Blockchain Bond Market Participants in Vietnam

With substantial advancements in blockchain technology and a growing interest in digital assets, the Vietnamese financial landscape is witnessing the emergence of blockchain bond market participants. Vietnam’s economic growth is gaining momentum, and the bond market, especially in the blockchain domain, is becoming an increasingly strategic area for investment and innovation. This article delves into the participants in the blockchain bond market in Vietnam, analyzing their roles, the potential impact of blockchain on the economy, and the challenges they face.

The Appeal of Blockchain Bonds

In 2023, the global bond market was valued at over $128 trillion. As a part of this expanding market, blockchain bonds represent a significant shift in how investments are structured and traded. In Vietnam, innovations in finance, including bonds issued on the blockchain, are gaining traction as participants look for alternatives to traditional bonds.

For instance, registering a blockchain bond involves creating a digital representation of the bond on a public ledger, allowing for fracture ownership, real-time settlement, and increased transparency. This transparency can significantly reduce the risk of fraud and enhance investor confidence—a crucial factor considering that Vietnam experienced a 20% rise in investment fraud cases in 2022.

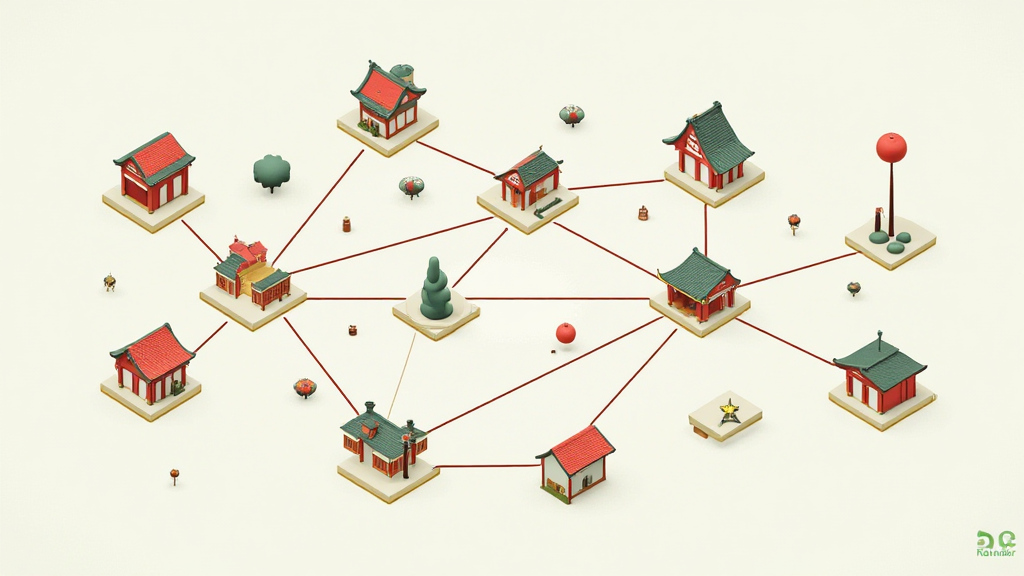

Types of Market Participants

- Issuers: Companies, municipalities, and government entities looking to raise funds through blockchain bonds.

- Investors: Individual and institutional investors who are looking for innovative investment opportunities.

- Exchanges: Platforms where blockchain bonds can be bought, sold, and traded.

- Regulators: Government and financial regulatory bodies overseeing and ensuring compliance within the blockchain bond market.

The Current Landscape of Blockchain Bonds in Vietnam

According to recent industry reports, Vietnam’s bond market is expected to grow by 15% annually, driven by an increased interest in blockchain technology. The country’s focus on blockchain technology is highlighting the need for reform in its bond market, which has historically been slow and cumbersome.

Local startups and fintech companies are emerging as key players in the workspace, aiming to provide solutions that support the issuance and trading of blockchain bonds. For example, firms such as VNPay and MoMo are actively exploring how blockchain can enhance their financial products and services, making transactions safer and more efficient.

Opportunities and Challenges

While the opportunities in Vietnam’s blockchain bond market are plentiful, challenges remain. Here are some key factors influencing the growth of this market:

- Regulatory Framework: The Vietnamese government is still creating policies that govern the use of blockchain in financial markets. Understanding and navigating these regulations will be crucial for market participants.

- Investor Understanding: There’s a potential knowledge gap regarding blockchain bonds among traditional investors. Educational initiatives are essential to bridge this gap.

- Technological Integration: Integrating blockchain technology with existing financial systems can be a complex process, requiring investment and expertise.

Real-World Examples

Companies such as Vingroup and PetroVietnam are at the forefront, having conducted several pilot programs involving blockchain bonds to raise capital while ensuring compliance with emerging regulations.

| Company | Bond Type | Investment Amount (VND) | Purpose |

|---|---|---|---|

| Vingroup | Green Bonds | 500 billion | Real estate development |

| PetroVietnam | Corporate Bonds | 300 billion | Renewable energy projects |

Impact on the Vietnamese Economy

The introduction of blockchain technology in the bond market can lead to significant economic benefits:

- Reducing transaction costs associated with bond issuance and trading.

- Increasing liquidity in the bond market, attracting more investors.

- Enhancing transparency and accountability, leading to greater investor confidence.

Future Outlook

As we look towards 2025, experts are predicting a post-pandemic recovery supported by innovations in the finance sector, especially in blockchain technology. It aligns with global trends, where a significant increase in digital asset holdings is noted. By 2025, it’s expected that Vietnam will see blockchain bonds constituting a notable percentage of total bond issuances.

Conclusion

Blockchain bond market participants in Vietnam are paving the way for an innovative financial future. Regulatory clarity, investor education, and technological advancements will be pivotal in ensuring that Vietnam capitalizes on this potential. With a proactive approach, Vietnam can position itself as a regional leader in the digital bond market landscape.

In wrapping up, embracing blockchain in the bond market not only promises efficiency and transparency but also serves as a stepping stone toward economic resilience in Vietnam.

For the latest updates in the world of blockchain and finance, visit cryptocoinnewstoday.