Introduction to Crypto Trading Limits

The allure of cryptocurrency trading has never been more pronounced, particularly with the rising interest in leverage trading. In 2024 alone, an estimated $3.5 billion was lost due to irresponsible trading practices. This underlines a critical question – how can traders protect their investments while maximizing their potential? This guide seeks to elucidate the nuances of HIBT crypto leverage trading limits and empower traders with essential insights.

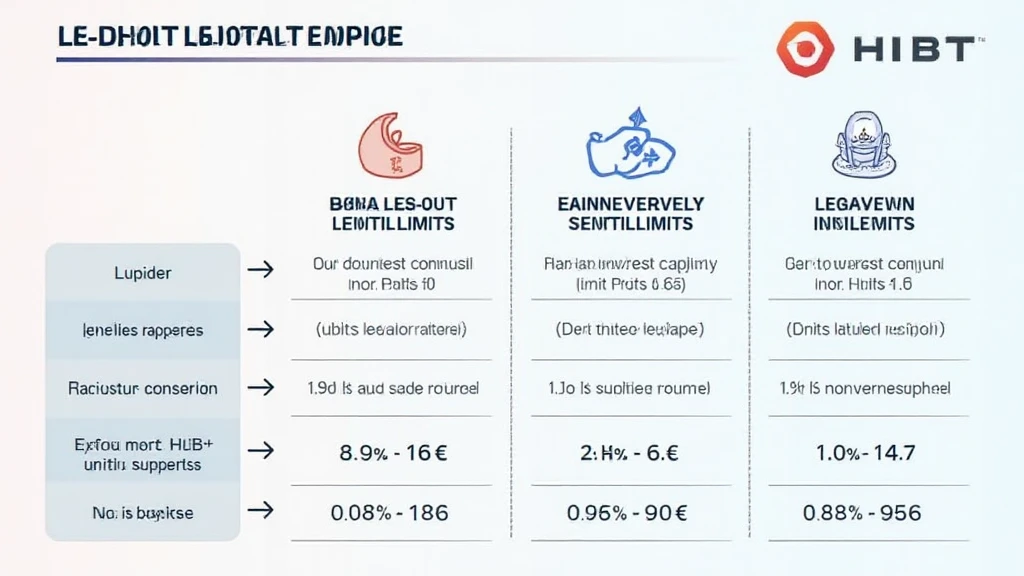

What is HIBT Crypto Leverage Trading?

HIBT (High Interest Blockchain Trading) leverage trading allows traders to operate with more funds than they possess, effectively increasing their potential gains—and their potential losses. Trading with leverage entails borrowing money for increasing purchasing power in the crypto market. Like a bank offering a mortgage, trading platforms provide leverage to enhance the trading experience.

Key Concept: Leverage Ratio

Traders can engage with various leverage ratios, which can range from 2:1 to 100:1 in some contexts. However, as the leverage increases, so does the risk. An ill-timed position can lead to a ‘liquidation event’, meaning traders can lose their entire investment in mere seconds. Hence, understanding your trading limits is crucial.

Importance of Trading Limits

Trading limits are not merely regulatory measures—they’re safety nets designed to protect investors and the integrity of the trading platform. Without limits in place, unregulated markets can lead to drastic volatility, which not only affects the traders but also the overall economy surrounding cryptocurrencies.

How Limits Ensure Market Stability

– **Risk Management:** Imposing caps on leverage prevents traders from overextending themselves.

– **Market Integrity:** Limits prevent market manipulation and protect the viability of pivotal exchanges.

– **Investor Protection:** These measures ensure retail investors do not lose more than they can afford, fostering a sustainable trading environment.

Understanding HIBT Crypto Leverage Trading Limits in Vietnam

In Vietnam, the crypto market is burgeoning rapidly. Recent data shows a growth rate of 40% in crypto adoption among local users in 2024. As traders begin their journeys on platforms like HIBT, understanding leverage limits becomes crucial.

Popularity Surge

– **2024 data:** Approximately 2 million new users involved in crypto trading in Vietnam.

– **Future Projections:** By 2025, Vietnam’s crypto market is expected to reach $1 billion in trading volumes.

These statistics highlight the increasing need for education on safe trading practices, particularly with HIBT crypto leverage trading.

Setting Your Trading Limits

Knowing how to set your leverage trading limits is vital to your success. Here’s a structured approach:

– **Understand Your Risk Tolerance:** Assess your appetite for risk before diving into trading. Consider whether you’re willing to endure potential losses.

– **Research Different Leverage Options:** Investigate the available leverage ratios on your trading platform, such as HIBT. The most common ratios are 2:1, 5:1, and 10:1.

– **Simulate Trading Scenarios:** Use demo accounts to practice trading with leverage without putting your capital at risk.

– **Identify Asset Volatility:** Research the assets you’re interested in trading. More volatile assets typically require lower leverage to mitigate risk.

The Risks of High Leverage Trading

While leverage trading can amplify gains, it can also amplify losses. Here are the critical risks to consider:

– **Margin Calls:** When the market moves against your position, you might be required to deposit more capital to maintain your position.

– **Rapid Market Changes:** Cryptocurrency is known for its volatility. A swift price decline can trigger automatic sell-offs, locking in losses.

– **Overconfidence Effects:** The lure of potential gains can lead traders to overlook critical risk management strategies.

Strategies for Safe Leverage Trading

To navigate the risks of HIBT crypto leverage trading limits, consider implementing the following strategies:

– **Start Small:** Begin with lower leverage ratios and gradually increase as you gain more experience.

– **Utilize Stop-Loss Orders:** Implement stop-loss orders to limit potential losses automatically.

– **Diversify Your Portfolio:** Spread out your investments across various cryptocurrencies to mitigate risk.

Conclusion and Key Takeaways

In conclusion, understanding HIBT crypto leverage trading limits is essential for safeguarding your investments while maximizing potential returns. As the crypto market continues to grow, particularly in Vietnam where user adoption is rising, this knowledge becomes fivefold more crucial. Educating yourself on market dynamics and employing risk management strategies will pave the way for a sustainable trading experience.

With the proliferation of digital currencies, staying informed and making educated trading decisions is more important than ever. Remember, always **consult with financial professionals** before engaging in high-leverage trading.

For more insights and information, be sure to visit [HIBT.com](https://hibt.com).

Author Insights:

Dr. Alex Cheng, a cryptocurrency researcher with over 15 published papers on blockchain security and smart contract auditing, offers valuable perspectives on navigating today’s crypto landscape.