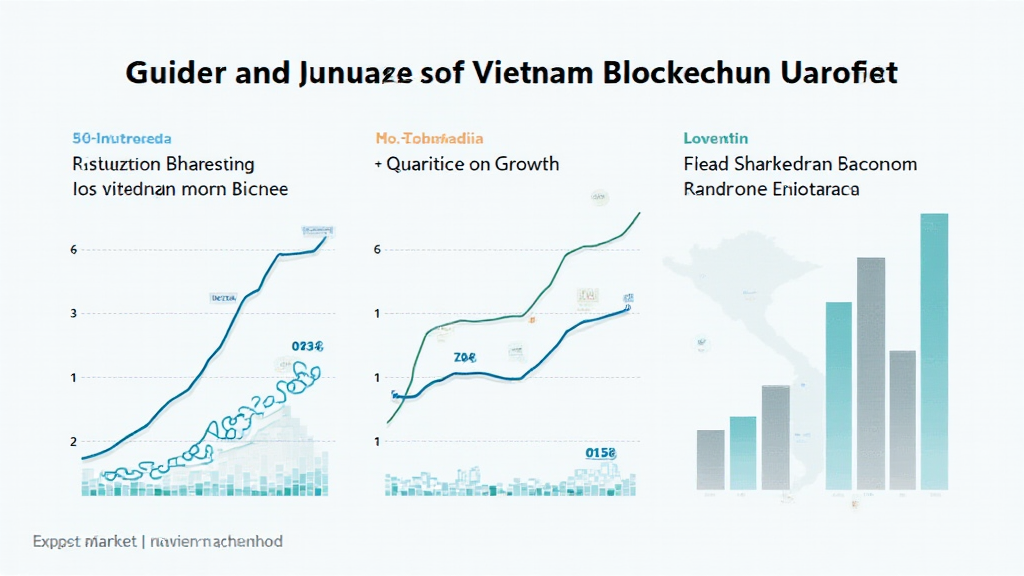

Current Trends in Vietnam’s Crypto Futures Market

Vietnam has been demonstrating remarkable growth in the crypto sector, with user adoption increasing by over 37% year-on-year. The burgeoning interest in digital assets provides fertile ground for futures trading. Local platforms are rapidly adopting futures contracts, with numerous exchanges catering to the Vietnamese market.

Here are several observations regarding the market trends in Vietnam:

- Increased Regulatory Scrutiny: The Vietnamese government is tightening regulations surrounding cryptocurrencies to protect investors.

- Growing Institutional Interest: More Vietnamese institutions are starting to invest in cryptocurrency, which is increasing market liquidity.

- Technological Advancements: Innovations in blockchain and trading technology are simplifying access to futures markets.

Conclusion: Mastering HIBT Crypto Futures Strategies

Grasping HIBT crypto futures strategies is essential for investing smartly in the cryptocurrency market. By employing techniques such as trend following, leveraging market sentiment, and managing risks effectively, traders can enhance their earnings and safeguard their investments amidst market fluctuations. Remember, trading in futures carries risks, and it is crucial to stay informed while adapting strategies based on evolving market conditions.

As the crypto landscape continues to grow, utilizing HIBT futures may present unique opportunities, especially in markets like Vietnam, where interest is rapidly evolving.

For further insights on market strategies and trends, visit hibt.com.

Author: Dr. Nguyen Van Phuc, a blockchain analyst with over 15 published papers in the field, has led key audits for notable crypto projects, combining expertise in technology and finance.