Vietnam Blockchain Tax Compliance: Navigating Regulatory Frameworks

With Vietnam’s blockchain adoption skyrocketing, the need for robust tax compliance measures has never been more crucial. According to recent statistics, the number of blockchain users in Vietnam has surged by over 400% in the past two years. This dramatic rise presents unique challenges and opportunities for both investors and regulators. In this comprehensive guide, we will delve deeply into the evolving landscape of Vietnam blockchain tax compliance and equip you with the knowledge to navigate the regulatory framework effectively.

Understanding Blockchain Taxation in Vietnam

Blockchain technology, the backbone of cryptocurrencies, is fundamentally changing how we approach financial transactions. An essential aspect of this change is understanding how taxation applies to these digital assets. The Vietnamese government has begun to implement clear tax guidelines specifically for blockchain transactions.

- The General Department of Taxation has issued several circulars regarding the taxation of cryptocurrencies.

- According to the Vietnamese Ministry of Finance, income derived from crypto trading is subject to personal income tax.

The Regulatory Landscape

Vietnam’s approach to blockchain taxation is still in its infancy, yet concrete steps are being taken:

- Draft Regulations: In 2023, the government proposed new regulations to further clarify the tax obligations for blockchain businesses and individual investors.

- International Standards: The government aims to align Vietnam’s cryptocurrency regulations with international standards, such as the OECD’s guidelines.

Navigating Compliance: Key Considerations

As an investor or operator in the blockchain space, staying compliant is imperative. Let’s break down some key considerations you must keep in mind:

Tax Obligations for Individuals

- If you are trading cryptocurrencies, it is essential to report your trading profits to the tax authorities.

- Short-term capital gains and long-term capital gains are taxed differently in Vietnam; understanding these distinctions can have huge implications for your net income.

- Always keep accurate records of your transactions to make tax filings easier.

Business Compliance

- Businesses dealing with cryptocurrencies must register with the tax authorities.

- It is crucial to understand the different types of taxes applicable, such as corporate income tax and value-added tax (VAT).

The Future of Blockchain Tax Compliance in Vietnam

As the market evolves, the Vietnamese government is expected to release more detailed frameworks that provide clarity on how to approach blockchain taxation. For example, the potential implementation of a specialized tiêu chuẩn an ninh blockchain could bolster compliance efforts significantly.

Emerging Challenges

- Decentralized Finance (DeFi): With the rise of DeFi platforms, tracking transactions for taxation is becoming increasingly complex.

- Smart Contracts: Understanding how to audit smart contracts for compliance will be more crucial as businesses implement them.

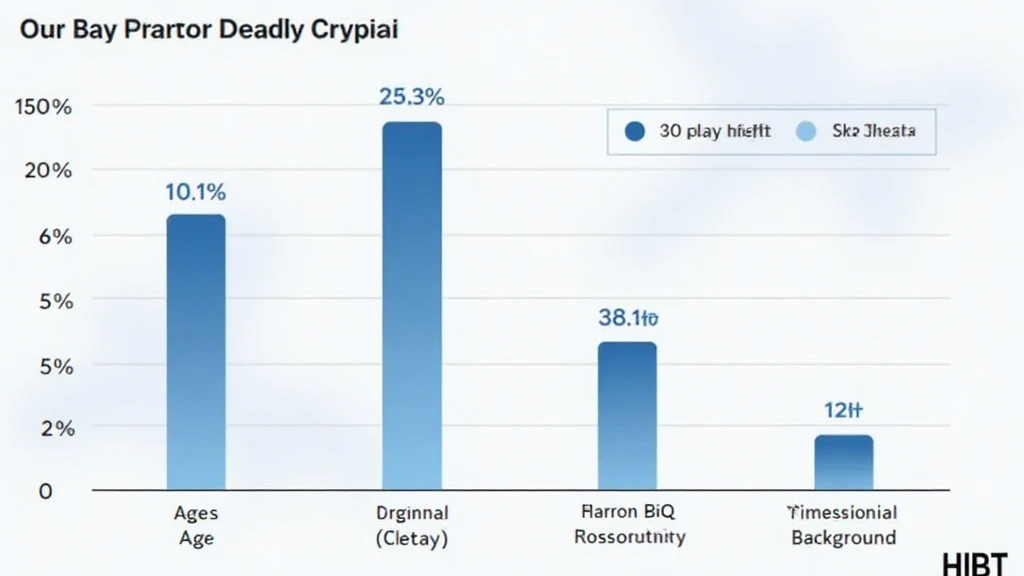

Real-world Implications and Statistics

According to hibt.com, approximately VND 8 trillion (over $350 million) was reported in crypto transactions within Vietnam last year. This figure emphasizes the importance of clear tax compliance guidelines:

| Year | Crypto Transactions (VND) | Growth Rate (%) |

|---|---|---|

| 2022 | 2 trillion | – |

| 2023 | 8 trillion | 300% |

Conclusion: The Path Ahead

As blockchain technology matures in Vietnam, so will the frameworks that govern it. Staying informed about Vietnam blockchain tax compliance is vital for anyone involved in this landscape. The onus is on investors and businesses alike to ensure they understand their obligations. As the regulatory environment evolves, proactive engagement with tax professionals and continued education on compliance measures will be essential to avoid potential pitfalls.

In conclusion, whether you are an individual investor or part of a business, comprehending the nuances of blockchain taxation in Vietnam is not simply advantageous; it’s imperative in navigating the future of digital finance.

For more insights into the evolving landscape of cryptocurrencies and taxes in Vietnam, check out our Vietnam crypto tax guide for essential tips and best practices.