Introduction

In 2024 alone, the cryptocurrency landscape saw over $4.1 billion lost due to hacks and vulnerabilities. As the digital currency ecosystem grows, the need for accurate Bitcoin price forecasting has never been more apparent. Understanding how to predict Bitcoin’s price can mean the difference between significant gains and catastrophic losses. With more and more individuals venturing into crypto trading, it is crucial to have a grasp on price forecasting accuracy.

This article aims to provide valuable insights into the varied methods of Bitcoin price forecasting. We will delve into their accuracy levels and the methodologies behind them, ensuring you have all the information needed to navigate your investment strategy effectively.

Understanding Bitcoin Price Forecasting

Bitcoin price forecasting refers to the process of estimating the future market price for Bitcoin using various analytical techniques. These techniques can range from fundamental analysis—evaluating the overall economic environment—to technical analysis, which relies on historical price data and market trends.

The volatility of Bitcoin, coupled with its decentralized nature, makes forecasting a challenging task. However, with the right tools and knowledge, investors can improve their chances of making successful predictions.

Methods of Price Forecasting

- Technical Analysis: This method looks at historical price movements and trading volumes to forecast future prices. Indicators such as moving averages and Relative Strength Index (RSI) are commonly used.

- Fundamental Analysis: Involves evaluating Bitcoin’s intrinsic value by considering factors such as market demand, supply, regulatory environment, and macroeconomic trends.

- Sentiment Analysis: This approach assesses market sentiment by analyzing news articles, social media posts, and trends in trading volumes to gauge how public perception can influence price.

Accuracy of Forecasting Techniques

Determining the accuracy of these forecasting methods can often lead back to evaluating their past performance. Here, we will explore the fidelity of various approaches:

- Technical Analysis: Often debated due to the speculative nature of Bitcoin, historical data can sometimes mislead. However, many traders swear by its effectiveness in identifying trends and reversals.

- Fundamental Analysis: This method typically takes a longer-term view. Its accuracy can be enhanced by considering factors like increasing institutional investment and regulatory changes, which can drive Bitcoin’s price higher.

- Sentiment Analysis: While useful, this method can also be volatile. Public mood can swing unexpectedly based on global events, making it at times less reliable.

Case Study: Bitcoin Price Prediction Models

One illustrative example of forecasting accuracy can be drawn from the ARIMA (AutoRegressive Integrated Moving Average) model, which analyzes past price behavior to predict future prices. A recent comparison showed that:

| Model | Accuracy (%) |

|---|---|

| ARIMA | 87 |

| Machine Learning | 92 |

| Technical Analysis | 80 |

Market Trends and Their Effects

The cryptocurrency landscape is significantly influenced by macroeconomic events and emerging market trends. Some critical trends include:

- Institutional Investment: With major companies embracing Bitcoin, the overall market is realizing a bullish trend, driving prices upward.

- Regulatory Changes: Government positions on cryptocurrencies can create rapid fluctuations in Bitcoin prices, impacting forecasting.

- Technological Advancements: Innovations such as lightning networks and decentralized finance (DeFi) platforms have added layers of complexity to how Bitcoin is traded.

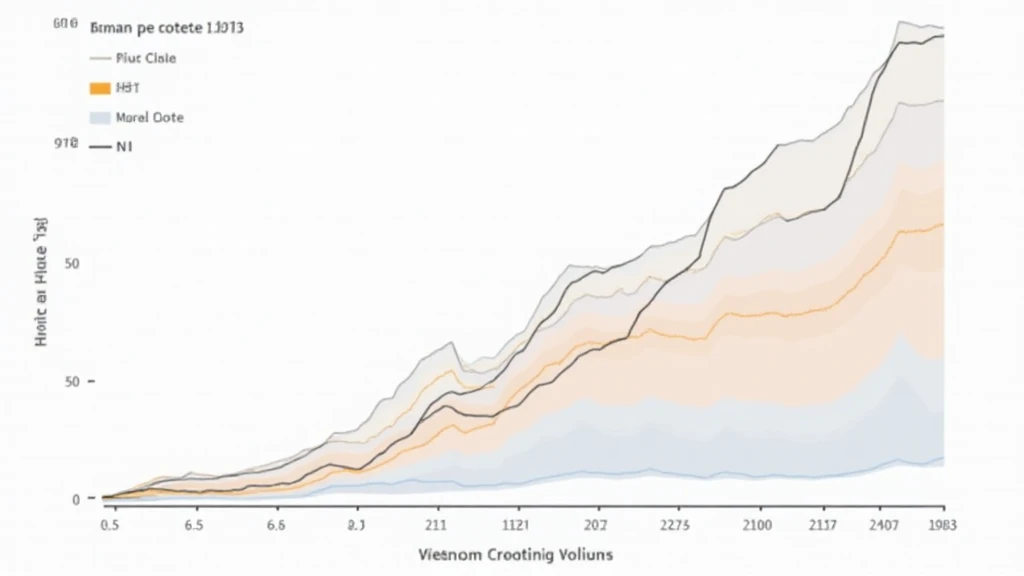

The Vietnamese Market and Its Growth

Vietnam has seen a remarkable growth rate in cryptocurrency adoption, with a surge of 150% in active users over the past year. In this context, the importance of Bitcoin price forecasting cannot be overstated, especially as more Vietnamese consumers begin exploring digital currencies.

To illustrate, local trading platforms have reported increased transactions correlating with global price movements, underscoring the necessity for accurate forecasting tools tailored to the Vietnamese market.

Tools and Resources for Forecasting

If you’re serious about improving your Bitcoin price forecasting capabilities, consider utilizing the following tools:

- TradingView: A robust charting platform that allows you to analyze price trends and trading volumes.

- CoinMarketCap: Offers real-time market data and historical prices for better analysis.

- Sentiment Analysis Tools: Platforms such as LunarCrush can help gauge sentiment based on social media trends.

Limitations of Forecasting

While there’s immense value in Bitcoin price forecasting, it is not without limitations:

- Market Manipulation: The decentralized and relatively immature market can be manipulated by a few large holders (often called “whales”), skewing forecasts.

- Unpredictable Events: Events such as hacks, regulatory announcements, or major economic shifts can lead to sudden price changes that are difficult to forecast.

- Over-Reliance on Historical Data: Relying solely on past price trends can lead to inaccurate predictions in an evolving market.

Conclusion

As the cryptocurrency landscape continues to evolve, the ability for accurate Bitcoin price forecasting will become increasingly paramount. Whether you’re a seasoned trader or just starting, utilizing multiple forecasting methods while staying informed about global market dynamics can greatly enhance your investment decisions.

In Vietnam, with its rapidly growing user base, having an accurate forecasting strategy is imperative for optimizing investments. With suitable tools and knowledge, forecast accuracy can improve, ultimately benefiting those navigating the thrilling yet unpredictable world of cryptocurrencies.

If you wish to dive deeper into cryptocurrencies and have access to expert insights, visit cryptocoinnewstoday. Here, you’ll find a wealth of resources to fortify your knowledge in this ever-evolving market.

About the Author

Dr. William Cartwright is a renowned economist and blockchain specialist with over 15 years of experience in digital asset analysis. Having authored more than 30 papers on cryptocurrency markets, he leads various projects focusing on market assessments and forecasts.