MicroStrategy’s Bitcoin Price Target Revisions: Insights and Implications

As the cryptocurrency market continues to evolve, companies like MicroStrategy have increasingly become key players in the financial landscape. With $4.1 billion lost to DeFi hacks in 2024 alone, understanding MicroStrategy’s position and price target revisions for Bitcoin offers crucial insights into market expectations and investor strategies. In this article, we will delve into the reasons behind these revisions, their implications for Bitcoin, and provide a comprehensive overview for investors looking to navigate the dynamic crypto space.

The Role of MicroStrategy in Bitcoin Adoption

MicroStrategy, a business intelligence firm, has emerged as a significant advocate for Bitcoin. Since its first purchase in 2020, the company has continuously sought to integrate Bitcoin into its balance sheet. The rationale behind this bold strategy stems from several factors:

- Inflation Hedge: With rising concerns about inflation (factored at a staggering 5% annually in recent reports), Bitcoin is seen as a safe harbor.

- Digital Gold Appeal: Like traditional gold, Bitcoin has a finite supply, which adds to its allure as a store of value.

- Institutional Confidence: MicroStrategy’s decisions have helped to legitimize Bitcoin as a viable asset class for institutional investors.

Market Sentiment and Price Target Revisions

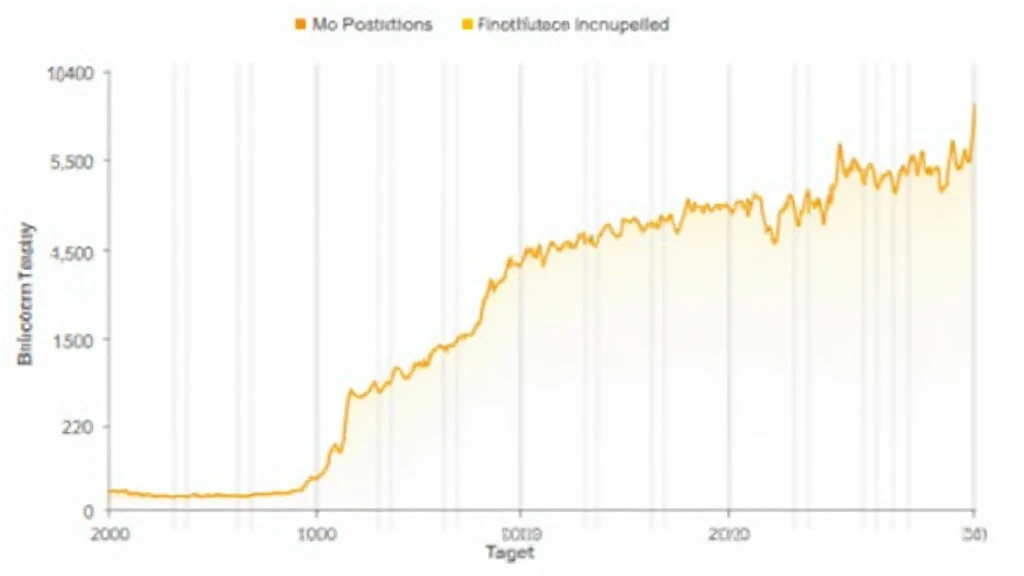

In the past quarters, MicroStrategy has issued several revisions to its Bitcoin price targets. Each revision presented a shift in market sentiment, influenced by various factors such as regulatory developments and macroeconomic trends.

Understanding Price Targets

Price targets are analytical tools used by investors to forecast future prices based on current market conditions. MicroStrategy’s modifications have often mirrored significant market movements:

- Initial Target: The initial price target set at $20,000 was based on early adoption trends.

- Revised Targets: Recent adjustments have escalated targets to upwards of $50,000-100,000, reflecting bullish investor sentiments.

Impact on Vietnamese Market Dynamics

As MicroStrategy continues to revise its Bitcoin price targets, the impact on emerging markets like Vietnam becomes increasingly relevant. The current crypto user growth rate in Vietnam is approximately 38%, highlighting a rapidly expanding demographic eager to engage with Bitcoin.

This growth can be attributed to:

- Increased Awareness: Local investors are becoming more aware of Bitcoin’s potential as a financial asset.

- Regulatory Advances: Improved regulatory frameworks are encouraging participation from both retail and institutional investors.

Future Price Projections and Strategic Recommendations

Given the volatility of the cryptocurrency market, accurately predicting future prices for Bitcoin involves substantial risk. However, MicroStrategy’s previous models are a good starting point for constructing your own expectations.

- Adopt a Long-Term Perspective: While short-term fluctuations are inevitable, focusing on long-term trends will yield better outcomes.

- Diversification: Similar to traditional finance, crypto investors should consider diversifying their portfolios.

- Education: Continuous learning about market trends can assist investors in making informed decisions.

Conclusion

MicroStrategy’s price target revisions for Bitcoin illustrate the interaction between corporate strategy and market trends, offering insights that can benefit investors. With a growing interest in digital assets, especially in emerging markets like Vietnam where user growth rates remain robust, understanding these dynamics is critical for any investor keen on navigating the ever-changing crypto landscape.

In a market where volatility is the only constant, keeping an eye on institutional movements such as MicroStrategy’s changes can serve as an essential guide for future investments.

Note: Not financial advice. Consult local regulators for guidelines.

For more insights, visit cryptocoinnewstoday.