Introduction

In 2024, a staggering $4.1 billion was lost due to hacks in decentralized finance (DeFi), prompting investors to seek more secure asset protection methods. Cryptocurrency has revolutionized how we perceive and conduct financial transactions, yet it continues to bear risks that necessitate robust collateral frameworks. This article delves into the significance of cryptocurrency bond collateral frameworks, providing essential insights for both seasoned investors and newcomers alike.

The Importance of Bond Collateral in Cryptocurrency

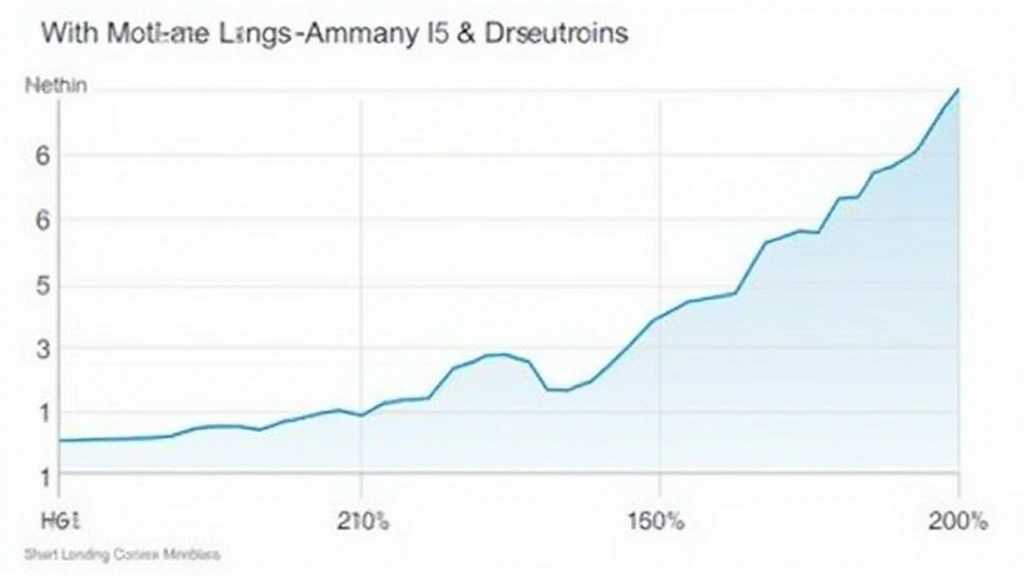

Bond collateral is akin to a safety net within the volatile crypto landscape. Just as traditional bonds secure a loan with underlying assets, cryptocurrency bond collateral frameworks ensure that the investments are backed by tangible assets or guarantees, reducing the risk for investors.

- Objective Security: These frameworks create a buffer against market volatility.

- Enhanced Credibility: They build trust among investors by increasing transparency.

- Regulatory Compliance: With proper structures, entities can align better with regulations, essential in regions like Vietnam where crypto regulations are evolving.

Understanding Cryptocurrency Bond Structures

Before delving into frameworks, let’s break down how cryptocurrency bond structures operate:

- Asset Anchor: The cryptocurrency acts as collateral, ensuring that the bond has a safety value.

- Smart Contracts: These automate collateral management, ensuring immediate responses to market changes.

- Risk Mitigation Strategies: Can include diversification of collateral types to spread risk.

Case Study: Vietnam’s Growing Crypto Market

According to recent studies, Vietnam experienced a 300% growth in crypto users in 2024, showcasing the increasing interest in digital assets among the Vietnamese population. As this trend continues, the need for effective crypto bond collateral mechanisms becomes evident. This aligns with the surge of interest in tools like