Vietnam STO Regulations: Essential Insights for Investors

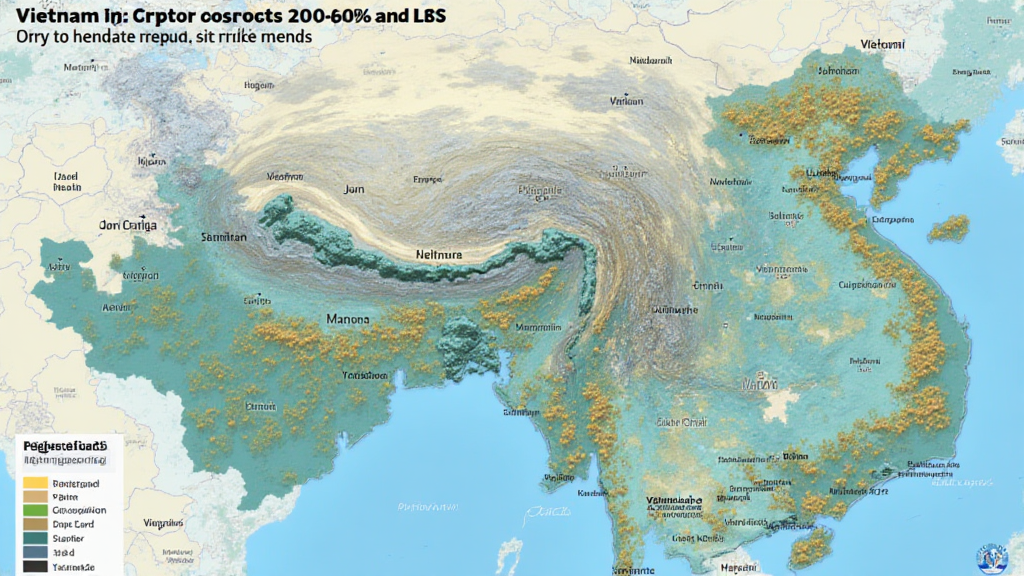

With the rise of blockchain technology, regulatory frameworks across the globe are evolving. In Vietnam, the burgeoning interest in Security Token Offerings (STOs) has led to the need for a structured set of regulations. As of 2025, it is estimated that the Vietnamese blockchain market will expand significantly, reflecting a user growth rate of over 25% annually. This presents a pivotal opportunity for investors. Here’s the catch: understanding the regulations surrounding STOs in Vietnam is crucial for navigating this promising landscape.

Understanding Vietnam’s Blockchain Ecosystem

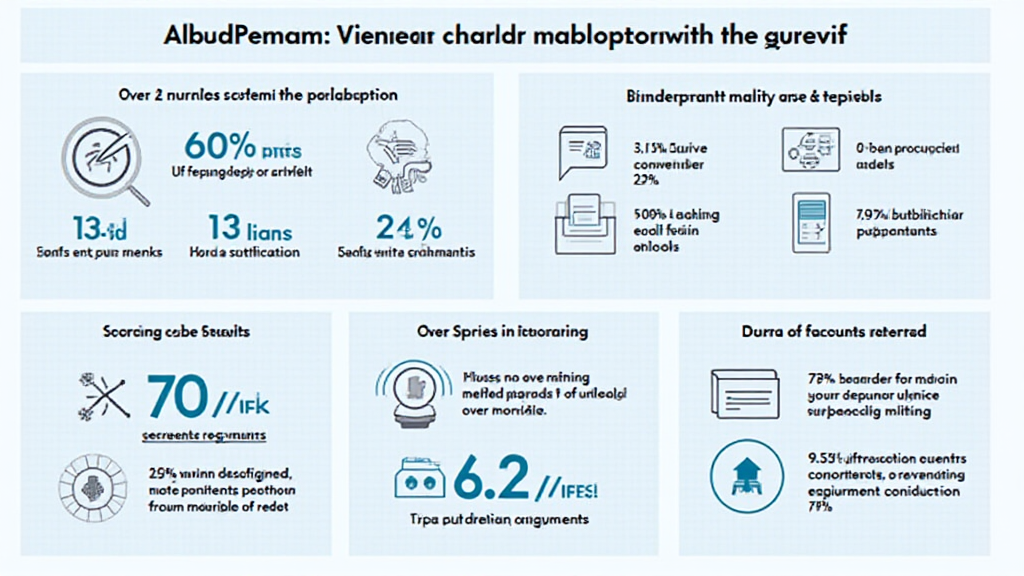

The Vietnamese blockchain market has shown immense potential, becoming a hotspot for technology enthusiasts and investors alike. Recent reports indicate that over 60% of Vietnamese internet users have expressed keen interest in cryptocurrencies and digital assets, sparking a transformative shift in how financial transactions are approached.

- Regulatory Landscape: The Vietnamese government has been proactive in establishing guidelines that ensure safety and compliance within the blockchain ecosystem.

- Growth Statistics: According to local authorities, the number of blockchain start-ups in Vietnam quadrupled in the past three years, highlighting the country’s rapid adoption of digital assets.

The Role of STOs in Vietnam

Security Token Offerings represent a significant evolution within the investment world. Unlike traditional utility tokens, which often provide access to a product or service, STOs are backed by real assets and thus have greater regulatory clarity. This makes them appealing to investors looking for a legitimate avenue to invest in the blockchain space.

- Assets Covered: STOs can include various assets such as real estate, stocks, and commodities, providing a diversified portfolio.

- Investor Protection: With regulations in place, STOs offer more protection compared to ICOs, ensuring investors are safeguarded against fraud.

Current Regulations Surrounding STOs in Vietnam

As of now, Vietnam’s regulatory framework for STOs is shaped by several key principles aimed at promoting transparency and security. The Vietnam State Securities Commission (SSC) has outlined specific guidelines for the issuance of STOs, ensuring that investors are well-informed.

- Licensing Requirements: Any entity wishing to issue security tokens must obtain the necessary licenses from the SSC, ensuring compliance with both local and international standards.

- Public Disclosure: Issuers are required to provide comprehensive information about their projects, including financial reports and risk assessments.

Implications for Investors

Investors looking to enter the Vietnamese STO market must be cognizant of the regulations that govern their investments. Adhering to these regulations not only enhances credibility but also builds trust within the investment community.

- Diversification: With diverse offerings, investors can mitigate risks associated with market volatility.

- Regulatory Acknowledgment: Engaging in well-regulated STOs ensures a higher level of investor protection, minimizing the risk of fraud.

Conclusion

As the Vietnam STO landscape continues to evolve, investors must stay informed about the regulations that impact their investment decisions. By understanding the legalities and the market dynamics, investors can navigate the complexities of STOs in Vietnam effectively. Remember, it’s not just about understanding the potential rewards but also recognizing the risks involved.

As outlined, the Vietnam STO regulations present a promising yet cautious opportunity for investors eager to engage with blockchain technology. Always consult with local regulators to ensure compliance and safeguard your investments in this expanding market.

For more insights into the Vietnamese cryptocurrency landscape, check out our detailed Vietnam crypto tax guide.

To summarize, the key to successful investment in Vietnam’s STOs lies in understanding the regulations and making informed decisions. As this market matures, those who are prepared will reap the rewards, while those who neglect the importance of regulation may face significant setbacks. Stay informed, stay compliant!

cryptocoinnewstoday will keep you updated on the latest developments in blockchain regulations and investment strategies.