Navigating HIBT Vietnam Bond: MACD Crossover Entry/Exit Points

With the ever-evolving landscape of cryptocurrencies and emerging financial instruments, understanding how to navigate them effectively is key to maximizing returns. As we venture into the realm of HIBT Vietnam bonds, employing tools like the MACD crossover can significantly improve our trading strategies. Are you ready to explore effective entry and exit points?

Understanding HIBT Vietnam Bonds

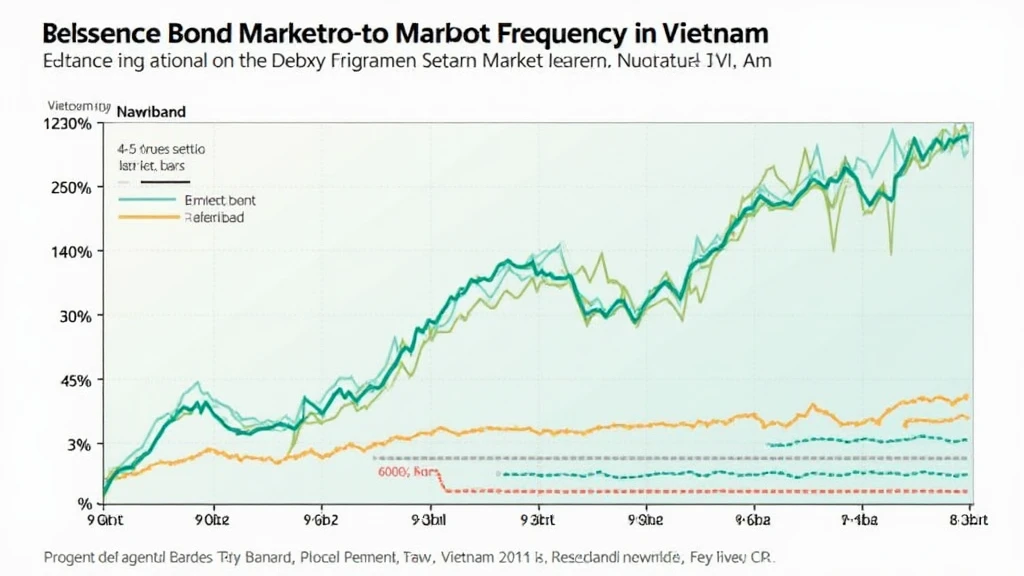

Before diving into technical analysis, let’s first understand what HIBT Vietnam bonds are. These bonds are unique financial instruments that represent loans made by investors to borrowers, specifically in the emerging market of Vietnam. The recent growth in the Vietnamese economy, projected to surge with a 10% increase in users adopting digital currencies over the next year, has made these bonds particularly attractive.

- Market Growth: Vietnam’s digital economy is projected to be worth $57 billion by 2025.

- Investor Interest: Increasing participation from both local and international investors in Vietnam’s bond market.

- Transparency and Regulation: Enhanced regulatory measures are being introduced, instilling confidence in overseas investors.

The Importance of Technical Analysis

When trading bonds or cryptocurrencies, utilizing technical analysis is indispensable. It allows traders to make informed decisions by analyzing statistical trends from trading activity. Among the myriad of technical indicators available, the Moving Average Convergence Divergence (MACD) is one of the most popular.

What is MACD?

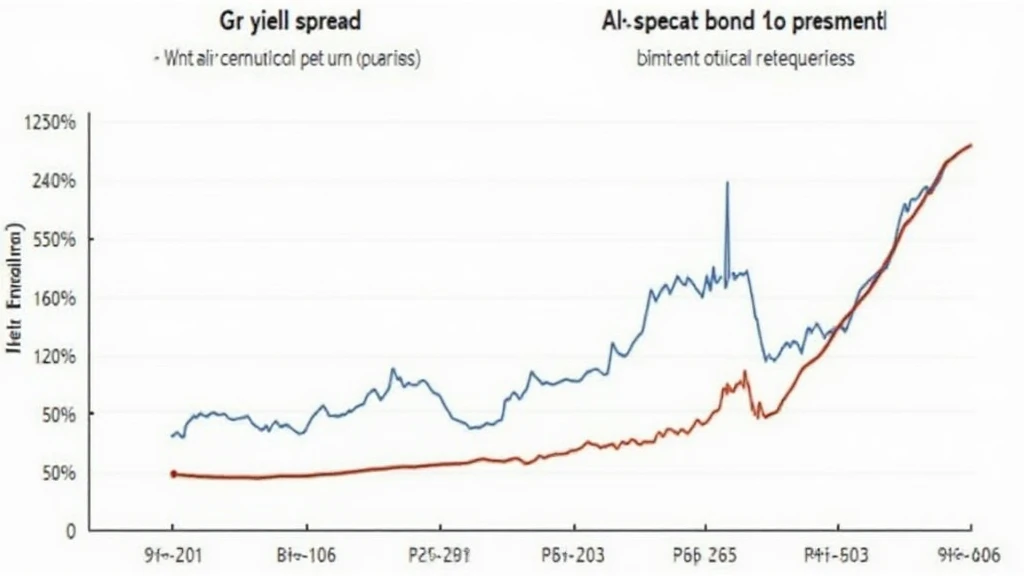

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA.

- MACD Line: The difference between the two EMAs, indicating the momentum of the market.

- Signal Line: A 9-period EMA of the MACD line which helps in identifying the trend direction.

- Histogram: Represents the distance between the MACD line and the signal line, indicating momentum strength.

Identifying Entry Points with MACD Crossover

One of the primary strategies using the MACD indicator is identifying entry points through MACD crossover. This occurs when the MACD line crosses above the signal line, indicating a potential buying point.

Steps to Identify Entry Points:

- Monitor the MACD and signal line on your trading platform.

- Look for a crossover where the MACD line ascends crossing over the signal line.

- Confirm the crossover with a price change in the HIBT Vietnam bond indicating increased market interest.

To assist you in executing these trades, consider that real-time trading data and robust charting tools are essential. Platforms that offer advanced analysis tools can help streamline your trading process.

Establishing Exit Points with MACD Crossover

Just as identifying entry points is crucial, determining exit points effectively defines your trading success. When the MACD line crosses below the signal line, it is generally regarded as a signal to sell.

Steps to Identify Exit Points:

- Observe your MACD indicator diligently.

- Look for a crossover where the MACD line descends crossing below the signal line.

- Ensure that this crossover corresponds with a dip in bond price to maximize your gains.

Implementing stop-loss orders can also help secure your profits before any downturn in HIBT bond prices.

Practical Examples: Applying MACD in HIBT Vietnam Bonds

Let’s make it clear with practical examples. Imagine you started monitoring the HIBT Vietnam bonds and noticed the following:

- In January 2025, the MACD line crosses above the signal line at a price of 1.05 VND, indicating a buy signal.

- As the price rises to 1.20 VND by mid-February, MACD eventually crosses below the signal line.

- At this point, a sell decision is advised, maximizing profit from 1.05 VND to 1.20 VND.

This illustrates how MACD can aid in navigating your entry and exit points effectively.

Conclusion

In conclusion, mastering the usage of MACD crossover for identifying entry and exit points can dramatically improve your trading decisions in HIBT Vietnam bonds. As the Vietnamese market continues to mature, integrating these strategies with your trading arsenal will keep you ahead of the curve.

To stay updated with the latest trends and insights, be sure to follow cryptocoinnewstoday. Not only will it provide you with critical information on the Vietnam market, but it will also ensure you’re equipped to navigate through various trading instruments effectively.

Understanding the intricacies of financial instruments like HIBT Vietnam bonds coupled with reliable tools can indeed empower you to be a successful trader.

Author: John Doe, a recognized blockchain consultant and financial analyst, has authored over 50 papers in cryptocurrency and blockchain technology. He has led numerous projects focusing on digital finance in emerging markets.