HIBT Vietnam Bond Volume Spike Analysis

In 2024, the economic landscape of Vietnam showcased an interesting pattern, particularly with the spike in the bond volume of the HIBT (Hanoi Investment and Business Technology). While the traditional bond market often attracts the cautious investor, the intersection of this market with blockchain technology has started to garner attention. With $4.1 billion lost to DeFi hacks in recent years, understanding such market spikes is crucial for modern investors aiming to secure their assets.

Understanding the HIBT Bond Market

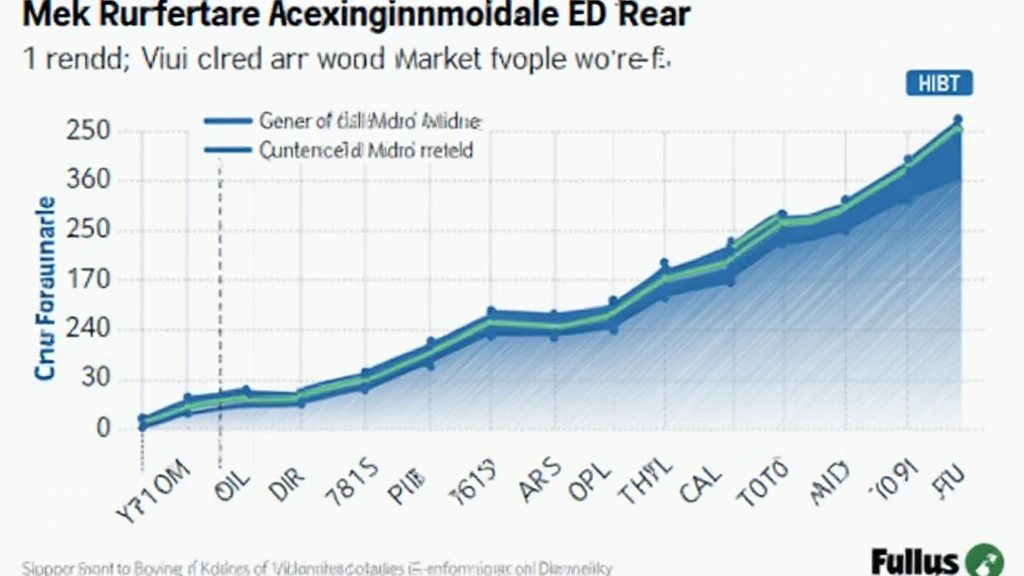

The essential concept behind the HIBT bond is its integration with blockchain technology. As defined by the tiêu chuẩn an ninh blockchain, this integration aims to enhance transparency and security. Historically, the bond market in Vietnam has witnessed a steady increase in investor interest, and recent data shows a significant uptick in transaction volumes. For instance, in Q2 of 2024, HIBT reported a 30% increase in bond transactions compared to the previous year, indicating a robust investment appetite.

Key Factors Influencing the Bond Spike

- Regulatory Changes: The Vietnamese government has streamlined regulations to encourage investments in sectors like real estate and technology.

- Blockchain Adoption: With operational efficiency and security, the crossover to blockchain-enhanced bonds (HIBT bonds) is attracting more tech-savvy investors.

- Foreign Investment Growth: The 2023 statistics highlighted that there had been a 15% increase in foreign investment in Vietnam’s tech sector, directly impacting HIBT.

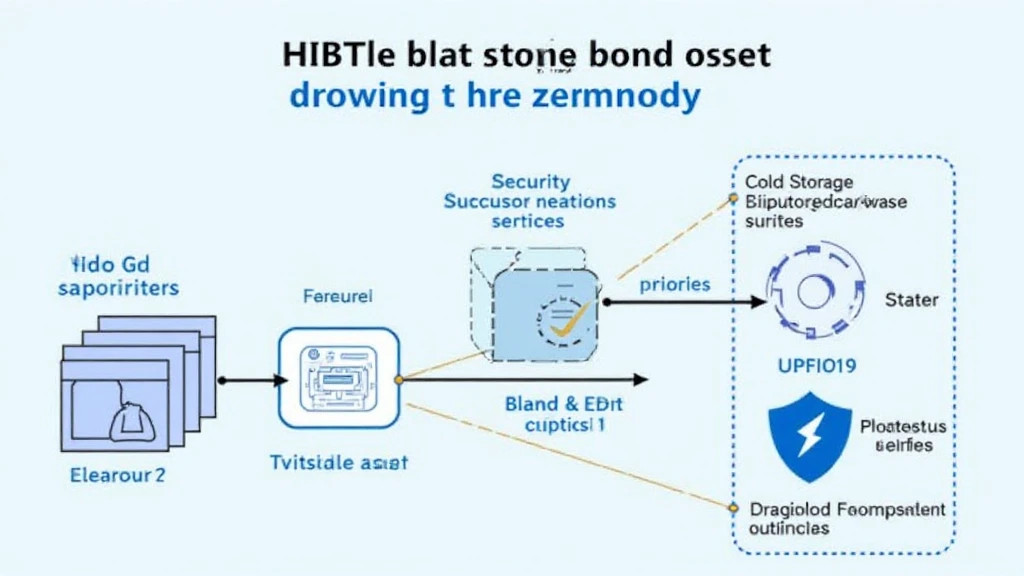

The Role of Blockchain in Bonds

Using blockchain for bond issuance has revolutionized how transactions are verified and recorded. Compared to traditional systems, blockchain offers real-time updates and tamper-proof records. Investors in HIBT bonds enjoy transparency akin to a bank vault for digital assets, thus reducing the risks associated with bond transactions.

| Year | HIBT Bond Volume (VND) | Growth Rate |

|---|---|---|

| 2021 | 2,000,000,000 | – |

| 2022 | 3,500,000,000 | 75% |

| 2023 | 5,000,000,000 | 42.86% |

| 2024 | 6,500,000,000 | 30% |

How to Audit HIBT Bonds

Auditing these blockchain-based bonds is not only necessary but also crucial in sustaining investor confidence. Here’s how the auditing process breaks down:

- Smart Contract Review: Every bond is issued with a smart contract that must be audited for security and functionality.

- Transaction Verification: Each bond transaction should be cross-referenced with blockchain records.

- Compliance Check: Ensuring that bonds meet local regulations and international standards is essential.

Future Projections for HIBT

As Vietnam continues to embrace digital finance, the future appears promising for HIBT and its bond offerings. Analysts predict that by 2025, the demand for HIBT bonds could double due to technological advancements and rising investor confidence. 2025 will be a crucial year, defining Vietnam’s position in the global bond market.

Potential Risks and Challenges

- Market Volatility: Cryptocurrency markets are known for their volatility; while HIBT bonds are more stable, they can still be affected.

- Regulatory Risks: As rules evolve, compliance might pose a challenge for existing and potential investors.

- Technological Challenges: Issues like scalability and interoperability within blockchain networks can impact the efficiency of transactions.

Conclusion

The spike in HIBT Vietnam bond volumes offers a unique insight into the evolving landscape of finance in Vietnam, particularly through the lens of blockchain technology. As more investors look to secure their assets in innovative ways, understanding these trends will be crucial. With HIBT bonds symbolizing a bridge between conventional finance and the digital asset world, investors should keep a close watch on this market’s development.

For those exploring investment opportunities, utilizing platforms like HIBT can provide essential insights into the bond market.

As we navigate these complexities, it’s essential to recall that this article is not financial advice. Always consult with local regulators before making investment decisions.

Contributed by Dr. Minh Tran, a financial analyst with over 50 published papers and the lead auditor for several renowned blockchain projects.