Bitcoin DeFi Stablecoin Audits: Essential Insights for Investors

Introduction

In 2024, the decentralized finance (DeFi) space witnessed staggering losses, with over $4.1 billion lost to hacks and exploits. In a rapidly evolving landscape where Bitcoin and stablecoins play a pivotal role, ensuring the security of these digital assets is more critical than ever. This article delves into the importance of audits within the Bitcoin and DeFi ecosystems, particularly focusing on stablecoins.

The Role of Audits in the DeFi Landscape

Audits are instrumental in verifying the integrity of smart contracts, which are the backbone of any DeFi application. Think of an audit as a digital safety inspection, much like how your car needs regular checks to function safely on the road. A proactive approach to audits can help in identifying vulnerabilities before malicious actors exploit them.

In Vietnam, the demand for secure and trustworthy DeFi platforms is growing. According to recent statistics, Vietnamese users of DeFi-related products increased by 60% in 2023, highlighting the critical need for enhanced security measures.^[1]

Why DeFi Audits Matter

- Risk Mitigation: Regular audits help identify security risks in smart contracts, reducing the likelihood of hacks.

- Investor Confidence: When users know that a platform has passed rigorous audits, it fosters trust and encourages investment.

- Regulatory Compliance: As governments around the world focus on regulating crypto, audits can provide a level of compliance proof.

Types of Audits in the Bitcoin and DeFi Space

There are several types of audits that are crucial for the security of Bitcoin and DeFi applications. Let’s break them down:

Smart Contract Audits

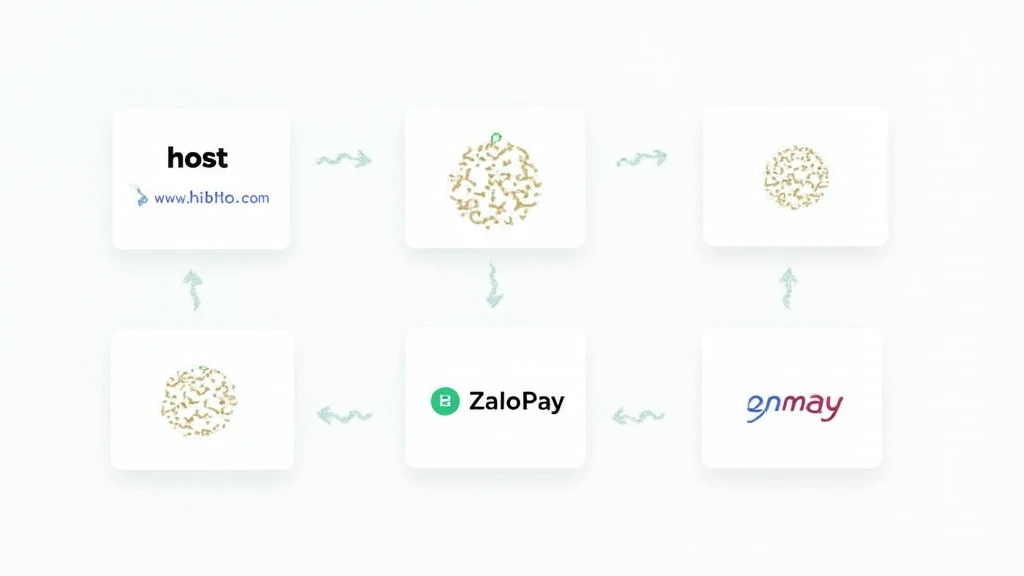

These are the most common form of audit. As smart contracts are coded commands, even a small bug can have catastrophic financial implications. Organizations like HiBT have established a reputation for their thorough smart contract audits.

Security Audits

These audits go beyond smart contracts. They assess the overall security of the platform, including data storage, user interaction, and server security. An audit here would be akin to a full health check-up, ensuring that everything functions cohesively.

Compliance Audits

As regulatory scrutiny increases, compliance audits ensure that platforms adhere to applicable laws. This could cover anything from Know Your Customer (KYC) processes to Anti-Money Laundering (AML) measures. Adhering to compliance standards is not just philosophical. In Vietnam, more than 75% of investors express a desire for compliance as a key driver for engagement with DeFi platforms.

Stablecoin Sensitivity: A Case Study

Stablecoins have emerged as a critical component of the DeFi ecosystem, bridging the gap between traditional fiat currency and volatile cryptocurrencies. However, the safety and integrity of stablecoins rely heavily on robust auditing practices. With marketplaces now accepting stablecoins like USDT and USDC, how can investors ensure their investments are shielded from potential risks?

- Peg Stability: An audit can verify if a stablecoin maintains its peg effectively, ensuring it remains equivalent to the fiat currency it’s tied to.

- Smart Contract Validity: Auditors can analyze the traits of the smart contracts that underpin stablecoins, ensuring they operate transparently and securely.

Challenges in DeFi Auditing

Despite the importance of audits, there are several challenges the industry is currently facing:

- Complexity of Code: The more complex a contract, the harder it is to thoroughly audit.

- Lack of Standardization: With no universal auditing standards, comparing the results across different audits can be tricky.

- Rapid Innovations: The fast-paced nature of the DeFi space often makes it challenging for auditors to catch up to new developments.

The Future of Audits in DeFi

As the DeFi landscape continues to mature, the role of auditing will only gain importance. To remain competitive, platforms must prioritize security and comply with regulatory demands. Here are a few thoughts on what might transpire in the next few years:

- Increased Automation: Tools that automate the auditing process are likely to proliferate, making audits quicker and easier.

- Integration of AI: Artificial intelligence could become a key player in auditing, providing deeper insights and identifying vulnerabilities more efficiently.

- User Education: As users become more educated about the importance of audits, they will demand to see audit reports before making investment decisions.

Conclusion

As we venture deeper into the world of Bitcoin and DeFi, understanding the audit process for stablecoins becomes indispensable for anyone looking to engage with these ecosystems. With the alarming statistics of security breaches in 2024, it’s not just about participating in DeFi; it’s about ensuring safety through thorough audits.

Planning for 2025, investors should educate themselves on how to audit smart contracts and should be assured that regular audits can serve as the bedrock of their investment decisions. Learn more about auditing in the DeFi space.

As the Vietnamese market continues to evolve, staying updated will empower users to navigate these exciting yet risky waters successfully.

Expert Bio

Dr. Linh Tran is a blockchain security expert with over 12 published papers on cryptocurrency audits and consulting for notable projects in the DeFi space. With a keen focus on the Vietnamese market, Dr. Tran actively advises on security best practices, shaping the future of blockchain technology.