Understanding Bitcoin Halving Community Sentiment & Its Implications

As the cryptocurrency landscape continues to evolve, significant events shape the dynamics of investor behavior and market sentiment. One such event is the Bitcoin halving, a mechanism that cuts the mining rewards for Bitcoin by half approximately every four years. This action not only influences Bitcoin’s supply but also impacts the overall community sentiment surrounding the cryptocurrency. In this article, we will explore how Bitcoin halving affects community sentiment and its broader implications for the market in 2025.

Introduction to Bitcoin Halving

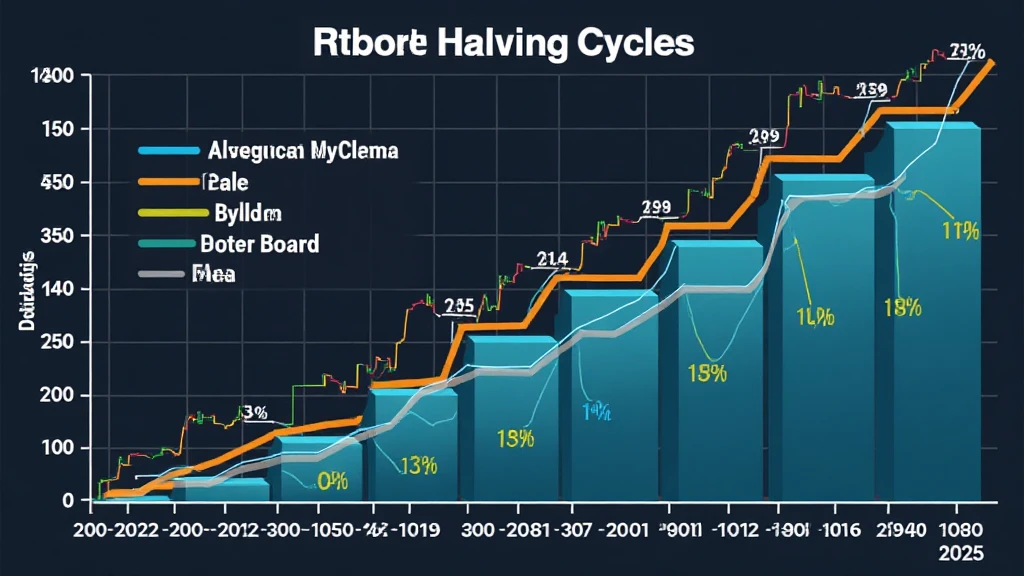

The concept of Bitcoin halving is fundamental to the cryptocurrency’s monetary policy. By design, Bitcoin’s total supply is capped at 21 million coins, making it a deflationary asset. Each halving reduces the mining rewards from 6.25 BTC to 3.125 BTC, limiting the supply and theoretically increasing scarcity. The halving event creates buzz within the community, often leading to heightened interest and speculation. According to recent statistics, $4.1 billion has been lost to DeFi hacks in 2024, emphasizing the need for a secure investment environment as Bitcoin continues to rise.

The Link Between Bitcoin Halving and Community Sentiment

Community sentiment surrounding Bitcoin tends to fluctuate dramatically during halving events. Past halvings in 2012, 2016, and 2020 demonstrated how anticipation can drive price volatility. Here are several factors that shape understanding of community sentiment during halving:

- Market Speculation: As the halving date approaches, traders and investors often speculate on price movements. This can create a sense of urgency and excitement, causing an increase in buying activity.

- Misinformation: With the hype of halving comes the risk of misinformation. Unverified claims regarding price predictions can lead to misplaced confidence or fear, affecting sentiment negatively.

- Media Coverage: Intensive media coverage fuels sentiments, both positive and negative. As the halving date approaches, news outlets dissect the implications, significantly affecting public perception.

- Historical Precedents: Community sentiment can reflect on past performance during previous halving events, leading to a herd mentality that may impact speculative trading.

Impact on Market Dynamics

The implications of Bitcoin halving extend beyond community sentiment, influencing market dynamics profoundly. Understanding these shifts is essential for investors and stakeholders:

Supply and Demand Dynamics

As the supply of new Bitcoin decreases, demand pressures can lead to elevated prices if investor interest remains strong. Historical data shows that each halving has roughly preceded dramatic price increases, suggesting that the law of supply and demand plays a pivotal role.

Investor Behavior

During halving events, cryptocurrency investors often exhibit increased buying behavior, influenced by FOMO (fear of missing out). This elevated activity tends to push prices higher, creating a momentum effect that is both exciting and risky.

Understanding the Vietnamese Market: A Case Study

Vietnam is emerging as a notable player within the cryptocurrency realm. Reports indicate that the Vietnamese user base increased by 120% in the past year. The culture of altcoins and community-driven projects contributes significantly to this growth. During Bitcoin halving, the sentiment among Vietnamese investors reflects strong engagement, as many actively participate in trading communities and discussions.

In this context, let’s view the Vietnamese translation and its relevance:

- Bitcoin Halving: Halving Bitcoin – Halving Bitcoin diễn ra mỗi 4 năm

- Community Sentiment: Cảm xúc cộng đồng – Cảm xúc của cộng đồng tiền điện tử thường tăng cường trong thời gian này

The exploration of community sentiment around halving events in Vietnam showcases the localized effects of global cryptocurrency phenomena, aligning with the broader shifts in investor behavior.

Conclusion: The Future of Bitcoin Halving and Community Sentiment

As we approach the next Bitcoin halving, the sentiment surrounding it will likely continue to shape market behaviors and investor actions. Understanding the intricate dynamics between halving, community sentiment, and market implications is crucial for navigating the upcoming trends. With insights gained from historical data and local market analyses, investors can potentially mitigate risks and capitalize on opportunities presented by this significant event.

For anyone looking to stay informed about the evolving landscape of cryptocurrencies, including Bitcoin, be sure to follow updates on platforms such as cryptocoinnewstoday. It’s essential to rely on credible sources in a space that is rapidly changing and often susceptible to misinformation.

Author Bio: Dr. Elizabeth Moore, an expert in blockchain technology with over 15 published research papers and a lead auditor for several well-known crypto projects, provides insights into the evolving crypto market landscape.