HIBT Liquidity Pool Management Strategies

With the increasing show of strength in decentralized finance (DeFi), the significance of liquidity pools has surged greatly. According to industry reports, in 2023, liquidity pools accounted for over 60% of the total transaction volume across various DeFi platforms. For investors and liquidity providers, employing effective HIBT liquidity pool management strategies is crucial for maximizing returns and minimizing risks.

Understanding Liquidity Pools

A liquidity pool is essentially a collection of funds locked in a smart contract that provides liquidity for trading pairs. In traditional finance, think of it as a bank vault that holds deposits, making it easier for customers to withdraw funds when needed. This model also helps maintain price stability and reduces slippage during transactions.

- Liquidity Pools in DeFi: They serve as automated market makers (AMMs), allowing users to trade without needing a traditional buyer or seller.

- Role of HIBT: HIBT tokens represent a stake in the liquidity pool, granting holders a share of the fees generated from trades.

Strategies for Effective HIBT Liquidity Management

To succeed in managing HIBT liquidity pools, consider the following strategies:

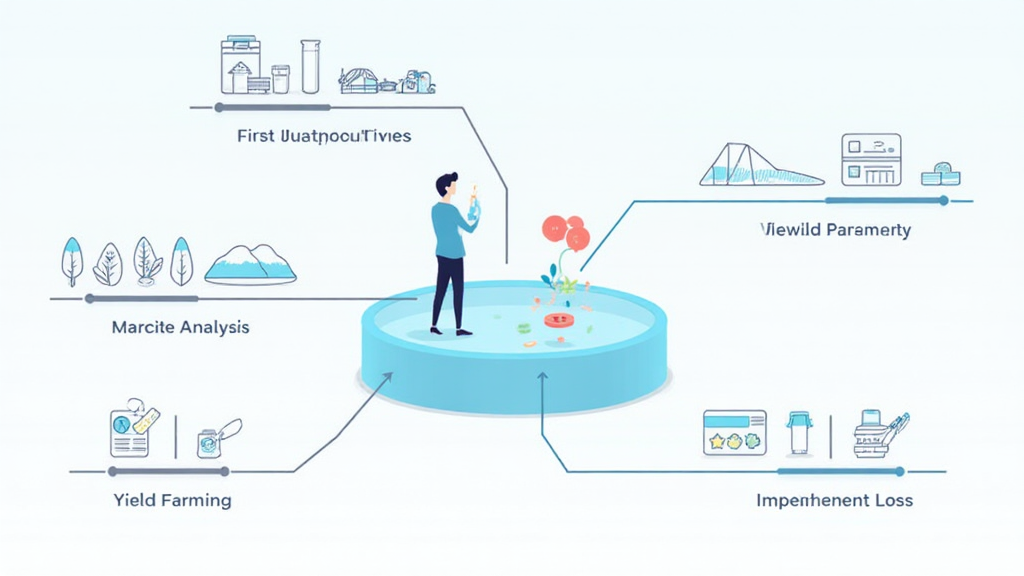

1. Assessing Market Conditions

Understanding market trends is vital. Evaluating factors such as trading volume, market volatility, and external economic events will help you make informed decisions. The goal is to enter or exit liquidity pools at optimal times. For instance, during market downturns, liquidity can dry up, making it risky to provide liquidity.

2. Diversification is Key

Diversifying your investments by providing liquidity to multiple pairs can reduce risk exposure. This strategy spreads out potential losses and allows you to take advantage of different market segments.

3. Monitoring Impermanent Loss

Impermanent loss occurs when the price of tokens in the liquidity pool diverges significantly. The more volatile the tokens, the greater the potential for impermanent loss. One strategy is to monitor the volatility of pairs actively. You can also adjust your positions accordingly.

4. Utilizing Yield Farming

Yield farming is the process of maximizing returns on your assets. You can stake HIBT tokens in liquidity pools to earn additional tokens as rewards. This strategy requires a balance of risk and reward.

5. Setting Exit Strategies

Having a clear exit strategy is crucial. Decide beforehand under which conditions you will withdraw your liquidity. This could depend on achieving certain returns or the onset of market volatility.

Exploring the Vietnamese Crypto Market

Vietnam has shown remarkable growth in the cryptocurrency sector, with user adoption rates climbing by 350% in 2023. Vietnamese users are increasingly engaging with DeFi platforms, and understanding local trends can provide valuable insights into liquidity pool management.

- The demand for HIBT liquidity pools in Vietnam is evident as the market continues to mature.

- Understanding Vietnamese regulations can help in strategic deployment of liquidity in local exchanges.

Conclusion

By employing effective HIBT liquidity pool management strategies, investors can navigate the complexities of DeFi and potentially reap significant rewards. Continuously adapting your strategies based on market conditions and user behavior in regions like Vietnam, with their vibrant crypto community, can provide a strategic edge.

Additional Resources

For a deeper dive into liquidity pools, explore related articles such as “Understanding Decentralized Exchanges” and “How to Audit Smart Contracts.” For the latest on HIBT tokens and liquidity strategies, visit hibt.com.

Not financial advice. Consult local regulators before investing.