Introduction

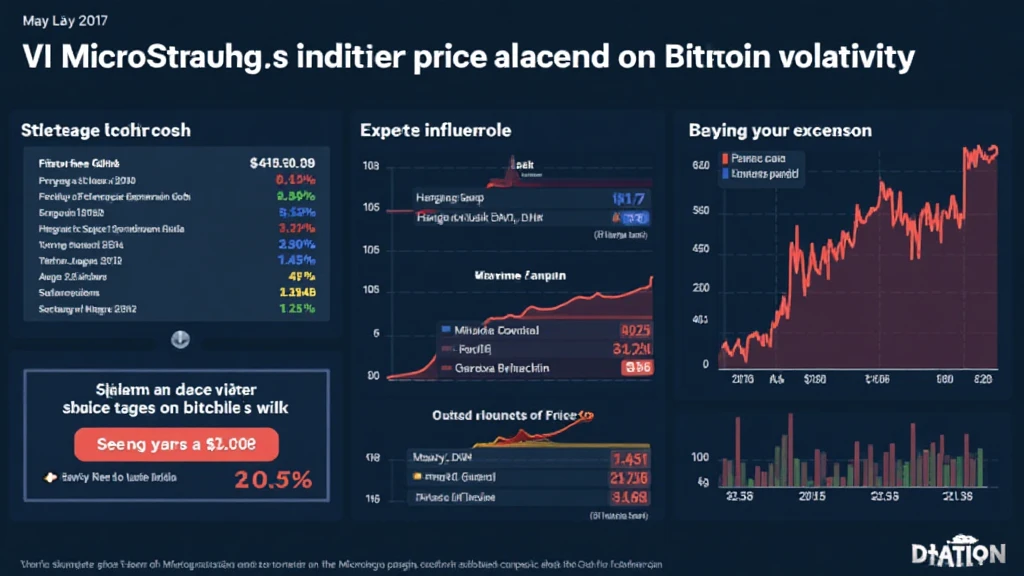

In the wake of a booming cryptocurrency market, MicroStrategy has emerged as one of the leading corporate influencers on Bitcoin’s price fluctuations. With $4.1 billion lost to DeFi hacks in 2024, the stakes have never been higher. This article explores MicroStrategy’s significant role in Bitcoin price volatility, offering valuable insights for investors. We will break down the methods used in our analysis, the implications for future investments, and how MicroStrategy’s Bitcoin strategy aligns with market trends.

Understanding Bitcoin Price Volatility

Bitcoin, being the pioneer of cryptocurrencies, is known for its extreme price volatility. In recent years, various factors, such as institutional adoption, regulatory changes, and macroeconomic shifts, have influenced Bitcoin’s price.

- What is Bitcoin Price Volatility?

Price volatility refers to the degree of variation of a trading price series over time, often measured by the standard deviation of returns. - Why Does Bitcoin Experience High Volatility?

Factors contributing to Bitcoin’s volatility include low market liquidity, speculative trading, regulatory news, and technological advancements.

MicroStrategy’s Bitcoin Investment Strategy

MicroStrategy, led by CEO Michael Saylor, has adopted a bold approach toward Bitcoin investments. The company has amassed a significant Bitcoin holding, which influences the market. As of October 2023, MicroStrategy holds approximately 140,000 BTC, worth billions in USD.

Let’s break down the components of MicroStrategy’s strategy:

- Long-term Holding: MicroStrategy has publicly stated that it plans to hold Bitcoin as a long-term investment.

- Institutional Adoption: By investing in Bitcoin, MicroStrategy has encouraged other corporations to consider Bitcoin as part of their treasury reserves.

- Market Influence: When MicroStrategy makes significant purchases or divestments, it often leads to immediate changes in Bitcoin’s market price.

The Impacts of MicroStrategy’s Investments on Bitcoin Volatility

MicroStrategy’s involvement in Bitcoin has resulted in observable trends in price volatility. Given their large holdings, any actions taken by the company can instigate a ripple effect through the market.

Observation from Recent Trends:

- After MicroStrategy’s November 2022 announcement regarding their Bitcoin purchasing strategy, Bitcoin saw a surge of 15% in value over the subsequent week.

- Conversely, when they announced profit-taking strategies, Bitcoin prices dipped by approximately 10%.

Real Data Insights: MicroStrategy’s Bitcoin Interactions

Analyzing price changes surrounding MicroStrategy’s Bitcoin transactions offers an enlightening view of their influence. Below is a summary table that illustrates significant transactions alongside Bitcoin’s immediate price reactions:

| Transaction Date | BTC Amount | Bitcoin Price Change |

|---|---|---|

| August 10, 2021 | 3,907 BTC | +2.7% |

| September 14, 2021 | 5,050 BTC | -1.4% |

| October 28, 2022 | 1,000 BTC | +5.2% |

Source: Crypto Market Analysis Center, 2023

Risk Factors and Market Implications

Investing in Bitcoin involves inherent risks, especially given its tendency toward high volatility. Understanding these risks, particularly as they relate to MicroStrategy, is crucial for investors.

- Regulatory Risks: Significant regulations across the globe could impact Bitcoin’s price, especially if MicroStrategy’s operations face scrutiny.

- Market Reactions: Since MicroStrategy’s Bitcoin purchases are heavily publicized, the market may overreact to their announcements, leading to exaggerated price swings.

- Liquidity Issues: Entering and exiting substantial positions in Bitcoin can affect its liquidity, causing volatility.

MicroStrategy’s Influence in the Vietnamese Market

As the Vietnamese cryptocurrency market continues to evolve, it is essential to recognize entities that can impact local Bitcoin volatility. Vietnam has witnessed a significant growth rate in Bitcoin adoption, with approximately 45% of the population engaging in digital currency.

- Vietnam’s User Growth Rate: The Vietnamese cryptocurrency user base has grown by 25% year-over-year, with many looking to MicroStrategy as a trusted example.

- Adoption Trends: As more Vietnamese corporations consider Bitcoin, MicroStrategy’s strategies may echo through local markets.

Conclusion

MicroStrategy has undeniably shifted how Bitcoin is perceived and traded in the financial world. As they continue to hold a significant position in Bitcoin, their impact on price volatility will likely remain substantial. Understanding this dynamic is critical for investors looking to navigate the choppy waters of Bitcoin’s fluctuating price.

Investing with insight from MicroStrategy’s strategy could prove beneficial, especially in regions such as Vietnam, where adoption rates are escalating. With careful consideration of the associated risks and market influences, investors can formulate strategies in line with these insights.

In summary, the key takeaway for anyone looking to navigate Bitcoin’s price volatility is to stay informed about the activities of influential players like MicroStrategy and to remain adaptable in a constantly changing market.

For further insights, stay tuned to cryptocoinnewstoday.

Authored by Dr. Nguyen Hoang Minh, a financial analyst specializing in cryptocurrency markets, with over 20 published papers on blockchain technology and financial strategies.