Introduction

With the growing popularity of cryptocurrencies, understanding market volatility has never been more critical. According to a recent report by Chainalysis, approximately $4.1 billion was lost to hacks in DeFi platforms in 2024 alone. This alarming statistic highlights the importance of having reliable metrics to assess market conditions effectively. In this comprehensive guide, we will dive deep into HIBT crypto market volatility metrics, offering insights and strategies to navigate the often unpredictable nature of digital asset investments.

What are HIBT Crypto Market Volatility Metrics?

Market volatility refers to the degree of variation in trading prices over time. It showcases how drastically the price of a cryptocurrency can change within a short period. HIBT crypto market volatility metrics specifically focus on determining and analyzing the fluctuations associated with various cryptocurrencies.

- Standard Deviation: A quantitative measure of the amount of variation or dispersion of a set of values.

- Average True Range (ATR): A technical indicator used to measure market volatility by decomposing the entire range of an asset price for that period.

- Beta Coefficient: Measures the tendency of an asset’s returns to respond to swings in the market.

The Importance of Understanding Market Volatility

In the context of trading, market volatility can be a double-edged sword. On one side, it presents opportunities for profit; on the other, it poses significant risks. Here’s why understanding market volatility is essential for cryptocurrency traders:

- Risk Management: Understanding volatility allows traders to manage their risk effectively. You can set stop-loss orders at more strategically sound levels.

- Trading Strategies: By analyzing volatility metrics, traders can adapt their strategies accordingly, whether they are day trading or long-term investing.

- Market Sentiment: High volatility often aligns with market panic or exuberance, which can provide insights into investor sentiment.

HIBT Metrics in Action: How to Use Them for Better Trading Decisions

Let’s break down how to leverage HIBT crypto market volatility metrics to make more informed trading decisions:

- Monitoring Volatility: Regularly check the standard deviation of your chosen cryptocurrencies to gauge daily fluctuations.

- ATR Implementation: Use ATR to set realistic targets for profit-taking or loss-cutting depending on the market conditions.

- Adjusting Portfolio Exposure: Based on your risk tolerance and the beta coefficient, adjust your exposure to highly volatile assets.

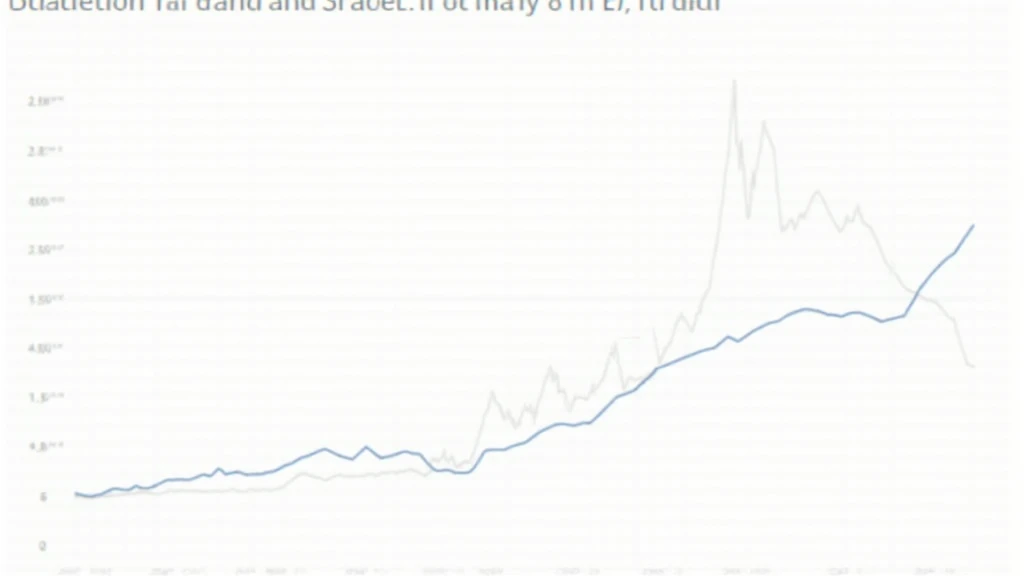

Real Data: Assessing Vietnam’s Cryptocurrency Market

The Vietnamese cryptocurrency market has shown remarkable growth, with recent statistics indicating a user growth rate of over 130% in the last year. This underscores the significance of HIBT metrics, especially in a rapidly evolving market like Vietnam:

- Growing User Base: The surge in users indicates rising interest, necessitating the need for effective volatility assessment metrics.

- Stablecoin Adoption: Local users are increasingly shifting towards stablecoins to mitigate the effects of volatility associated with traditional cryptocurrencies.

Best Practices for Tracking HIBT Metrics

In an age where technology evolves rapidly, it’s crucial to stay informed about market metrics. Here are some best practices for tracking HIBT crypto market volatility metrics:

- Use Advanced Tools: Utilize tools that allow you to track volatility metrics in real-time.

- Set Alerts: Customize alerts for volatility changes in cryptocurrencies you are invested in.

- Continuous Learning: Stay updated with industry changes and enhance your technical analysis skills.

Conclusion

It’s evident that understanding HIBT crypto market volatility metrics is essential for successful trading in the crypto sphere. Equipped with these metrics, traders can make more confident choices in what is often a turbulent market. Navigating market fluctuations while leveraging sound analytics will invariably lead to better trading outcomes. Remember, as the market evolves, continuous learning and adaptation will be your best strategies!

For more on cryptocurrency metrics, visit HIBT for detailed insights.

As always, we recommend conducting thorough research and consulting with local regulators regarding financial advice applicable in your jurisdiction.

Authored by: Dr. Vu Nguyen, a seasoned financial analyst with over 10 published papers and expertise in cryptocurrency auditing projects.