Introduction: Understanding Bitcoin Halving

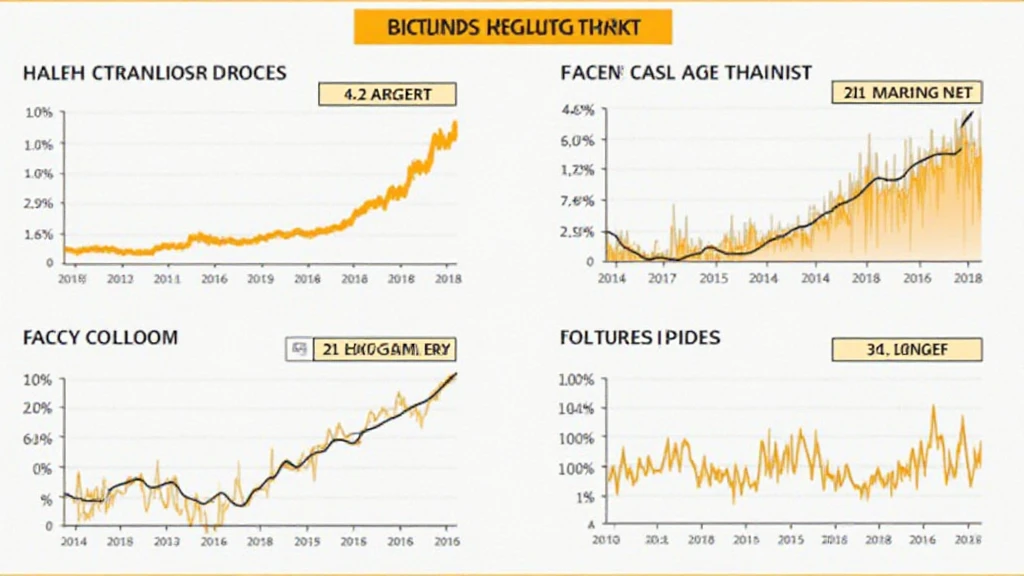

Bitcoin halving events have been a hot topic for investors and enthusiasts alike. With an average of 4 years between halvings, the next occurrence is set for May 2024, with significant implications for the cryptocurrency market. Research indicates that the market has historically reacted to these events in profound ways. In fact, according to a report by Glassnode, significant price increases typically follow each halving by an average of 300% within the subsequent year. This pattern begs the question: what can we predict for the Bitcoin market leading up to and following the next halving event?

The Mechanism of Halving

Before diving into predictions, let’s clarify what Bitcoin halving is. Essentially, it refers to the process where the reward for mining new blocks is cut in half, thus reducing the rate at which new bitcoins are generated. The rationale behind this mechanism is to control inflation and create scarcity.

As we saw during the previous halvings in 2012, 2016, and 2020, the market often stirs as speculators and long-term investors make their moves. Analysing past market trends can provide insights into what might happen next.

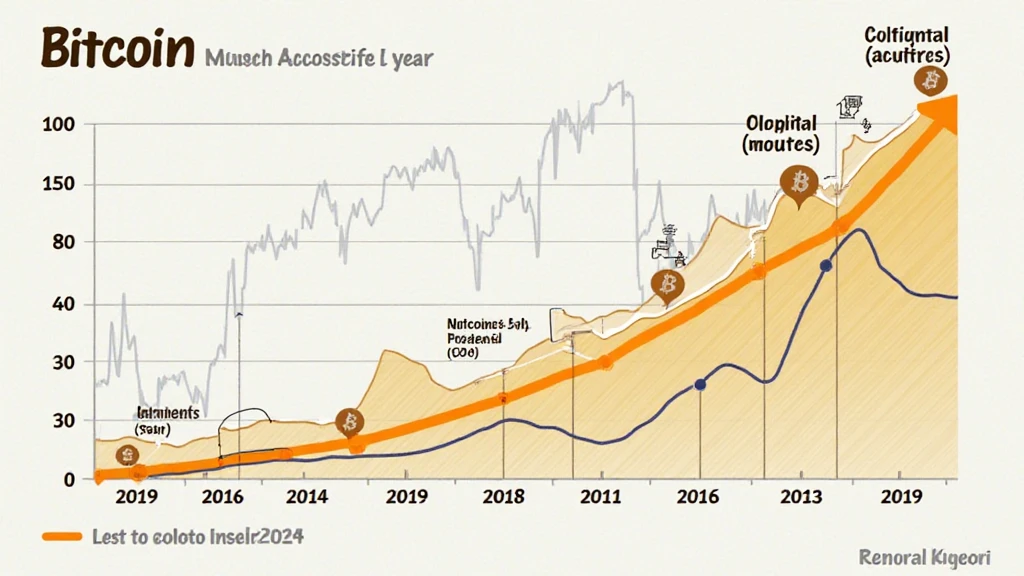

Historical Price Movements

Historically, Bitcoin prices have surged after each halving. For example, after the 2016 halving, Bitcoin saw its price rise from about $650 to nearly $20,000 by the end of 2017. Similarly, post-2020 halving, Bitcoin reached an all-time high of over $60,000 in April 2021. However, these trends are not without their pitfalls, as market corrections often follow the euphoric highs.

Market Predictions for Bitcoin Post-Halving

With the upcoming halving in May 2024, analysts are keenly looking at various indicators.

Analytical Projections

- Price Increase Projections: Analysts predict Bitcoin could reach new highs between $70,000 to $100,000 within 12 months post-halving, driven by market demand and dwindling supply.

- Trading Volume Surges: A considerable increase in trading volume typically emerges as the halving approaches, indicating rising interest from both retail and institutional investors.

- Market Sentiment Shifts: Bullish sentiments often dominate during this period. The fear of missing out (FOMO) could drive more participation in the market.

Global Market Influences

Several macroeconomic factors can impact Bitcoin’s price post-halving:

- Inflation Rates: With central banks around the world continuing to print money, Bitcoin’s appeal as a hedge against inflation could bolster interest.

- Regulatory Changes: Governments are continually refining their stance on cryptocurrencies. Regulatory acceptance in markets like Vietnam can lead to increased user adoption.

Investor Strategies for Bitcoin Halving

Investors need to adopt strategies tailored to Bitcoin’s market dynamics during the halving cycle.

Diversification is Key

- Spread Your Investments: Don’t put all your eggs in one basket; consider allocating some funds to altcoins, especially those expected to boom post-halving.

- Utilize Dollar-Cost Averaging: This strategy involves investing a fixed amount periodically, which can mitigate risks associated with volatility.

Local Market Insights: Vietnam

Vietnam has displayed a remarkable growth rate for cryptocurrency users. According to Statista, the number of cryptocurrency users in Vietnam is expected to rise by 30% in 2024. Such growth reflects a growing interest in cryptocurrencies among the population, which could amplify the effects of Bitcoin halving on local market sentiments.

This aligns with the global trend where countries with increased user adoption see deeper market penetration and higher volumes of trading activity, which in turn could influence Bitcoin’s market performance in the region.

Conclusion: What to Expect

As we are on the cusp of another Bitcoin halving, understanding market predictions is crucial for investors. While historical data suggests a bullish sentiment, one must take into account market volatility and external economic factors. Notably, Bitcoin isn’t merely an investment; it’s evolving as a digital asset that defines the future of finance. Experts suggest remaining vigilant, conducting thorough research, and approaching investments with a balanced view. This readiness will prime investors for whatever the market has in store post-halving.

Ultimately, whether you’re an experienced trader or a newcomer to the scene, the Bitcoin halving presents both opportunities and challenges. Stay updated with resources like cryptocoinnewstoday for ongoing insights and valuable tips!

Author: Dr. Alex Marshall, a cryptocurrency researcher with over 10 publications in blockchain technology and a lead auditor at CryptoSecure Labs.