Cryptocurrency Bond Analytics: Insights for Vietnam’s Growing Market

As the cryptocurrency landscape continues to evolve, Vietnam stands out as a burgeoning market, driven by increased interest in digital assets and innovative financial products. A remarkable $4.1 billion was lost to DeFi hacks in 2024, raising critical concerns about security in the space. So how can investors protect themselves while navigating this complex environment? Enter cryptocurrency bond analytics—an essential tool for understanding market dynamics. In this article, we seek to illuminate that landscape and offer invaluable insights for both seasoned investors and newcomers alike.

Understanding Cryptocurrency Bonds

Cryptocurrency bonds combine the principles of traditional bond markets with the innovation of blockchain technology. Let’s break this concept down:

- What are Cryptocurrency Bonds? – Much like traditional bonds, cryptocurrency bonds are instruments used by organizations to raise funds but are secured by cryptocurrencies. These digital bonds are typically issued on blockchain networks, providing transparency and traceability.

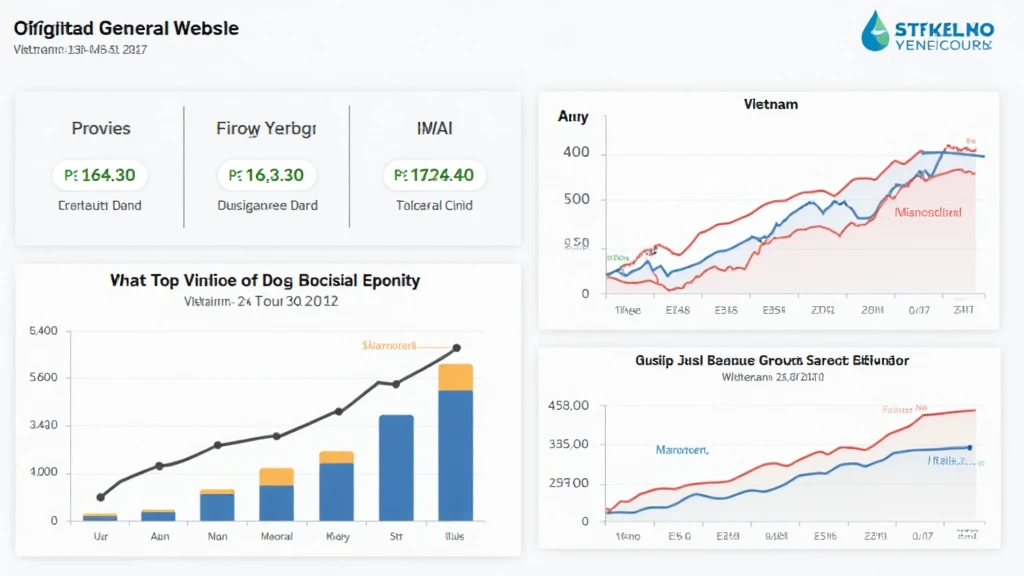

- Why Vietnam Matters – Vietnam has seen explosive growth in its crypto sector, with a reported 150% increase in users from 2021 to 2023, paving the way for innovative financial products like cryptocurrency bonds.

- Benefits of Blockchain Technology – Utilizing blockchain technology offers enhanced security, reduced transaction costs, and quicker settlements compared to traditional bond markets.

Market Dynamics Influencing Cryptocurrency Bonds in Vietnam

Several factors contribute to the robust growth of cryptocurrency bonds in Vietnam:

- Rise of DeFi Platforms – Decentralized finance (DeFi) has garnered significant interest, facilitating crypto-bond issuance through peer-to-peer platforms.

- Government Regulations – The Vietnamese government has been proactive in establishing a regulatory framework that fosters innovation while ensuring investor protection.

- Local Demand – With crypto adoption steadily increasing, there is a growing appetite for new investment vehicles, particularly among younger demographics eager to diversify their portfolios.

Navigating the Risks of Cryptocurrency Bonds

Of course, investing in cryptocurrency bonds isn’t without its challenges. Here’s what to watch out for:

- Market Volatility – Cryptocurrency prices can fluctuate dramatically. Bonds tied to highly volatile assets may carry inherent risk.

- Security Threats – The potential for hacks remains a significant issue. Investors should conduct thorough due diligence and consider smart contract audits.

- Regulatory Uncertainties – Changes in government policies can impact the issuance and liquidity of cryptocurrency bonds, so staying informed is key.

How to Analyze Cryptocurrency Bonds

Conducting effective cryptocurrency bond analytics involves several strategies:

- Evaluate Issuer Credibility – Research the organizations issuing bonds and their backing assets.

- Understand Market Trends – Follow market developments closely. Tools like hibt.com can provide critical data on emerging trends.

- Conduct Smart Contract Audits – Ensuring the integrity of smart contracts is vital; tools and services are available to assist with this.

The Future of Cryptocurrency Bonds in Vietnam

The outlook for cryptocurrency bonds in Vietnam appears promising. According to Chainalysis, by 2025, the market capitalization of cryptocurrency-based financial instruments is expected to reach an astonishing $10 billion, including bonds. Here’s what we can anticipate:

- Increased Institutional Investment – As trust in cryptocurrency systems grows, institutional players are likely to enter the market, boosting liquidity.

- More Robust Infrastructure – Emerging tech solutions will enhance the issuance and trading of cryptocurrency bonds.

- Regulatory Clarity – As the landscape matures, clearer regulations are likely to encourage investor confidence.

Conclusion

In conclusion, cryptocurrency bond analytics presents a unique opportunity for investors in Vietnam to tap into a growing market while navigating associated risks. With a solid understanding and practical approaches, such as conducting thorough research and leveraging smart technology, investors can position themselves for success in the evolving world of digital finance. Remember, not financial advice—always consult local regulators before making investment decisions. Let’s wrap this up—understanding where the market is heading and exploiting new opportunities can lead to fruitful investments in the long run. To learn more about this dynamic space, visit cryptocoinnewstoday.

Author Bio

Dr. Emily Tran is a blockchain technology expert with over 10 years of experience in financial analytics. She has published over 30 papers in reputable journals and led discussions on significant projects in Blockchain audits.