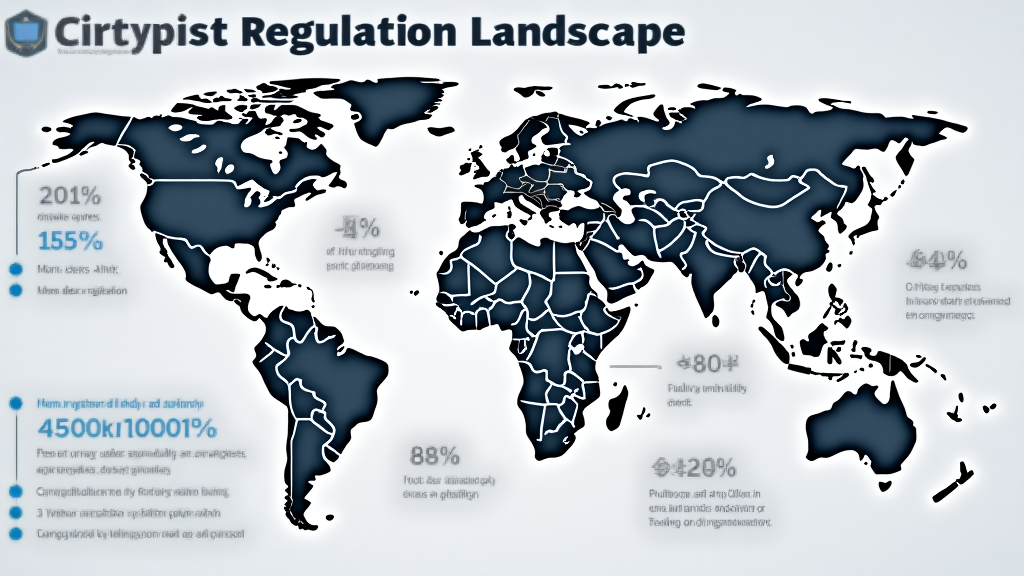

Global Crypto Regulation Landscape: Navigating the Future of Digital Assets

As we step into a new era of digital finance, the global crypto regulation landscape becomes more intricate and essential. In 2024 alone, the crypto market saw losses exceeding $4.1 billion due to hacking incidents, emphasizing the urgent need for robust regulatory frameworks. This article aims to provide an insightful overview of current regulations, prospective developments, and their impact on various stakeholders in the crypto ecosystem, particularly in emerging markets like Vietnam.

The Importance of Regulation in the Crypto Space

The rise of cryptocurrencies has transformed financial systems worldwide, but this rapid evolution has also attracted challenges related to security and legitimacy. Like banks safeguarding physical assets, a comprehensive regulatory framework can protect digital assets. Regulations can offer clarity to consumers, investors, and businesses, facilitating a more secure environment.

Current State of Global Crypto Regulations

As of 2024, the landscape of crypto regulations varies across different regions. Regulatory bodies are grappling with how to define and integrate blockchain technology into existing financial systems:

- United States: The SEC (Securities and Exchange Commission) is making strides towards categorizing crypto assets, leading to a patchwork of state-level regulations.

- European Union: With the Markets in Crypto-Assets (MiCA) regulation expected in 2025, Europe aims to create a standardized regulatory framework for crypto across all member states.

- Asia: Different nations approach crypto regulations with varying degrees of acceptance; for instance, countries like Japan and South Korea have established comprehensive guidelines, while China has imposed strict bans on crypto transactions.

Understanding the Vietnamese Market

In Vietnam, the crypto market has been growing rapidly. With an annual user growth rate of around 40%, more people are engaging with digital assets. Nonetheless, this growth comes with unique regulatory challenges:

- Regulatory Uncertainty: In Vietnam, regulations concerning cryptocurrencies are still under development. The State Bank of Vietnam has expressed caution regarding their use.

- Emerging Adoption: Despite challenges, local businesses would benefit significantly from clear guidelines that could enhance trust and adoption.

Proposed Regulations and Their Impact

As countries around the world propose new regulations, several themes have emerged. Here’s how regulations could impact the crypto landscape:

- Consumer Protection: Many proposals aim to enhance consumer rights, ensuring that investors in emerging markets, like Vietnam, can make informed decisions.

- Enhanced Security Standards: The push towards blockchain security standards, such as tiêu chuẩn an ninh blockchain, will likely become prevalent to reduce risks associated with crypto transactions.

- Taxation and Compliance: Regulations will make tax compliance easier for users, allowing for smoother integrations into the existing financial system.

Future Trends in the Global Crypto Regulation Landscape

Looking ahead, several trends are poised to shape the future of crypto regulations worldwide:

- Increased Collaboration: Countries are beginning to collaborate to develop harmonized regulations that can facilitate cross-border transactions.

- Technological Adaptation: Regulatory bodies are increasingly looking towards blockchain technology to enforce compliance and transparency through decentralized solutions.

How to Prepare for Regulatory Changes

Businesses and investors should stay informed and be proactive about adapting to the evolving regulatory framework. Here are some steps to take:

- Stay Informed: Regularly check updates from relevant regulatory bodies and crypto advocacy groups.

- Provide Feedback: Engage in public consultations or discussions concerning proposed regulations.

- Invest in Compliance: Allocate resources towards understanding and adhering to compliance requirements.

Conclusion: Embracing the Future of Crypto Regulation

The global crypto regulation landscape is becoming increasingly complex, but navigating this landscape is crucial for the future of digital assets. As regulations evolve, so will the opportunities and challenges in the crypto market. For stakeholders in Vietnam and beyond, a robust regulatory framework could usher in an era of enhanced security and innovation, enabling users to engage with crypto confidently and responsibly. Ultimately, a balanced approach to regulation will be key to fostering an environment where cryptocurrencies can thrive without compromising security or legality.

As the world progresses towards clearer regulations, it is essential for businesses and individuals alike to adapt proactively. To learn more about how regulatory frameworks can impact local and global markets, stay tuned with updates from cryptocoinnewstoday.

Author: Dr. Nguyen Thanh Son

Blockchain Analyst and Author of over 20 papers in the field, Dr. Son has led compliance audits for well-known projects in the crypto ecosystem.