How to Invest in RWA Bonds Vietnam: A Comprehensive Guide

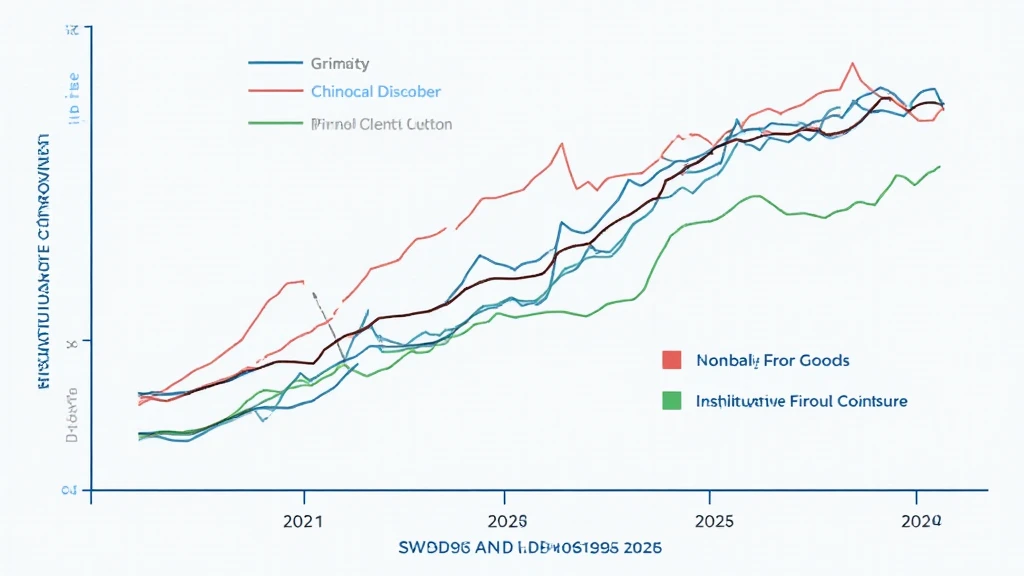

With the Vietnamese economy rapidly evolving and attracting a multitude of foreign investments, RWA (Real World Asset) bonds have emerged as a notable investment avenue. According to recent industry reports, Vietnam’s economic growth in 2025 is projected to hit a remarkable rate of 6.5%, making it a hotspot for both local and international investors.

In this article, we’ll delve into how to invest in RWA bonds in Vietnam, examining the intricacies of this investment landscape, potential risks, and how it aligns with the broader global trend of integrating blockchain technologies. By the end, you’ll have a clearer understanding of how to navigate this space, and you’d be well-equipped to make informed decisions.

Understanding RWA Bonds

RWA bonds, or Real World Asset bonds, are financial instruments that represent ownership in real assets like property, machinery, or commodities. As these assets are tokenized on the blockchain, they offer enhanced security, transparency, and ease of trade.

- **Security**: Blockchain uses cryptography and consensus algorithms, ensuring that transactions are secure.

- **Transparency**: All transactions are recorded on the blockchain, making them easily auditable.

- **Liquidity**: Tokenized assets can be traded on various platforms, providing liquidity that traditional assets may lack.

According to a report by Hibt.com, the tokenization of assets in Vietnam is expected to grow by over 30% in the coming years, underlining the importance of understanding RWA bonds in this rapidly evolving environment.

Why Invest in RWA Bonds in Vietnam?

Investing in RWA bonds in Vietnam offers distinct advantages:

- **Market Growth**: With a burgeoning economy, Vietnam presents ample investment opportunities. The increase in consumer spending and urbanization is driving up the demand for various real-world assets.

- **Diverse Options**: RWA bonds can be based on several underlying assets, providing investors with options to diversify their portfolios.

- **Regulatory Support**: The Vietnamese government is progressively creating a legal framework surrounding cryptocurrency and blockchain investments, increasing investor confidence.

How to Get Started with RWA Bonds

Ready to dip your toes into the world of RWA bonds? Here’s how you can get started:

- Educate Yourself: Research the specific types of RWA bonds available in the Vietnamese market. Find credible sources, reports, and white papers that explain the risks and potential rewards.

- Choose a Reputable Platform: Look for exchanges that provide access to RWA bonds. Ensure they comply with local regulations and are recognized in the cryptocurrency community.

- Start Small: If you’re new to RWA bonds, consider starting with small investments. This practice allows you to gain experience without taking on excessive risk.

- Consult Experts: Speak to financial advisors or individuals who have a proven record in RWA investments. They can provide valuable insights based on market trends.

Key Risks to Consider

Just as with any investment, investing in RWA bonds carries risks:

- **Market Volatility**: The value of RWA bonds can fluctuate significantly based on market demand and economic conditions.

- **Regulatory Changes**: As blockchain and digital assets are relatively new sectors, regulations may change, impacting the legality and operation of RWA bonds.

- **Technology Risks**: Potential hacks or technical failures can compromise security, leading to loss of assets.

Leveraging Blockchain Technology in RWA Bonds

One of the defining features of RWA bonds is their connection to blockchain technology. The use of blockchain underpinning these assets provides several benefits:

- **Enhanced Security**: The blockchain’s decentralized nature ensures that assets are less susceptible to fraud and cyberattacks.

- **Transaction Efficiency**: Transactions can be executed much faster than traditional methods, providing quicker access to funds.

- **Global Reach**: Blockchain allows for cross-border transactions, making investments easier across different countries, including Vietnam and beyond.

Local Market Insights

The Vietnamese market is proving to be a compelling environment for RWA bonds:

- The **user growth rate** in Vietnam’s crypto market is among the highest in Southeast Asia, with millions of new users entering the space each year.

- Government initiatives are being implemented to embrace blockchain technology, leading to more accessible investment avenues for retail investors.

Moreover, the Vietnamese government is focusing on developing a regulatory framework surrounding blockchain technology, including the tokenization of assets, providing both safety and legitimacy to investors.

Future Trends in RWA Bonds

As we focus on the future, several trends are anticipated to shape the RWA bonds landscape:

- **Increased Institutional Investment**: Major financial institutions are beginning to show interest in RWA tokens, integrating them into their portfolios.

- **Integration with DeFi**: The collision of RWA bonds with decentralized finance (DeFi) protocols will provide new utility and investment strategies.

- **Advancements in Security Standards**: Enhancements in blockchain security standards (tiêu chuẩn an ninh blockchain) are expected, reducing risks related to security breaches.

Understanding these trends equips investors with the tools to stay ahead in the market.

The Bottom Line

Investing in RWA bonds in Vietnam presents a unique opportunity amid the country’s economic growth and a burgeoning digital asset ecosystem. By leveraging data, understanding the local landscape, and recognizing the risks involved, you can position yourself for success in this new investment frontier.

As you embark on your investment journey, remember: there is no such thing as a no-risk investment. Always conduct thorough research and consider seeking advice from financial professionals.

For more insights into the world of cryptocurrency, including investment strategies and market updates, visit cryptocoinnewstoday.

Author: Dr. Nguyễn Bình, a renowned financial analyst with over 10 published papers in blockchain technology and a key contributor to significant audits of major crypto projects.