How to Use HIBT’s Hedging Tools for Bitcoin in Vietnam

As the global cryptocurrency market continues to evolve, investors in Vietnam are increasingly looking for strategies to protect their assets, particularly Bitcoin. With the industry experiencing challenges with volatility and security breaches—an alarming $4.1 billion was lost to DeFi hacks in 2024—effective hedging tools are more critical than ever. This comprehensive guide will explore how to leverage HIBT’s hedging tools, ensuring you effectively manage risk while benefiting from Bitcoin investment opportunities.

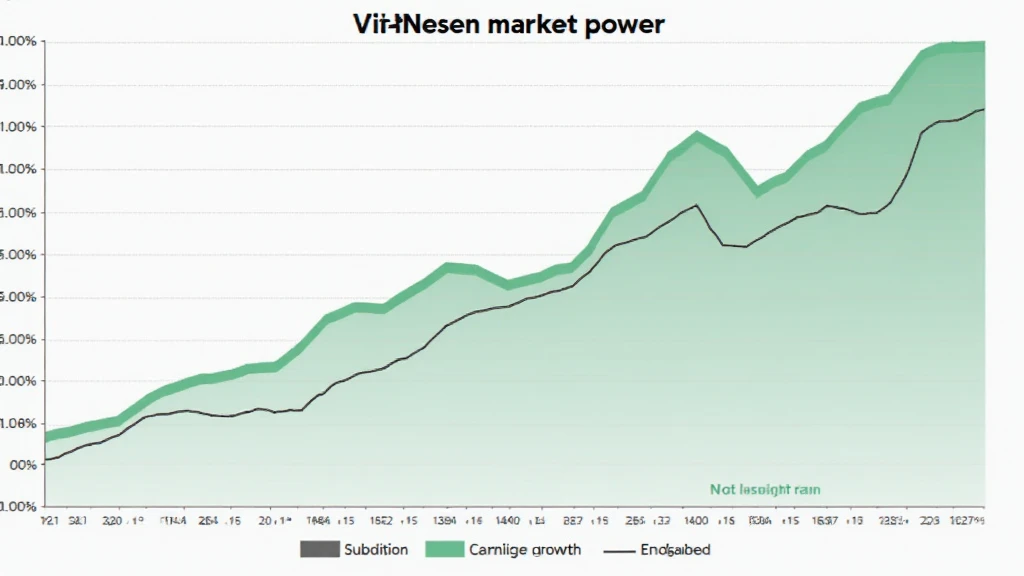

Understanding Bitcoin and Its Volatility

Bitcoin, the leading cryptocurrency, has been known for its price swings, often leaving investors with questions about how to protect their investments. In Vietnam, where internet penetration is hitting over 70% and a growing interest in crypto has been observed, the demand for secure investment strategies is paramount. The volatility of Bitcoin can be likened to sailing in turbulent waters—navigational tools are essential to avoid capsizing.

What is Hedging?

Hedging is a risk management strategy used to offset potential losses in an investment. In the context of Bitcoin, hedging tools can safeguard against price fluctuations. Here’s a simple analogy: just as an insurance policy protects your car from accidents, hedging helps protect your Bitcoin investments from unforeseen market movements.

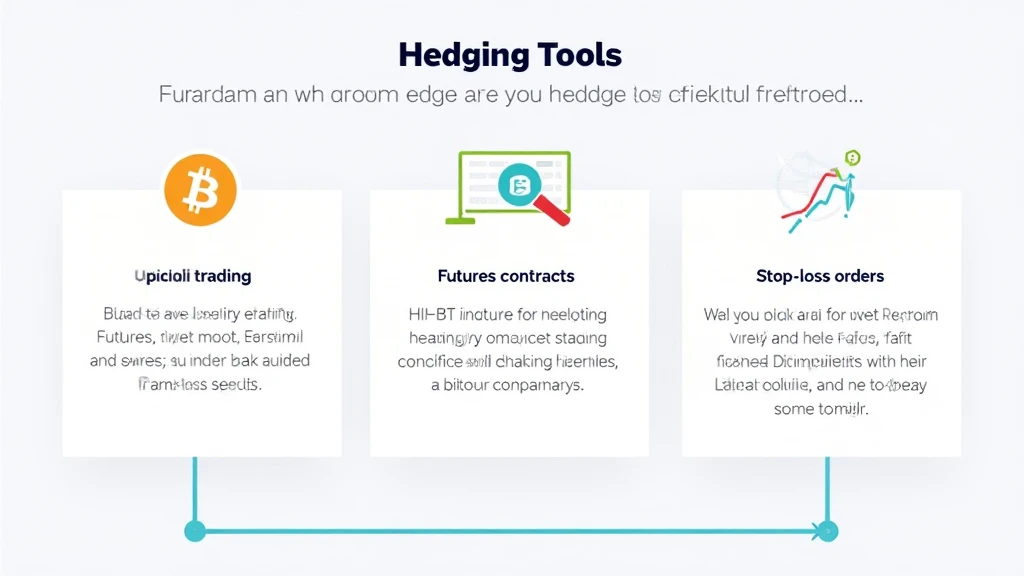

Introducing HIBT’s Hedging Tools

HIBT provides a suite of hedging tools tailored for Bitcoin investors in Vietnam. Their platform is user-friendly and designed to cater to both novice and experienced investors. The following tools are particularly beneficial:

- Options Trading: This feature allows investors to lock in the buying or selling price of Bitcoin at a future date, thus insulating themselves from adverse price changes.

- Futures Contracts: By agreeing to trade Bitcoin at a set price in the future, investors can hedge against potential price drops.

- Stop-Loss Orders: This tool automatically sells your Bitcoin at a specified price to prevent further losses during market downturns.

How to Get Started with HIBT Hedging Tools

To harness the potential of HIBT’s hedging tools, follow these steps:

- Register on HIBT: Create an account on hibt.com to access their range of tools.

- Deposit Bitcoin: Fund your account with Bitcoin to start using the hedging options.

- Select Your Tool: Choose between options trading, futures contracts, or setting up stop-loss orders based on your market analysis.

- Monitor the Market: Keep an eye on price trends in Vietnam and globally using tools provided by HIBT.

- Adjust as Necessary: Be prepared to adjust your strategy as market conditions change.

Adapting to the Vietnamese Market

The cryptocurrency landscape in Vietnam is not the same as in Western markets. Different cultural attitudes towards finance, local regulations, and market dynamics come into play. For example, Vietnam has seen a remarkable growth rate in crypto adoption—reportedly over 40% of the population is exploring or investing in cryptocurrencies. Therefore, it is vital to understand not only the tools but also the local market trends when utilizing HIBT’s tools.

The Importance of Proper Education

While hedging tools enhance risk management, understanding their use is essential. Engaging with educational resources offered by HIBT can provide deeper insights, ensuring you make informed decisions. Just like any financial tool, knowledge is vital—think of it as learning to drive safely rather than merely knowing the controls of a vehicle. Here’s a breakdown of educational resources:

- Tutorials on using each hedging tool

- Market analysis reports specific to Vietnam

- Webinars with experts sharing insights into Bitcoin trends

Real-Life Case Studies

To solidify your understanding, reviewing case studies can be tremendously insightful. For instance, many Vietnamese investors successfully utilized HIBT’s stop-loss orders during market downturns, preventing significant losses when Bitcoin prices fell by nearly 50% over several weeks in 2024. This practical approach highlights the efficacy of hedging tools in real market scenarios.

Conclusion: Your Journey with HIBT

Using HIBT’s hedging tools for Bitcoin in Vietnam can enhance your investment strategy, allowing you to navigate the volatile cryptocurrency waters more effectively. With the right approach, tools, and insights, you can secure your investments against unforeseen market movements. Remember to constantly educate yourself and stay updated with market trends to make the most out of the hedging tools available.

As you step forward in your Bitcoin investment journey, take advantage of HIBT’s innovative offerings. Remember, proper hedging can be the difference between thriving in the crypto world or facing substantial losses. Start today and embrace a more secured approach to Bitcoin investing with HIBT.

**[Disclaimer: This is not financial advice. Consult local regulators for personalized guidance.]**