Unveiling Vietnam’s Cryptocurrency Bond Market: Trends and Insights

A recent report states that over $4.1 billion was lost to decentralized finance (DeFi) hacks in 2024 alone, prompting investors to look for safer alternatives within the ever-evolving cryptocurrency landscape. One such alternative gaining traction is the cryptocurrency bond market. In Vietnam, this market is rapidly developing, driven by increasing interest in digital assets among investors and institutions alike. In this article, we will delve into the current state and future outlook of the cryptocurrency bond market in Vietnam, providing analysis and insights that can guide investors.

The Rise of Cryptocurrency Bonds in Vietnam

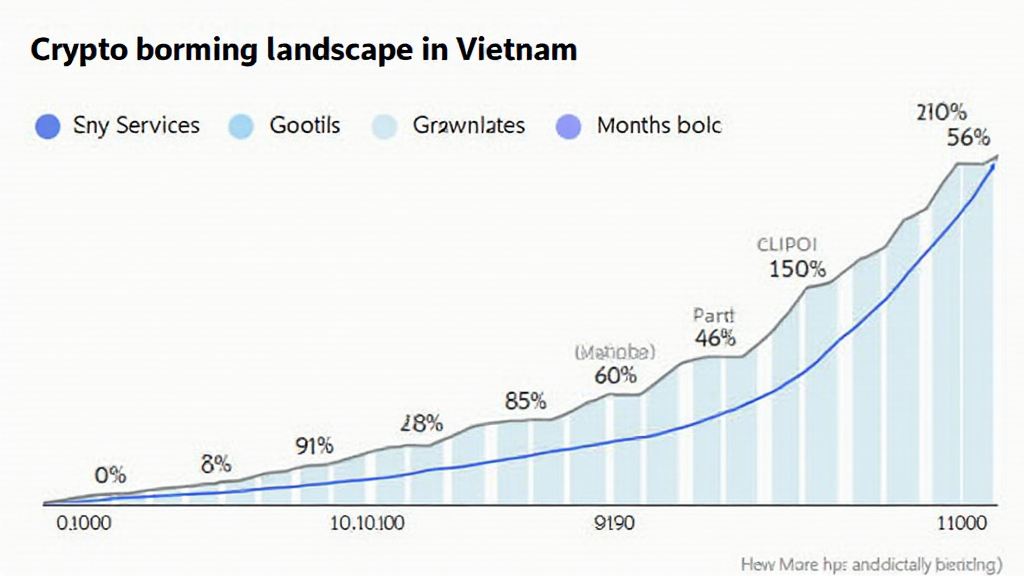

Vietnam has emerged as a significant player in the digital currency arena, with a reported growth rate of 230% in the number of cryptocurrency users from 2021 to 2022. This growth signals a burgeoning interest in alternative investment vehicles, including cryptocurrency bonds.

- Blockchain technology is gaining traction in Vietnam due to its associated benefits such as transparency, security, and efficiency.

- The Vietnamese government has recognized the importance of tiêu chuẩn an ninh blockchain (blockchain security standards) in fostering a reliable cryptocurrency market.

Understanding Cryptocurrency Bonds

Cryptocurrency bonds are essentially debt securities that are issued and traded on blockchain-based platforms. They offer investors a way to earn returns while supporting projects in the cryptocurrency space. Here’s how they work:

- Investors can purchase cryptocurrency bonds using popular digital currencies like Bitcoin or Ethereum.

- Bond issuers use the proceeds from these sales to fund various blockchain projects or innovations.

- Returns are often paid in digital assets, making them an attractive investment for crypto enthusiasts.

Benefits of Cryptocurrency Bonds

Investing in cryptocurrency bonds offers several advantages:

- High liquidity: Due to their presence on blockchain platforms, cryptocurrency bonds can be traded 24/7, providing investors with more flexibility.

- Portfolio diversification: They allow traditional investors to access the growing cryptocurrency market without directly purchasing volatile assets.

- Potential for higher returns: With the right projects, investors could see returns exceeding those from conventional bonds.

Market Trends and Predictions for 2025

As we look toward 2025, several key trends are likely to shape the cryptocurrency bond market in Vietnam:

- Increased Regulatory Clarity: The Vietnamese government is working on clearer regulations regarding cryptocurrency, which could boost investor confidence.

- Institutional Adoption: As more financial institutions begin to explore cryptocurrencies, the demand for crypto bonds is expected to rise.

- Technological Innovations: Advancements in blockchain technology will likely make cryptocurrency bonds more accessible and secure.

Challenges Facing the Cryptocurrency Bond Market

Despite the potential for growth, several hurdles remain:

- Volatility: The cryptocurrency market is known for its price swings, which could affect bond valuations.

- Security Risks: Despite the promise of blockchain technology, vulnerabilities can still expose investors to risks.

- Regulatory Issues: Without proper regulations, investor protection is compromised, leading to a lack of confidence in the market.

Investing in Cryptocurrency Bonds: A Guide

If you’re considering investing in the cryptocurrency bond market in Vietnam, here are some key steps to follow:

- Research: Understand the fundamentals of cryptocurrency bonds and the specific projects behind the bonds you’re interested in.

- Assess Risk: Evaluate the potential risks involved, including market volatility and security issues.

- Diversify: Do not put all of your assets into one type of investment. Diversification can help mitigate risk.

Looking Ahead: Vietnam’s Future in the Crypto Ecosystem

Vietnam is poised to become a leader in the cryptocurrency bond market as more regulations come into play and investment interest grows. According to industry analysts, the market is expected to reach $10 billion by 2025 as international and domestic players stake their claim in this burgeoning field.

With clear regulations and a better understanding of security around digital assets, Vietnam could attract more investments and drive innovation in the crypto space. Investors are encouraged to stay informed and consider the cryptocurrency bond market as a viable investment option.

In conclusion, as we analyzed Vietnam’s cryptocurrency bond market and discussed its growth trajectory, it is evident that this sector is on the rise. But, like any investment, it is essential to conduct thorough research, assess risks, and stay compliant with local laws.

For more insights on navigating the cryptocurrency landscape, keep visiting cryptocoinnewstoday, your go-to source for reliable cryptocurrency information.

Written by Dr. Nguyen Minh Tuan, a blockchain technology researcher and author of over 50 papers in the field. He has also led significant audits for numerous projects and is a thought leader in crypto economics.