Introduction

In the fast-paced world of cryptocurrency trading, effective strategies can make or break your investment. With billions lost each year to market volatility, knowing how to set take-profit orders is crucial for managing risks and securing profits. In 2024 alone, losses due to unprotected positions reached an astonishing $4.1 billion, underscoring the importance of strategic order placements.

In this guide, we’ll explore the nuances of setting take-profit orders on cryptocurrency platforms like CryptoCoinNewsToday, illustrating how you can safeguard your investments while maximizing returns. Here’s what we’ll cover:

- Understanding Take-Profit Orders

- Benefits of Setting Take-Profit Orders

- Step-by-Step Guide on Setting Take-Profit Orders

- Take-Profit Strategies in Different Market Conditions

- Common Mistakes to Avoid

Understanding Take-Profit Orders

A take-profit order is a type of limit order that automatically closes a trade when the price reaches a predefined level, allowing traders to secure profits without emotional interference. Similar to setting a stop-loss that helps you minimize losses, a take-profit order establishes your profit-taking level upfront—like having a safety net.

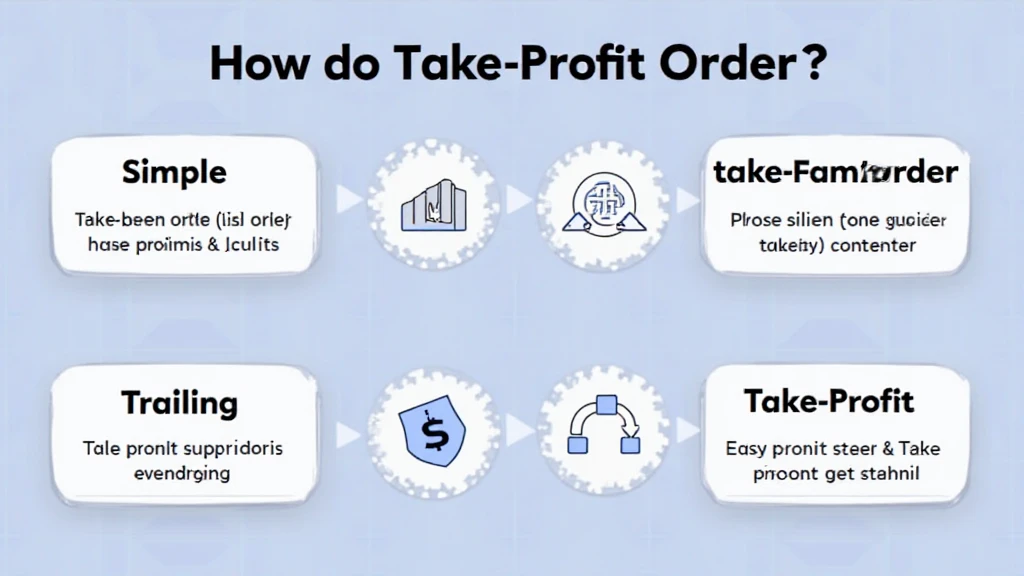

Types of Take-Profit Orders

- Simple Take-Profit Orders: These are straightforward orders set at a specific price above your entry point. For instance, if you buy Bitcoin at $30,000 and set a take-profit order at $35,000, the order is executed automatically when the price hits $35,000.

- Trailing Take-Profit Orders: These dynamic orders adjust the profit limit as the market price rises, locking in profits. For example, if you set a trailing stop at $5,000, the take-profit order will follow the market price within that limit, providing enhanced profit potential while protecting your gains.

Benefits of Setting Take-Profit Orders

Why should you consider setting take-profit orders?

- Emotion-Free Trading: Trades are executed based on pre-set levels, minimizing the risks of emotional decisions during market volatility.

- Profit Maximization: By defining your take-profit points, you can capitalize on market movements efficiently, ensuring that you don’t miss opportunities.

- Risk Management: Take-profit orders inherently limit potential losses by securing profits before market reversals happen.

Step-by-Step Guide on Setting Take-Profit Orders

Here’s a detailed breakdown of setting take-profit orders on CryptoCoinNewsToday:

- Select Your Trading Pair: Begin by choosing the cryptocurrency pair you wish to trade. For example, BTC/USDT or ETH/BTC.

- Review Market Conditions: Analyze the market trends. Are prices on an upward trajectory, or is a downturn expected? This analysis helps you determine your take-profit level.

- Determine Your Target Profit Level: Decide the price point at which you want to secure profits. A common strategy is to aim for a profit that aligns with your risk-reward ratio.

- Set the Take-Profit Order: On the trading interface, select the take-profit option and input your target price. Confirm the details.

- Monitor Your Trade: Even after setting your take-profit order, always keep an eye on the market, especially if unexpected volatility occurs.

For example, if you enter a trade by purchasing Bitcoin at $30,000 and believe that it will rise to $35,000 based on market conditions, you can set your take-profit order at $35,000. Should Bitcoin’s price peak at this level, your trade closes automatically, locking in a $5,000 profit.

Take-Profit Strategies in Different Market Conditions

The strategy for setting take-profit orders may vary based on market conditions:

Bull Markets

In a bullish market, prices can rise rapidly. Set your take-profit orders at higher targets, perhaps using trailing stops to maximize profits while ensuring you capitalize as the market trends upward.

Bear Markets

In bearish conditions, it’s advisable to set conservative take-profit levels, locking in smaller gains rapidly to mitigate losses from declining prices.

Sideways Markets

When the market is stagnant, consider setting tighter take-profit orders. The lack of directional movement often means lower volatility, so having defined exit points within narrower ranges becomes essential.

Common Mistakes to Avoid

Even when you know how to set take-profit orders, it’s essential to avoid these common pitfalls:

- Setting Unrealistic Targets: Overly ambitious profit targets can lead to missed opportunities. Stick to realistic levels based on thorough technical analysis.

- Not Using Trailing Stops: Failing to employ trailing stops can result in lost profits if markets suddenly turn against you.

- Ignoring Market Indicators: Always consider market sentiment and technical indicators before finalizing your take-profit levels.

Adding Vietnamese language keywords, such as “tiêu chuẩn an ninh blockchain”, into your strategies can also yield benefits. Incorporating local language terms can improve outreach to Vietnamese investors.

Conclusion

Understanding how to set take-profit orders is essential for both novice and experienced traders. By integrating effective risk management practices and regularly analyzing market conditions, you can protect your gains and bolster your trading strategy. Remember, securing profits is an integral part of successful trading in the volatile world of cryptocurrencies.

For more insights into cryptocurrency strategies, stay tuned with us at CryptoCoinNewsToday.