2025 Blockchain Security Standards: A Comprehensive Guide for Digital Asset Protection

With over $4.1 billion lost to DeFi hacks in 2024, understanding the importance of security in the world of digital assets has never been more pressing. As we transition into 2025, it’s crucial to be well informed about the essential blockchain security standards and how they can protect your investments.

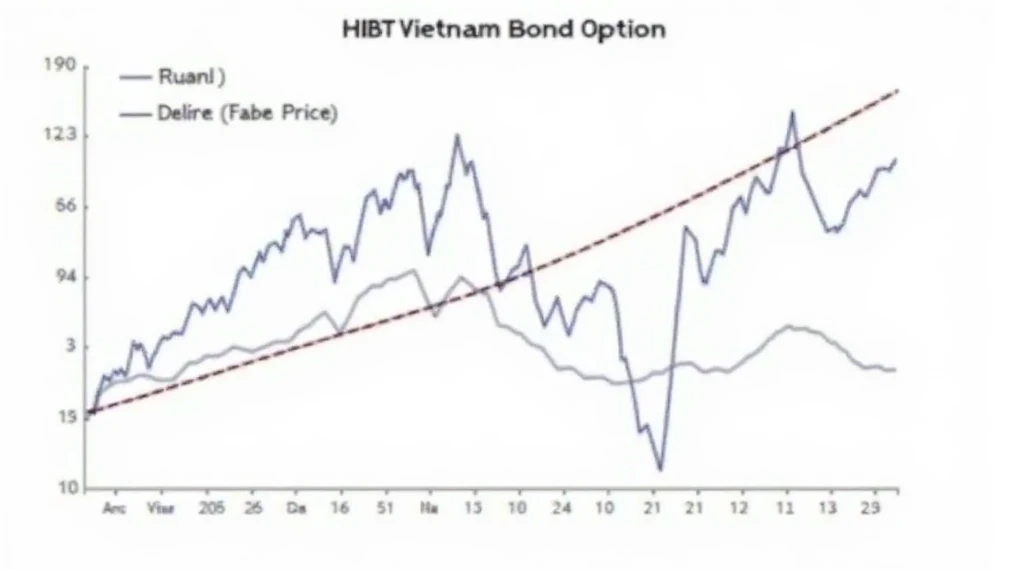

This article aims to articulate the safety thresholds that the HIBT Vietnam bond leverage ratio presents, alongside significant insights into optimizing your cryptocurrency investments using the platform cryptocoinnewstoday. Additionally, we will touch upon relevant regulations, real-world implications, and strategies for future-proofing your holdings in the ever-evolving cryptoecosystem.

Understanding HIBT Vietnam Bond Leverage Ratios

The HIBT Vietnam bond leverage ratio (tỷ lệ đòn bẩy trái phiếu HIBT Việt Nam) is a critical indicator that reflects the stability and potential return of investments in Vietnamese bonds. As of 2025, it is essential to evaluate how these ratios can influence the perceived security of cryptocurrency.

- Significance of Leverage Ratios: High leverage ratios can indicate both increased risk and potential for higher returns.

- Safety Thresholds: Establishing safety thresholds around these ratios mitigates risks associated with volatile market conditions.

- Impact on Investor Confidence: Understanding HIBT ratios can lead to increased investor confidence in the Vietnamese market.

Blockchain Security: Safety Thresholds Explained

Establishing safety thresholds for investments in blockchain assets is akin to setting firewalls in a digital fortress. Blockchain safety standards must be continuously updated to defend against emerging threats.

According to Chainalysis 2025, the number of crypto users in Vietnam has surged by 150%, further necessitating robust security measures.

Here’s a breakdown of some essential safety thresholds and their application:

- Transaction Limits: Setting caps on high-value transactions to prevent large-scale hacks.

- Smart Contract Audits: Regular audits on smart contracts can minimize exploitation risks.

- User Education: Ongoing education about phishing scams and wallet safety.

Decoding Consensus Mechanism Vulnerabilities

While blockchain is often hailed for its transparency and security, it is not immune to vulnerabilities. Understanding and addressing these weaknesses is pivotal for investors.

For instance, consensus mechanisms like Proof of Work (PoW) and Proof of Stake (PoS) can introduce unique challenges:

- PoW Risks: The high energy consumption can lead to a centralization of mining power, posing risks for network integrity.

- PoS Concerns: The wealth inequality can create barriers to entry for smaller investors, challenging the decentralized ethos.

Practical Strategies for Investors

As a savvy investor, adopting practical strategies to enhance the safety and performance of cryptocurrency investments is vital. Here are some recommended approaches:

- Diversity: Invest in a mix of stable and high-potential altcoins, like the most promising altcoins of 2025.

- Cold Storage: Utilize hardware wallets such as Ledger Nano X, which can reduce hacks by 70%.

- Continuous Learning: Stay informed about developments in blockchain technology, regulations, and market trends.

Implications of Local Cryptocurrency Regulations

As the Vietnamese government rolls out regulations to govern the cryptocurrency market, understanding these changes is crucial. These regulations often aim to enhance transparency and security while promoting user protection.

For instance, the recent legislation may introduce compliance requirements that encourage local exchanges to adopt standardized security protocols. This, in turn, can instill greater confidence amongst users:

- Compliance Measures: Exchanges must adhere to strict AML and KYC protocols to curb fraudulent activities.

- Market Impacts: Changes in regulations may cause fluctuations in market trends, necessitating agile responses from investors.

Conclusion: Future-Proofing Your Investments

In summary, understanding the HIBT Vietnam bond leverage ratio and its safety thresholds is vital for making informed decisions in the crypto market. As we head into 2025, embracing blockchain security standards is essential to ensure the safety of your digital assets.

Staying updated with regulatory landscapes, leveraging diversified investment strategies, and adopting robust security measures will fortify your investments against unforeseen challenges. Remember, cryptocurrency investments come with risks, so it’s advisable to consult local regulators before making financial commitments.

For the latest news and updates in the world of cryptocurrencies, visit cryptocoinnewstoday.

Author: Dr. Sophia Miles, a blockchain technology specialist with over 10 published papers and experience leading audits on major crypto projects.