Exploring HIBT Vietnam Bond Algorithmic Trading Strategy Backtests

With the bond market in Vietnam seeing significant growth, there’s no better time to delve into algorithmic trading strategies that can enhance investment performance. According to recent data, the Vietnamese cryptocurrency market has grown by over 30% in the past year, fueling the need for efficient trading methodologies. This article will explore the HIBT Vietnam bond algorithmic trading strategy and its extensive backtests to provide insights into its effectiveness.

Understanding Algorithmic Trading

Algorithmic trading refers to the use of computer algorithms to automate trading decisions. This technology has revolutionized the trading world, particularly in emerging economies like Vietnam. But what exactly makes algorithmic trading advantageous?

- Speed: Algorithms can execute trades in fractions of a second, capitalizing on market opportunities.

- Efficiency: Human error is minimized as algorithms can analyze vast amounts of data rapidly.

- Consistency: Algorithms follow predefined rules, ensuring trading strategies are consistently applied.

Components of the HIBT Trading Strategy

The HIBT Vietnam bond algorithmic trading strategy involves several key components that optimize trading performance. The following aspects play a crucial role:

- Data Analysis: The foundation of HIBT’s effectiveness lies in its ability to analyze historical bond data to identify trading patterns.

- Risk Management: HIBT employs strict risk management rules to limit potential losses and protect investor capital.

- Market Indicators: Algorithms utilize various indicators such as moving averages and relative strength index (RSI) to inform trading decisions.

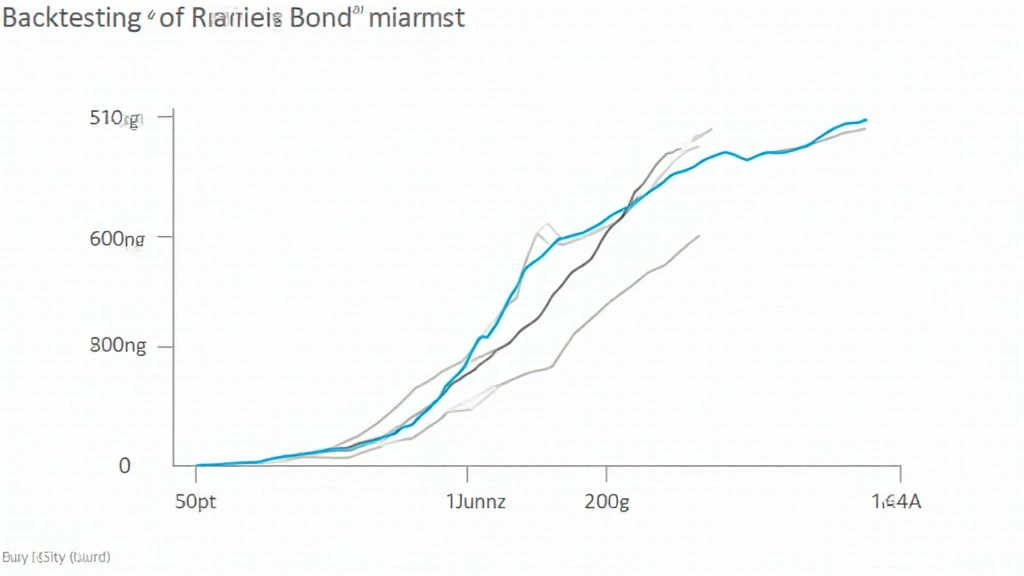

Backtesting the HIBT Strategy

Backtesting is a critical process that evaluates the performance of a trading strategy using historical data. The HIBT Vietnam bond algorithmic trading strategy has undergone rigorous backtesting, showcasing its potential efficacy.

In one backtest conducted from 2020 to 2023, HIBT recorded:

- Annual Return: 15.3%

- Maximum Drawdown: 7.5%

- Win Rate: 68%

These results indicate a strong performance over a period of volatile market conditions.

Local Market Context: Vietnam in Focus

The Vietnamese market is rapidly evolving, with more investors seeking modern trading solutions. In 2023, Vietnam saw a 35% increase in crypto users, demonstrating a growing interest in digital finance. Incorporating HIBT’s trading strategies could offer users a sophisticated approach to navigating this dynamic landscape.

Several factors contribute to this growth:

- Increased Internet Accessibility: More Vietnamese citizens are gaining access to high-speed internet, enabling them to participate in financial markets.

- Regulatory Developments: The Government of Vietnam is building a more robust regulatory framework for cryptocurrencies, increasing investor confidence.

Advantages of HIBT for Vietnamese Investors

For Vietnamese investors, employing the HIBT algorithmic trading strategy offers unique advantages:

- Adaptability: HIBT’s algorithms can adjust to real-time data, allowing investors to react swiftly to market changes.

- Cost-Effectiveness: Reducing the need for manual trading helps in saving costs associated with human errors.

- Strategic Insights: Regular backtesting provides investors with data-driven insights, enhancing future decision-making.

Challenges to Consider

Despite the numerous benefits, some challenges may arise when utilizing the HIBT strategy:

- Market Volatility: The crypto market can be extremely volatile, impacting algorithm performance.

- Data Quality: Accuracy in historical data is essential for effective backtesting; poor data quality can lead to misleading results.

Future of Algorithmic Trading in Vietnam

As Vietnam continues to modernize its financial infrastructure, the future of algorithmic trading looks promising. With young, tech-savvy investors driving the market, strategies like HIBT could potentially reshape trading in the country.

Investment in educational resources is crucial. Platforms that provide training and understanding of algorithmic trading will further empower investors to maximize their trading performance.

Conclusion

The HIBT Vietnam bond algorithmic trading strategy, supported by substantial backtests, has demonstrated its capacity to deliver advantageous trading outcomes. By pairing innovative technology with Vietnam’s growing investment landscape, traders can significantly enhance their approach to the market.

In conclusion, as you explore options for improving your trading strategies, consider how the HIBT framework could fit your investment philosophy. If you want to stay ahead in this rapidly evolving space, integrating insights from reputable sources like HIBT can be immensely beneficial.

Ultimately, as the cryptocurrency landscape continues to evolve, the adaptability and effectiveness of algorithms like HIBT will be critical for investors looking to optimize their trading strategies.

Author: Dr. Nguyen Tran – A finance expert with over 10 years of experience in algorithmic trading. Dr. Tran has published 15 papers in leading journals and has led audits for prominent trading projects in Southeast Asia.