Understanding Stablecoin Usage in Vietnam: The Future of Digital Currency

With blockchain technology rapidly changing the landscape of finance, stablecoins are emerging as a vital part of this transformation. In Vietnam, where the crypto market is gaining momentum, understanding stablecoin usage and its implications for the financial ecosystem is crucial. This article delves into the growing adoption of stablecoins in Vietnam, the driving factors behind this trend, and the potential future impacts on the economy.

The Rise of Cryptocurrency in Vietnam

According to reports, the Vietnamese user base for cryptocurrencies has seen significant growth, with more than 1 million citizens actively engaging with digital assets as of 2023. This rate is predicted to increase as people seek alternatives to traditional banking systems. The Vietnamese government has also begun recognizing cryptocurrencies officially, establishing a favorable regulatory framework for their development.

Stablecoins: What Are They?

Stablecoins, as their name implies, are cryptocurrencies designed to maintain a stable value. They are typically pegged to a reserve of assets, like the US dollar or gold, minimizing the volatility commonly associated with other cryptocurrencies. In Vietnam, stablecoins present an appealing solution for trading and remittances, offering users the best of both worlds: digital asset efficiency and the security of traditional currencies.

The Growing Demand for Stablecoins

As Vietnamese individuals and businesses increasingly adopt digital currencies, stablecoins are increasingly sought after due to their utility and emotional reliability. In fact, recent surveys indicate that about 60% of local crypto users prefer using stablecoins like USDT and USDC for transactions.

- **Transactional Efficiency**: Stablecoins facilitate peer-to-peer transactions without the high fees associated with traditional banking.

- **International Remittances**: The use of stablecoins can significantly reduce costs for Vietnamese workers sending money back home.

- **Ease of Integration**: Many decentralized finance (DeFi) applications in Vietnam are beginning to support stablecoins, making them more accessible for everyday users.

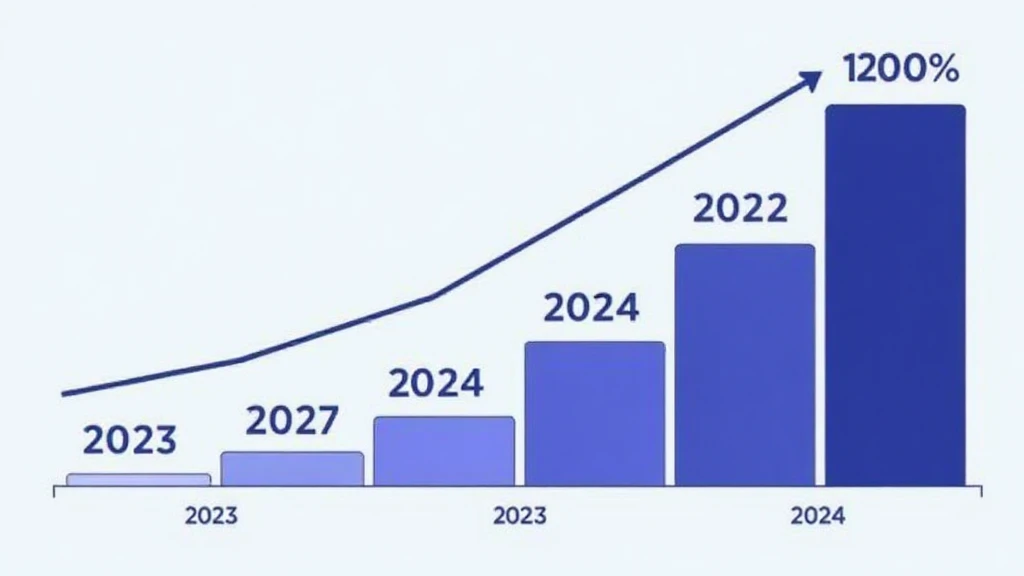

Market Growth and Future Potential

The stablecoin market in Vietnam is positioned for explosive growth. According to Chainalysis, the market size for digital currencies, especially stablecoins, is expected to hit

- **Regulatory Support**: The government’s efforts to regulate digital assets provide greater confidence to users and investors.

- **Technological Advancements**: Innovations in blockchain enhance the security and usability of stablecoins.

- **Increasing Financial Inclusion**: Stablecoins serve as accessible financial tools for unbanked populations, helping them enter the digital economy.

Practical Applications of Stablecoins in Vietnam

As the Vietnamese market adapts to blockchain technologies, stablecoins are finding various applications across multiple sectors:

E-Commerce and Retail

In the e-commerce sector, businesses are integrating stablecoins as a payment option. This trend allows for fast transactions and lower costs, providing a competitive edge. For example, major online platforms are witnessing a substantial increase in usage of stablecoins, with some reporting transaction growth of over 75% in recent months.

.

Real Estate Transactions

Stablecoins are also making inroads into real estate, where they offer a seamless method for property transactions. By facilitating transactions without needing conversion fees or dealing with foreign exchange, stablecoins simplify the process for both buyers and sellers.

Investment Opportunities

Investors in Vietnam are increasingly looking at stablecoins as a hedge against volatility and a tool for investing in digital assets with less risk. As DeFi protocols bloom in Vietnam, investors are eager to explore yield farming and liquidity provision using stablecoins.

Challenges and Considerations for Stablecoin Adoption

Despite the numerous benefits of stablecoin usage in Vietnam, challenges remain, including:

- **Regulatory Concerns**: While there is growing support, regulatory frameworks are still evolving, leading to uncertainties for users.

- **Security Issues**: Breaches and hacks can undermine user confidence, emphasizing the importance of robust security protocols during wallet usage.

- **Market Limitations**: Education around the usage and benefits of stablecoins is required to foster broader adoption.

Conclusion

In summary, the usage of stablecoins in Vietnam represents a significant shift in how people engage with digital currencies. As adoption grows, driven by regulatory support and market demand, stablecoins are likely to redefine the financial landscape in the country. This evolution not only enhances financial inclusivity but also positions Vietnam as a burgeoning hub for cryptocurrency innovation in Southeast Asia.

As Vietnam continues to embrace blockchain technology, monitoring the rise of stablecoin usage will be vital for stakeholders wanting to leverage the opportunities provided by this digital asset segment.

For more insights into the Vietnam crypto market and regulatory landscape, make sure to read our guides on Vietnam crypto taxes and the potential of

Ultimately, as the world moves towards digital finance, capturing the essence of how stablecoins transform economies will be crucial. Just as a bank vault safeguards your assets, stablecoins provide a reliable way to manage digital dollars in a volatile world.