Understanding HIBT Crypto Order Types: A Deep Dive

As the cryptocurrency market continues to evolve, traders are constantly looking for ways to optimize their strategies. In 2024 alone, over $4.1 billion was lost to hacks in decentralized finance (DeFi), raising concerns about security and trading efficiency. Understanding HIBT crypto order types is crucial for protecting your digital assets and improving your trading outcomes.

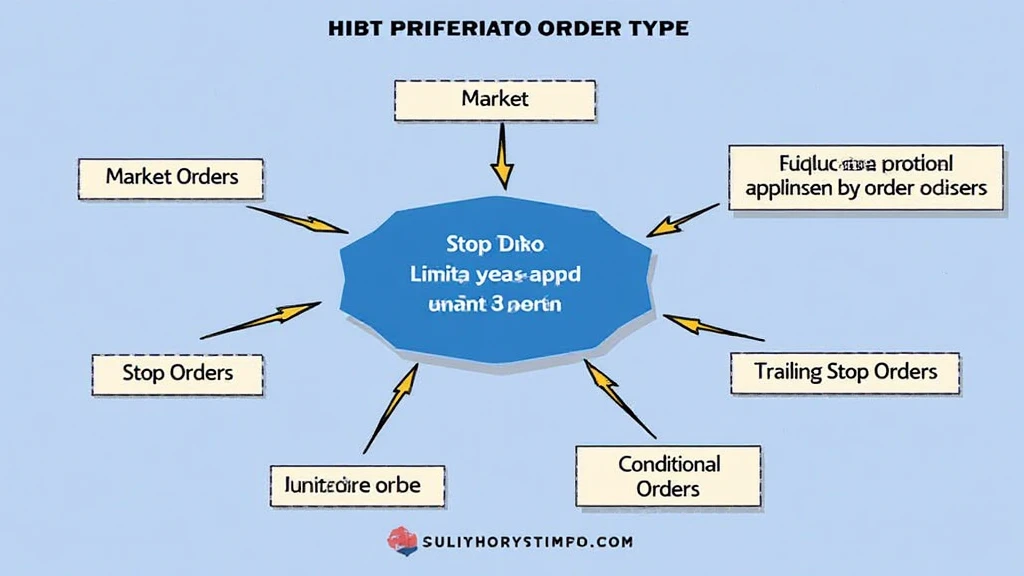

What Are HIBT Crypto Order Types?

HIBT, which stands for High-Impact Buy and Trade, represents several order types that traders can utilize within cryptocurrency exchanges. Each type serves its unique purpose, allowing traders more flexibility in executing trades based on market conditions.

- Market Orders: These orders are executed instantly at the current market price.

- Limit Orders: Traders set a specific price at which they’re willing to buy or sell a cryptocurrency.

- Stop Orders: These orders become a market order once a certain price is reached.

- Trailing Stop Orders: A type of stop order that adjusts the stop price at a fixed percentage or dollar amount above the market price.

- Conditional Orders: Executed only if predefined conditions are met.

The Importance of Choosing the Right Order Type

Selecting the appropriate HIBT crypto order type can significantly impact trading performance. Unlike traditional markets, cryptocurrencies are known for their volatility. For instance, with Bitcoin’s price fluctuations often exceeding 5% within hours, traders must be adept at choosing the right strategy to mitigate risks.

To illustrate, consider the following scenario:

- A trader believes Bitcoin will fall below $30,000. They can use a stop order to sell if the price reaches this point, thereby preventing further losses.

- On the other hand, if they anticipate a surge, a limit order enables them to set a price, ensuring their asset is sold at their desired threshold.

Market Order: Instant Execution

Market orders are perhaps the simplest and quickest way to buy or sell a cryptocurrency. When placing a market order, traders are essentially saying, “I want to buy (or sell) this coin at the current price, no matter what.” This can be advantageous in fast-moving markets.

For example, during market surges, using a market order ensures instant execution—vital to capitalize on rapidly rising assets. However, this comes with the risk of slippage, especially in highly volatile markets.

Vietnam’s crypto user growth rate has skyrocketed to over 30% in the last year alone, emphasizing the demand for quick and effective trading tools like market orders.

Limit Orders: Setting the Price

Limit orders are particularly useful for those looking to control their entry and exit points. By setting a specific price, traders can wait for the market to meet their conditions rather than chasing prices.

For example:

- A trader wants to buy Ethereum at $2,500 but notices it’s currently trading at $2,700; they set a limit order for $2,500.

- Should the price drop to their limit, the order will execute. This kind of strategy prevents impulse buying and helps in establishing a disciplined approach.

Stop Orders: Protecting Your Investment

Stop orders can act as a safety net in the volatile world of crypto. By determining a threshold, traders can automate their sales, protecting profits and minimizing losses.

“As the year progresses, utilizing stop orders has become essential for safeguarding profits amid unpredictable market shifts.” – Blockchain Expert

For instance, if a trader buys Bitcoin at $35,000, they can set a stop order at $33,000, ensuring that should the price plummet, their position would automatically sell, curbing potential losses.

Trailing Stop Orders: Flexibility Combined with Security

Trailing stop orders provide a unique feature where the stop price adjusts in accordance with market movements. If an asset’s price rises, the stop price moves up alongside it, creating an opportunity to lock in profits while still allowing for upside potential.

To clarify, consider the following scenario:

- A trader buys Litecoin at $150 and sets a trailing stop of $10. If the price rises to $180, the stop goes up to $170.

- If Litecoin then drops below $170, the trader still successfully captures a profit from their investment.

Conditional Orders: Precision Trading

Conditional orders are versatile and tailored to specific market conditions. These orders execute only when certain criteria are met, allowing traders to approach market participation strategically.

For instance, if **tiêu chuẩn an ninh blockchain** are met, a trader may set a conditional order based on indicators such as RSI or MACD. This type of order can optimize entry points by integrating technical analysis into trading strategies.

Choosing the Best Order Type for Your Strategy

Understanding these HIBT crypto order types is fundamental for successful trading in today’s market. However, it’s essential to consider your risk tolerance, market conditions, and trading strategies. Here are a few tips:

- Assess Market Volatility: In highly volatile periods, consider higher utilization of stop orders and limit orders.

- Set Realistic Goals: Ensure that your limit orders align with what you believe are achievable price targets.

- Stay Informed: Follow market trends and adjust your strategies accordingly.

Conclusion: Optimize Your Trading Strategy with HIBT Crypto Order Types

In conclusion, the HIBT crypto order types offered by exchanges provide robust options for enhancing your trading strategy. Whether through market orders for immediate access, limit orders for price control, or stop orders for risk management, each type brings unique benefits tailored to various trading scenarios.

As the Vietnamese crypto market grows, understanding these tools can give traders the necessary edge within this competitive landscape. By implementing these strategies wisely, you can navigate the concerns of security and efficiency while capitalizing on market opportunities.

As you explore these order types, remember that your trading approach should always align with your individual goals and risk tolerance. For comprehensive insights into navigating the crypto world, consider exploring more at hibt.com.

For further reading, don’t miss our article on Vietnam Crypto Tax Guide and Smart Contracts Auditing.

Author: Dr. An Nguyen, a distinguished blockchain analyst with numerous publications highlighting the critical elements of digital asset trading.