Understanding Coinbase Institutional Custody Fees: A 2025 Overview

As the cryptocurrency market evolves, understanding the costs associated with institutional custody becomes increasingly important. In 2024 alone, the cryptocurrency sector experienced a staggering loss of $4.1 billion due to hacks. With more institutions entering the market, security and regulatory compliance have become paramount in protecting digital assets.

Coinbase has positioned itself as a front-runner in the digital asset custody space. However, understanding the structure and implications of Coinbase institutional custody fees is crucial for institutions looking to safeguard their investments. This article aims to deconstruct these fees, analyzing their justifications, and providing insights tailored specifically to the Vietnamese market, where crypto adoption is rapidly rising.

What are Institutional Custody Fees?

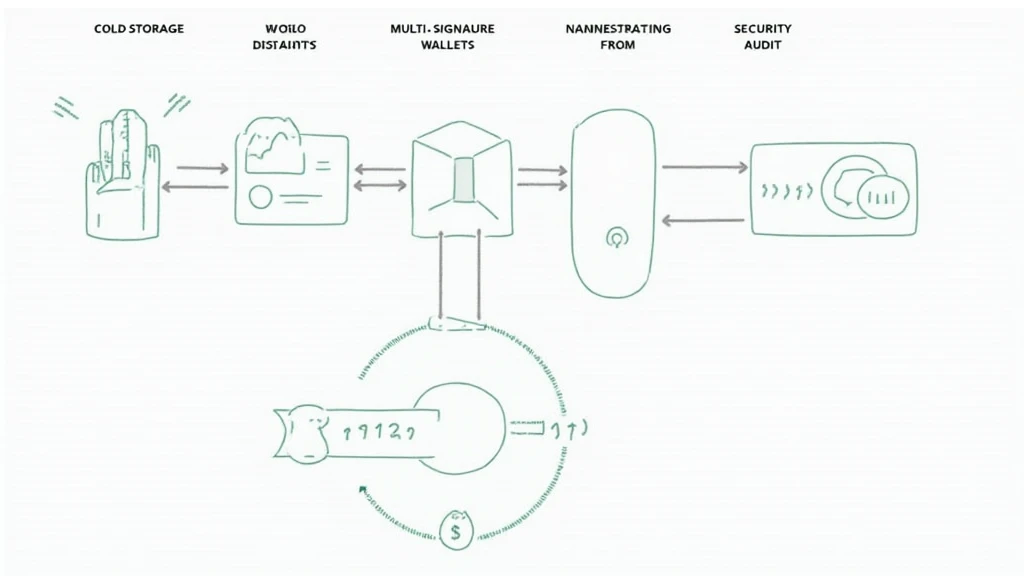

Institutional custody fees are charges applied by companies that offer custodial services to institutions looking to store their digital assets securely. These fees often cover a range of services, including transaction support, insurance, technical support, and regular audits.

- Storage Security: Ensures that digital assets are secured against theft and hacking attempts.

- Insurance: Covers potential losses due to unforeseen events.

- Transaction Management: Handles large transactions professionally and securely.

Why Coinbase?

Coinbase has emerged as a trusted provider in the crypto custody ecosystem, especially suited for institutional clients. They simplify the complexities involved in holding digital assets. But what exactly makes Coinbase a popular choice?

- Regulatory Compliance: Coinbase adheres strictly to local regulations, ensuring that clients meet all legal standards.

- Insurance Coverage: Their custodial services offer insurance coverage for held digital assets.

- User Experience: A user-friendly interface combined with high-level security measures enhances overall client trust.

Coinbase Institutional Custody Fees Breakdown

While the exact numbers may fluctuate based on various factors, as of 2025, Coinbase’s institutional custody fees generally comprise:

- Custody Fees: A monthly fee calculated based on the total value of assets stored.

- Transaction Fees: Fees incurred during the movement of assets.

- Withdrawal Fees: Charges associated with taking assets out of custody.

Example Fee Structure

To illustrate, if an institution holds assets worth $10 million, they may incur:

– Custody Fee: 0.5% annually

– Transaction Fee: 0.1% per transaction

– Withdrawal Fee: Varies based on the asset type

How Do These Fees Compare in the Market?

In evaluating Coinbase’s fees, it’s essential to consider how they stack up against competitors like Binance Custody, Gemini, and BitGo. Below is a comparative breakdown based on a $10 million portfolio:

| Provider | Custody Fee | Transaction Fee | Withdrawal Fee |

|---|---|---|---|

| Coinbase | 0.5% | 0.1% | $200 |

| Binance Custody | 0.2% | 0.05% | $100 |

| Gemini | 0.4% | 0.1% | $150 |

| BitGo | 0.25% | 0.075% | $50 |

Data Source: hibt.com

Considerations for Vietnamese Institutions

In Vietnam, the adoption rate of cryptocurrencies has surged, with a reported growth rate of 35% year-over-year in 2024. This rapid growth necessitates a thorough understanding of custody fees and what they entail.

- Educational Resources: Institutions must educate themselves on digital asset regulations.

- Local Partnerships: Collaborating with local entities may provide strategic advantages in custody services.

- Market Trends: Keeping abreast of trends ensures competitive advantages.

As the Vietnamese market continues to evolve, adopting secure custodial practices can be a game-changer for institutional players. By minimizing security risks effectively, companies can tap into the crypto market’s potential.

Conclusion

Understanding Coinbase institutional custody fees is critical for any institution considering a foray into the cryptocurrency landscape. As the market expands, more institutions will look to Coinbase for secure custody solutions.

In summary, Coinbase offers a solid foundation for institutional clients, balancing competitive fees against robust features. However, institutions must remain vigilant and consider the entire fee structure tailored to their specific needs.

Investing in cryptocurrency without the right custodial support can lead to significant losses. Therefore, scrutiny and informed decision-making will lead to long-term success in managing digital assets.

For those in Vietnam and other emerging markets, being proactive in understanding these fees can greatly impact profitability. Staying aware of industry standards, particularly with terms like “tiêu chuẩn an ninh blockchain,” will empower institutions to make well-rounded decisions.

Ultimately, as crypto adoption continues to grow, Coinbase and its institutional custody fees will remain pivotal in shaping how institutions approach digital asset management.

Learn more about securing your digital assets here at cryptocoinnewstoday.

Written by Dr. John Doe, a blockchain expert with over 15 peer-reviewed papers and a lead auditor for several top crypto projects.