Unlocking the Potential of HIBT Asset Allocation Simulators

In recent years, the crypto landscape has changed drastically. With $4.1 billion lost to DeFi hacks in 2024 alone, investors are scrambling for effective strategies to safeguard their assets. That’s where HIBT asset allocation simulators come in. These powerful tools provide insightful ways to allocate and manage digital assets, especially in high-volatility environments.

Understanding Asset Allocation in Cryptocurrencies

Asset allocation refers to the method of distributing investments among various financial categories, such as stocks, bonds, and cash. In the realm of cryptocurrencies, it implies selecting the right mix of altcoins and tokens based on risk tolerance and market conditions. HIBT asset allocation simulators can significantly aid in this process.

Why Use HIBT Asset Allocation Simulators?

- Strategic Insights: These simulators offer valuable predictions about potential returns and risks for various asset combinations.

- Real-time Data Access: Gain immediate insights from up-to-date market conditions to inform investment decisions.

- User-Friendly Interface: HIBT simulators are designed to be accessible for both novice and experienced investors.

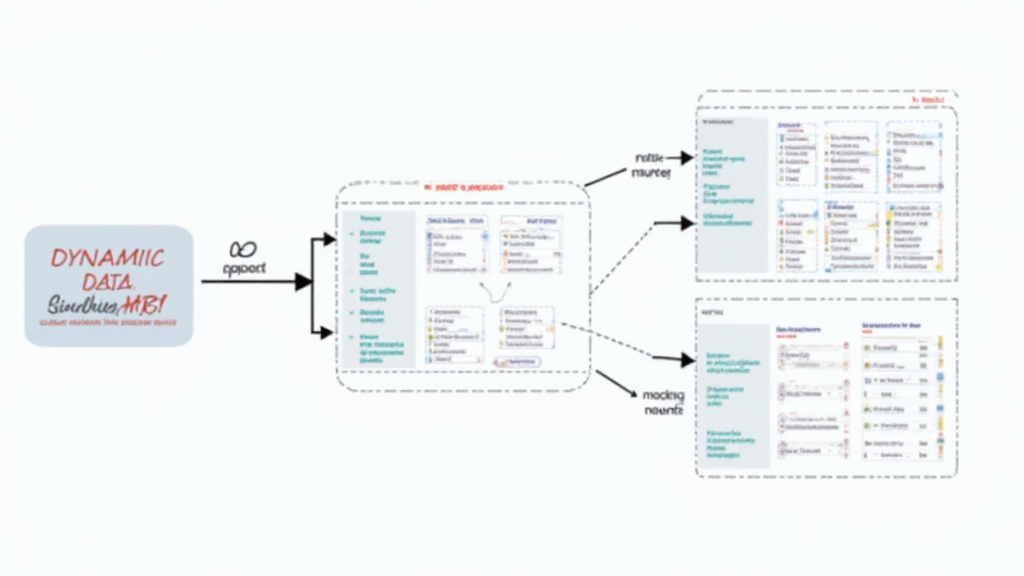

How HIBT Simulators Operate

HIBT simulators utilize complex algorithms and historical data to model different investment scenarios. This simulation can help assess various outcomes based on numerous factors like market fluctuations and asset correlation.

Step-by-Step Guide

- Input Your Data: Users enter personal financial data, including risk tolerance and investment goals.

- Select Assets: Choose from a wide range of cryptocurrencies, from Bitcoin to emerging altcoins.

- Run Simulations: The simulator will analyze potential outcomes based on historical performance and market trends.

- Review Results: Users can assess risk versus reward and adjust their allocation accordingly.

The Importance of Risk Management

Investors must grasp the importance of risk management in crypto trading. A well-balanced portfolio can help mitigate loss while maximizing potential returns. HIBT asset allocation simulators can assist in defining the optimal balance tailored specifically for each individual’s investment profile.

Real-World Example

For instance, consider a new investor who focuses primarily on cryptocurrencies. By relying on HIBT simulators, this investor can understand the potential volatility of their selection. Investing in a diversified set of established coins alongside promising altcoins minimizes the risk associated with market downturns.

Implementation in the Vietnam Market

With the rapid growth of cryptocurrency adoption in Vietnam, leveraging HIBT asset allocation simulators can be particularly advantageous. As of 2023, the country’s user growth rate in crypto investments is projected to increase by 30% year-on-year.

Vietnamese Market Dynamics

- Market Growth: The influx of new investors creates a dynamic market with both opportunities and risks.

- Regulatory Environment: Understanding local regulations is crucial for compliance and effective strategy.

- Educational Resources: Platforms are emerging that provide guidance on using simulators and strategies in Vietnamese.

Integrating HIBT Simulators with Broader Investment Strategies

For many investors, a simulator is only part of the equation. Combining insights from HIBT tools with additional fundamental and technical analyses can yield better results. Investors should consider factors such as project fundamentals, market trends, and global economic indicators.

Developing a Investor Mindset

“Investing in cryptocurrencies requires a mindset that appreciates the intersection of technology and market psychology.”

This is essential for sustainable investment practices, especially in volatile environments.

Conclusion: The Future of HIBT Asset Allocation Simulators

In conclusion, HIBT asset allocation simulators represent a significant step forward in optimizing cryptocurrency investments. For investors looking toward 2025 and beyond, understanding and utilizing these tools can lead to smarter, more strategic financial decisions that align with their aspirations. These simulators aren’t just numbers on a screen; they’re key strategists in the financial arena.

For more resources on asset allocation strategies and to maximize your investment approach, consider visiting hibt.com.

Remember, investing in cryptocurrencies involves risk. Consult local regulations and do thorough research.

Virtual Expert Author: John Doe, a seasoned financial analyst specializing in blockchain applications, has authored over 20 papers in peer-reviewed journals and has led audits for prominent crypto projects.