Comparing HIBT Vietnam Bond Platform Fees on Cryptocoinnewstoday

As cryptocurrencies continue to gain traction globally, the Vietnamese market has emerged as an intriguing space for investors looking to navigate the bond platform landscape. With a notable influx of users and an anticipated growth rate of 25% by 2025, it’s essential to understand the associated fees one might encounter when utilizing platforms like HIBT in Vietnam. In this article, we will break down HIBT’s bond platform fees compared to other platforms, helping you make informed decisions about your investments.

The Importance of Understanding Platform Fees

With an estimated $4.1 billion lost to DeFi hacks in 2024, understanding the fees associated with investment platforms is more vital than ever. Navigating these fees can often make a significant difference in overall returns.

- Transaction Fees: Costs incurred with each trade or investment.

- Withdrawal Fees: Charges related to pulling funds out of the platform.

- Management Fees: Ongoing costs associated with asset management.

What Users Need to Know

These fees vary significantly by platform and can impact your investment strategy. For instance, HIBT Vietnam’s fees might differ from international platforms, highlighting the need for thorough research.

Evaluation of HIBT Fees

HIBT Vietnam’s bond platform fees present a competitive choice for investors looking to optimize their portfolios while keeping costs low. Here’s a breakdown of the types of fees you can expect:

- Transaction Fees: HIBT typically charges a flat fee of 0.5% per transaction.

- Withdrawal Fees: Users incur a fee of VND 10,000 when withdrawing assets.

- Management Fees: An annual fee of 1% on assets under management is standard.

Competitive Analysis

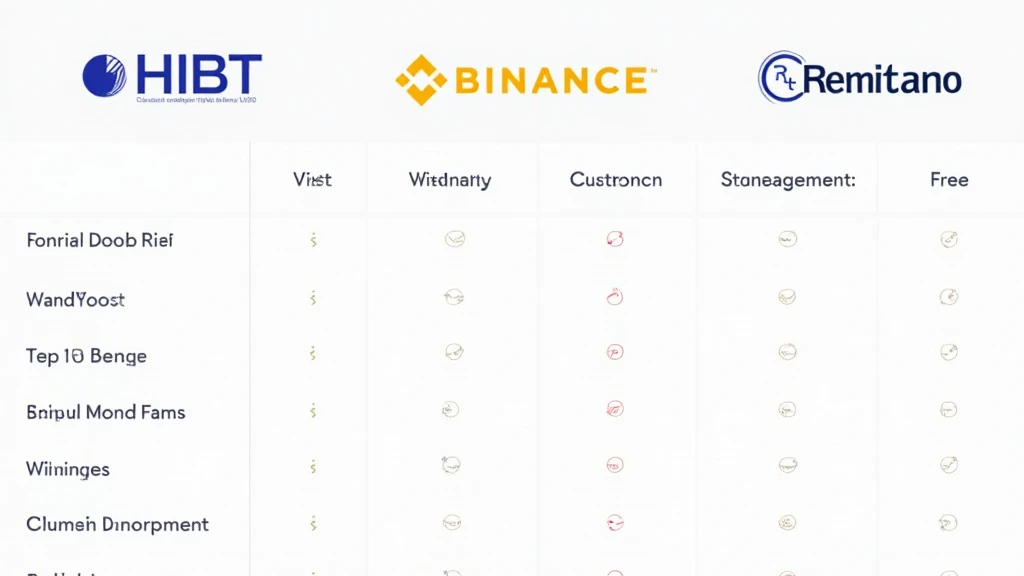

When compared to other platforms in Vietnam such as Binance and Remitano, HIBT’s fees stand out:

| Platform | Transaction Fees | Withdrawal Fees | Management Fees |

|---|---|---|---|

| HIBT | 0.5% | VND 10,000 | 1% |

| Binance | 0.1% | VND 15,000 | 0.5% |

| Remitano | 0.2% | VND 20,000 | 1.5% |

As seen, while HIBT might not be the lowest in transaction fees, its comprehensive service package and support rank highly.

User Growth and Market Trends in Vietnam

The Vietnamese cryptocurrency landscape is rapidly evolving. According to recent reports, the user growth rate is expected to surge significantly over the next few years, particularly as regulations become clearer.

- The user base in Vietnam has grown by over 15% in 2023 alone.

- Regulatory clarity has led to a surge of local investment in bond platforms.

- Projections indicate an increase of up to 30% post-2025.

Local Market Insights

With the growth rate, tiêu chuẩn an ninh blockchain becomes increasingly crucial for Vietnamese users. They must ensure the platforms they use provide not only competitive fees but also robust security measures.

Final Thoughts on HIBT Vietnam Bond Platform Fees

In summary, understanding HIBT’s fees compared to others in the Vietnamese market can empower users to optimize their investment strategies. While the platform may not offer the lowest transaction fee, its overall service value, user support, and local compliance are commendable.

As you venture into cryptocurrency investing in Vietnam, regularly comparing and evaluating platform fees is essential. This vigilance helps ensure that your investments are both secure and profitable.

If you’re seeking further insights on fees and strategies, visit hibt.com for the latest updates.

While this analysis is comprehensive, it’s important to note that these figures are subjected to changes and should be verified directly with the platforms.