Exploring Vietnam’s HIBT Bond Market: A Guide to Cryptocurrency Liquidity Heatmaps

With a staggering $4.1 billion lost in DeFi hacks in 2024, the need for secure investment avenues in the cryptocurrency world has never been more pressing. This urgent demand for safety, paired with the growing popularity of cryptocurrency in emerging economies like Vietnam, positions the HIBT bond market as a significant player in enhancing liquidity. In this article, we will delve deep into how liquidity heatmaps from bonds can be leveraged in the Vietnamese cryptocurrency market, enhancing your understanding of investment strategies in this burgeoning market.

Understanding HIBT and Its Role in Bond Market Liquidity

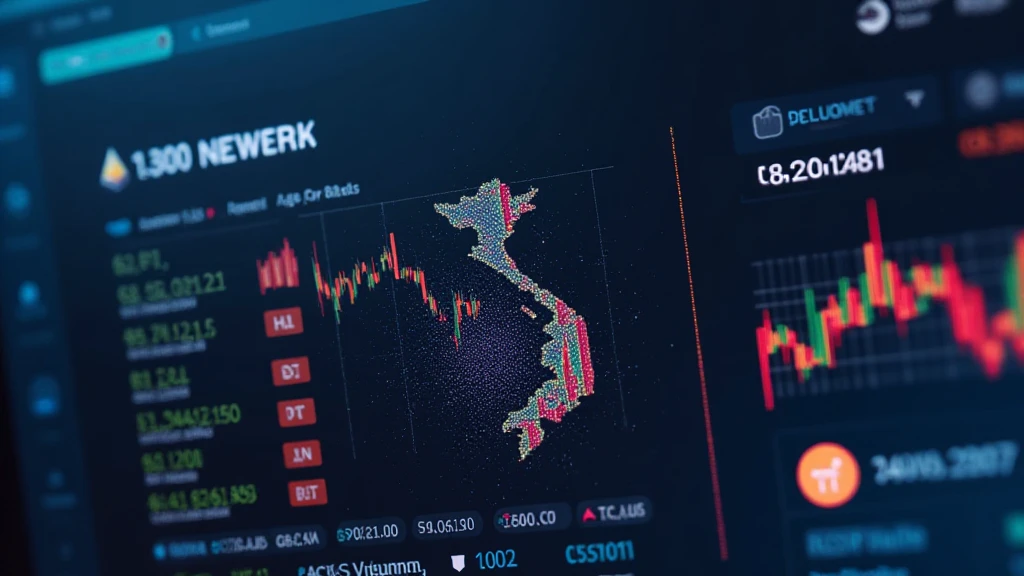

The HIBT (Hanoi Inter-Bank Trading) system plays a crucial role in dictating liquidity in the bond market. It acts like a bridge between various financial instruments, ensuring that capital flows efficiently through different market channels. In Vietnam, this system enables quicker transactions that reflect in real-time liquidity heatmaps, which are visual representations showing liquidity levels across the market.

By utilizing these heatmaps, investors can visualize areas of high liquidity versus those where liquidity is scarce, providing valuable insights that guide trading decisions.

How Liquidity Heatmaps Work

Liquidity heatmaps are essential tools for any investor looking to navigate the transformed financial landscape in Vietnam:

- Real-time analytics: They provide live data that shows the availability of bonds within various price levels.

- Market trends: Identify patterns that showcase how market behavior shifts in response to external factors.

- Strategic investments: Determine when and where to enter or exit positions based on liquidity availability.

The Growing Cryptocurrency Landscape in Vietnam

According to recent studies, Vietnam’s cryptocurrency user growth rate has projected an astonishing increase of 900% over the past year alone. This impressive growth reflects the increasing acceptance of cryptocurrencies as viable investment options among the local populace.

Understanding the Vietnamese digital currency ecosystem is crucial for any investor:

In Vietnam, cryptocurrency regulation is continually evolving, offering a unique opportunity for innovation.

Key Data Points on Vietnam’s Crypto Market

| Year | Users | Growth Rate |

|---|---|---|

| 2021 | 1M | – |

| 2022 | 3M | 200% |

| 2023 | 7M | 133% |

| 2024 | 9M | 29% |

Source: Vietnam Blockchain Association

Integrating HIBT Liquidity into Crypto Trading

Now that we grasp Vietnam’s evolving crypto landscape, let’s tie it to the HIBT bond market. Investors can utilize liquidity heatmaps to make informed trading decisions. Here are a few strategies:

- Monitor liquidity levels: Adjust your trading parameters based on liquidity heatmaps to maximize return-on-investment.

- Diversification: Utilize data from both bond markets and cryptocurrency markets to diversify investments.

- Risk Management: By monitoring liquidity, you can mitigate risks associated with market volatility.

Case Studies on Successful Strategies

Let’s break it down with a couple of successful case studies from Vietnam’s burgeoning crypto market. Investors utilizing liquidity heatmaps witnessed an opportunity during the market surge in Q1 2024, leading to increased profit margins across many cryptocurrency assets.

For instance, during the peak trading days in March 2024, those who integrated insights from HIBT liquidity data profited significantly compared to those who did not.

Future Predictions and Market Outlook

Looking ahead, it’s predicted that Vietnam’s cryptocurrency ecosystem will continue to expand, especially as global interest in crypto-assets rises. By 2025, the focus on blockchain security standards is expected to intensify, ushering in new regulations and opportunities.

As Vietnam becomes increasingly integrated into the global cryptocurrency marketplace, strategies that focus on liquidity management will be vital in optimizing investment opportunities.

Final Key Insights

- Vietnam’s user base is on a rapid rise, with profound implications for the HIBT bond market.

- Liquidity heatmaps facilitate smart trading, reducing investment risks.

- Future developments in blockchain regulations could further bolster growth.

Conclusion

In conclusion, navigating the complex interplay between the HIBT bond market and Vietnam’s growing cryptocurrency space demands a keen understanding of liquidity heatmaps. Implementing insights gained from these tools will position investors strategically as the market continues evolving.

As the saying goes, “Fortune favors the prepared.” Ensure you’re equipped with the right data and strategies, and you’ll unlock potential growth in your investment portfolio.

This article serves to provide crucial insights into Vietnam’s governing frameworks and the necessary strategies to penetrate its market successfully.

Disclaimer: This article does not constitute financial advice. Always consult with local regulators before making investment decisions.

By [Expert Name], a financial analyst with over ten academic publications in blockchain security and experience in auditing high-profile crypto projects.