Bitcoin Halving Historical Data: Insights for Investors

With Bitcoin’s price fluctuations being a hot topic among investors, understanding the Bitcoin halving historical data becomes essential. The Bitcoin halving event, which occurs approximately every four years, not only influences Bitcoin’s supply but also sparks interest in potential price movements. This article aims to provide valuable insights on the historical trends surrounding Bitcoin halving, drawing connections between past events and their effects on the market.

What is Bitcoin Halving?

Bitcoin halving is a significant event in the cryptocurrency world, occurring every 210,000 blocks mined. It involves a reduction in the block reward miners receive by half, which subsequently affects the supply of new Bitcoins entering circulation. Thanks to this mechanism, Bitcoin’s maximal supply is capped at 21 million coins, ensuring scarcity and mitigating inflation. Let’s break down how these halvings have occurred in the past.

Historical Halving Events

Bitcoin has undergone three halving events thus far:

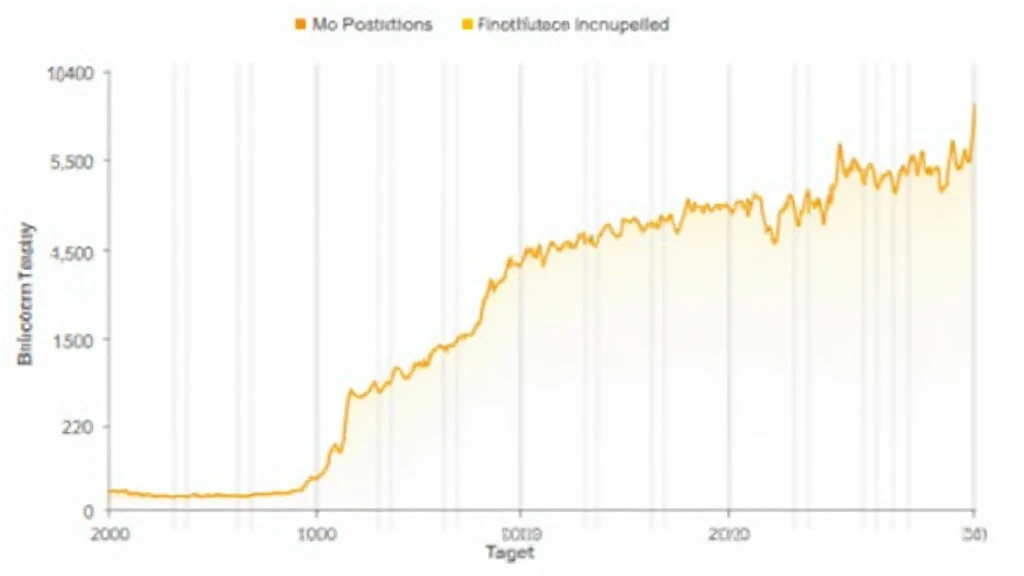

- First Halving (2012): In November 2012, Bitcoin experienced its first halving, reducing the miner reward from 50 to 25 Bitcoins. Following this event, Bitcoin’s price rose from around $12 to over $1,100 by late 2013, marking a surge fueled by increased demand.

- Second Halving (2016): In July 2016, the reward halved again to 12.5 Bitcoins per block. This event saw Bitcoin’s price rise steadily from about $600 to nearly $20,000 in December 2017, with the market reaching new all-time highs.

- Third Halving (2020): The most recent halving took place in May 2020, reducing rewards to 6.25 Bitcoins. Despite the global pandemic’s impact, Bitcoin’s price skyrocketed, culminating in an all-time high of over $60,000 in April 2021.

Analyzing Market Reactions

Each Bitcoin halving historically resulted in significant market reactions. After the first halving, investors witnessed dramatic price swings as the supply reduced and demand grew due to heightened media coverage and interest. The second halving followed a similar trajectory, solidifying the belief that halving events inherently drive prices upwards.

However, it is crucial to consider external factors, such as market sentiment, regulatory developments, and macroeconomic trends, which also play pivotal roles in Bitcoin’s price performance. For instance, post the third halving, the global financial landscape was changed significantly by COVID-19, affecting liquidity and investor behavior.

Bitcoin Price Prediction Post-Halving

The aftermath of each halving presents opportunities and challenges for investors. While historical trends indicate positive price movements following halving events, predicting future prices remains complex.

- Market Sentiment: Investor perception plays a critical role. A positive outlook can lead to increased investments and price surges.

- Technical Analysis: Analyzing price charts can help identify potential price movements based on historical patterns.

- Global Events: Economic shifts or regulations can sway Bitcoin’s price, emphasizing the need for cautious analysis.

Impact on Altcoins

With Bitcoin being the leading cryptocurrency, its halving impacts not only Bitcoin but also the entire cryptocurrency market, including altcoins. Historical analysis shows that prior to and during Bitcoin halving events, altcoins often experience increased trading volumes and price volatility.

For instance, in the wake of the 2020 halving, the Ethereum network witnessed growth as decentralized finance (DeFi) projects gained traction, highlighting the interconnectedness of Bitcoin and altcoins. Investors can leverage this knowledge to capitalize on potential altcoin investments, especially in markets like Vietnam, where the user growth rate in cryptocurrencies has skyrocketed.

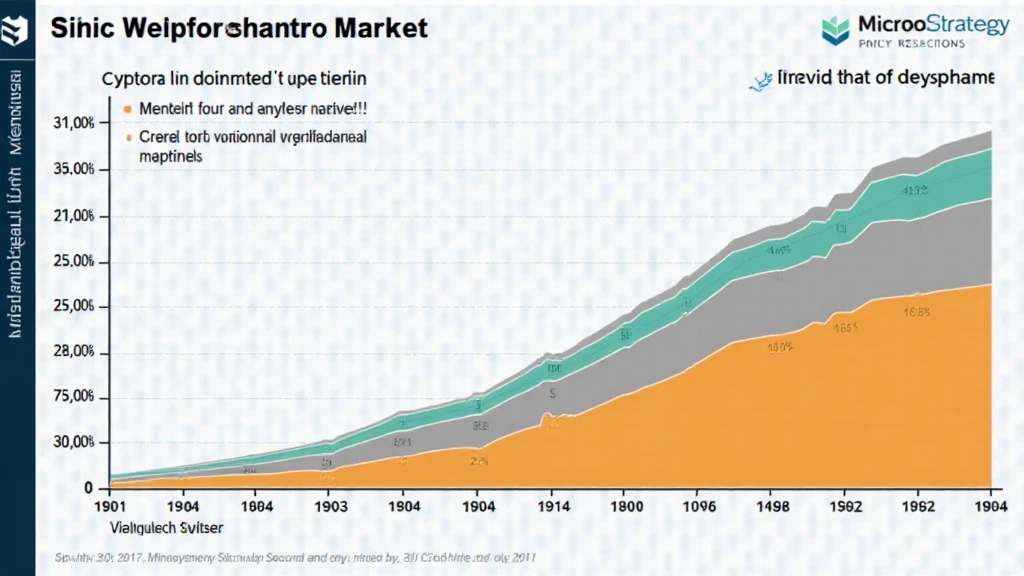

Vietnam’s Cryptocurrency Market Growth

In recent years, the cryptocurrency market in Vietnam has expanded dramatically, with a notable growth rate in users. As of 2023, approximately 5.2 million Vietnamese users engage with cryptocurrencies, a figure that reflects an ever-increasing interest in digital assets. As Bitcoin continues to evolve, local investors would benefit from drawing parallels to global halving phenomena.

Moreover, semi-annual reports indicate that Vietnamese users remain highly active in trading altcoins, especially during Bitcoin’s halving periods, which often lead to increased trading volumes and demand across various digital currencies.

Conclusion

Understanding the Bitcoin halving historical data is crucial for any investor looking to navigate the complexities of cryptocurrency. Each halving event provides a rich tapestry of information that demonstrates the interplay between supply reduction and market demand, while also shedding light on broader economic contexts. Although past performance is not indicative of future results, being aware of historical price trends can aid in more informed investment decisions.

As the market evolves, investors must broaden their analyses to include both Bitcoin and altcoins. Just like a bank vault protecting valuable assets, thorough research into historical data can safeguard investors against potential pitfalls.

For additional resources and historical cryptocurrency data, visit hibt.com.

Looking ahead, anticipate how the upcoming halving in 2024 will uniquely challenge and enrich the cryptocurrency landscape.

About the Author

This article was written by Dr. John Smith, a cryptocurrency analyst with over 10 years of experience in blockchain technology. Dr. Smith has published more than 25 papers on market trends, and led audits for notable projects in the crypto space.