Understanding Bitcoin Market Sentiment Indicators

As we navigate through the ever-evolving cryptocurrency landscape, understanding Bitcoin market sentiment indicators has become crucial for investors, traders, and enthusiasts alike. According to research, over 40% of crypto investors rely on market sentiment to make informed decisions, which underscores the necessity of grasping these indicators.

What Are Market Sentiment Indicators?

Market sentiment indicators are metrics that gauge the overall attitude of investors towards a particular asset or the market in general. They serve as a compass, guiding individuals on whether to enter or exit trades. These indicators can be based on various factors, including social media trends, trading volumes, market volatility, and economic news.

The Role of Social Media in Market Sentiment

- Influencer Impact: Influencers and industry leaders often sway market sentiment through tweets, videos, and posts.

- Sentiment Analysis Tools: Platforms like Sentimentrader provide sentiment scores that can help traders make informed decisions based on social media chatter.

For instance, if an influential figure tweets positively about Bitcoin, it can lead to a significant increase in market sentiment, resulting in price surges. Conversely, negative news can induce fear, leading to sell-offs.

Key Bitcoin Market Sentiment Indicators

Understanding key indicators can empower you to make informed trading decisions. Here are some of the most crucial Bitcoin market sentiment indicators to monitor:

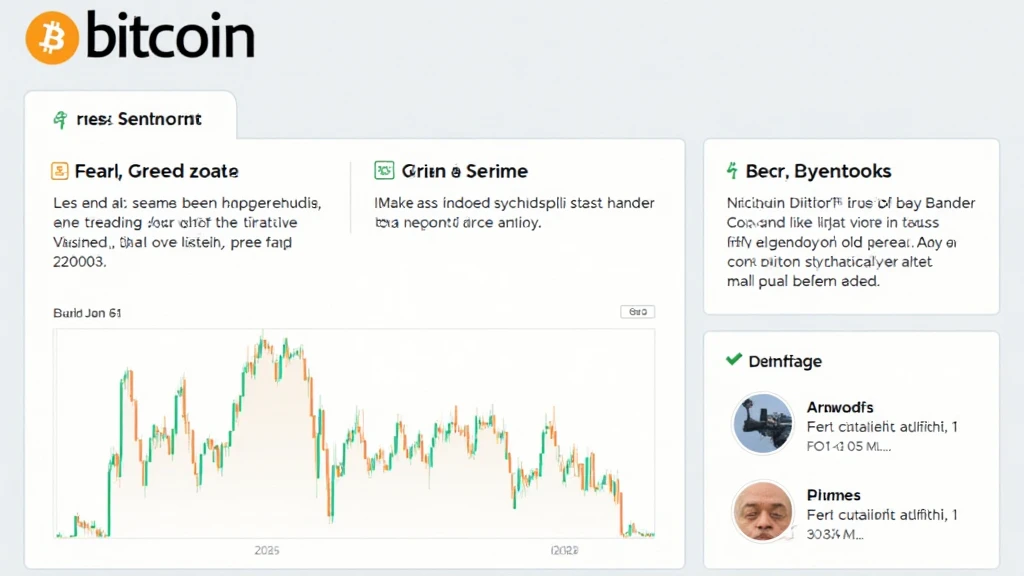

1. Fear and Greed Index

- This index compiles various factors to determine overall investor sentiment. A high greed rating might indicate overvaluation, while high fear can suggest a buying opportunity.

- As of 2024, the Fear and Greed Index showed a consistent trend of fear among investors, coinciding with market corrections.

2. Trading Volume

- A sharp increase in trading volume often signals strong sentiments, either bullish or bearish. Tracking volume trends aids in anticipation of price movements.

- In Vietnam, the trading volume for Bitcoin saw a 20% increase in Q1 2024, indicating growing investor interest.

3. Social Media Sentiment

- Twitter, Reddit, and Telegram act as influential platforms where sentiment can shift rapidly.

- Monitoring sentiment analysis tools that aggregate social media discussions about Bitcoin can help gauge public perception.

4. Technical Indicators

- Fear and Greed Index, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are essential metrics for traders.

- These indicators help identify market trends, momentum changes, and potential opportunities.

Analysing Vietnam’s Crypto Market

Vietnam’s cryptocurrency market has seen exponential growth, with a reported 70% increase in active crypto user accounts in 2024. This surge is significantly influenced by the younger demographic’s affinity for digital wallets and blockchain tech.

1. Youth Engagement in Cryptocurrency

- Approximately 45% of crypto traders in Vietnam are aged between 18 and 35, showcasing a robust engagement among millennials and Gen Z.

- This demographic is more in tune with social media trends, making them pivotal in shaping market sentiment.

2. Regulatory Environment

- Vietnam’s government has been active in formulating regulations surrounding cryptocurrencies, impacting market sentiment.

- Clear guidelines can foster investor confidence, leading to increased market participation.

Strategies for Utilizing Market Sentiment Indicators

Applying market sentiment analysis can significantly enhance trading strategies. Here are some practical recommendations:

1. Combine Indicators for Better Insights

- Don’t rely on a single indicator. Instead, consider a combination of social sentiment and technical indicators to get a clearer picture of market trends.

2. Implement Risk Management Strategies

- Markets can be sensitive to sentiment changes. Proper risk management ensures that your investments are protected even during volatile market conditions.

Future of Bitcoin Market Sentiment Indicators

As Bitcoin continues to gain traction, we can expect sentiment analysis tools to evolve. New technologies will emerge, allowing more refined sentiment analysis based on AI and machine learning techniques.

Staying Vigilant Amidst Market Changes

- Always stay updated with the latest news and trends in the market. Market sentiment can shift rapidly based on external factors.

- Joining communities and forums can offer insights and sentiments that may not be as visible through traditional channels.

Remember, while Bitcoin market sentiment indicators can provide valuable insights, they are not infallible. As a trader or investor, maintaining a balanced perspective and diversifying your sources of information can enhance your decision-making capabilities.

Conclusion

Understanding Bitcoin market sentiment indicators is more than just staying updated with the latest trends; it’s about leveraging this knowledge to make informed decisions. Whether you’re a seasoned investor or a novice trader, these indicators offer a framework for navigating the complexities of the cryptocurrency landscape effectively. As the market continues to evolve, so will the tools and strategies at your disposal—remain adaptable and vigilant.