Introduction

As the global cryptocurrency landscape continues to evolve, Vietnam is emerging as a significant player in the crypto market. Recent studies indicate that nearly 7 million people in Vietnam are now engaging with cryptocurrencies, marking a tremendous growth rate of 60% year-over-year. Such a rapid increase raises a pertinent question: How can we ensure liquidity in the Vietnam crypto market? This article aims to provide an in-depth analysis of Vietnam’s crypto market liquidity, focusing on critical trends, challenges, and strategies for sustainability.

Understanding Crypto Market Liquidity

In finance, liquidity refers to how quickly and easily an asset can be converted into cash without affecting its price. In the context of cryptocurrency, liquidity is vital as it enables investors to buy and sell coins efficiently. Here’s why liquidity matters:

- **Reduced Price Volatility:** A liquid market often leads to smaller price fluctuations.

- **Better Price Discovery:** Active trading helps determine an asset’s fair market value.

- **Ease of Entry and Exit:** Investors can enter or exit positions without significant slippage.

The State of Vietnam’s Crypto Market

Recent Growth Figures

According to hibt.com, Vietnam’s crypto market has witnessed an impressive surge in user adoption. Over the past year, reports suggest:

- **6%** of the population actively trading cryptocurrencies.

- **67%** increase in daily trading volume.

Factors Driving Growth

Several factors contribute to this rapid growth:

- Young Population: Vietnam boasts a vibrant youth demographic that is tech-savvy and eager to explore digital currencies.

- Government Interest: The Vietnamese government is increasingly recognizing the potential of blockchain technology and exploring regulations for digital assets.

- International Investment: Increased foreign investment is channeling into the Vietnamese crypto scene, bolstering liquidity.

Challenges to Liquidity in Vietnam’s Crypto Market

Regulatory Uncertainty

Despite the positive growth trends, regulatory uncertainty poses a significant challenge. The lack of clear frameworks around cryptocurrency trading can deter potential investors. For instance, tiêu chuẩn an ninh blockchain is yet to be clearly defined, creating room for confusion and risk.

Market Infrastructure

The existing market infrastructure also presents challenges. While there are several local exchanges, the overall trading ecosystem requires more robust security features and liquidity pools.

Strategies for Improving Liquidity

Encouraging Institutional Participation

One of the most effective ways to enhance liquidity is by encouraging institutional investors to enter the market. Strategies include:

- Creating favorable regulations: Transparent regulations make it easier for institutions to participate.

- Partnerships with Financial Institutions: Collaborating with banks can provide necessary trust and security.

Educating the Market

Investor education is crucial for sustained growth and liquidity. Awareness programs can help potential investors understand market mechanics, thereby increasing participation.

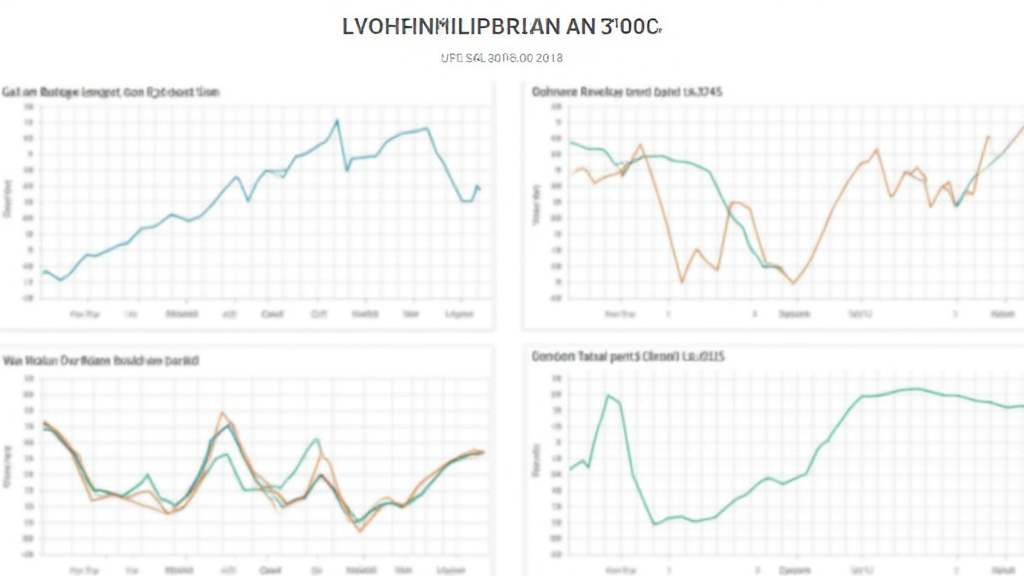

Future Outlook: What to Expect in 2025

Market Predictions

Looking ahead to 2025, experts suggest that the Vietnamese crypto market is poised for substantial growth. With predictions indicating a 200% increase in user adoption and trading volume, liquidity is expected to improve.

Potential User Growth Rate

Factors influencing this positive outlook include:

- Increased Acceptance: More businesses are beginning to accept cryptocurrencies.

- Blockchain Education: Enhanced educational initiatives focusing on blockchain technology are set to proliferate.

Conclusion

In conclusion, while the Vietnam crypto market is experiencing rapid growth, ensuring liquidity is crucial for its sustainability. Balancing regulatory frameworks, encouraging institutional participation, and educating investors will be essential steps in this journey. Stay tuned for developments in the Vietnam crypto market and make sure to measure your investment strategies against the evolving liquidity landscape. Remember, always consult local regulations before engaging with cryptocurrencies.

Read more about our insights on Vietnam’s growth potential in the crypto sector and feel free to share your thoughts or questions!