Mastering HIBT Crypto Portfolio Diversification

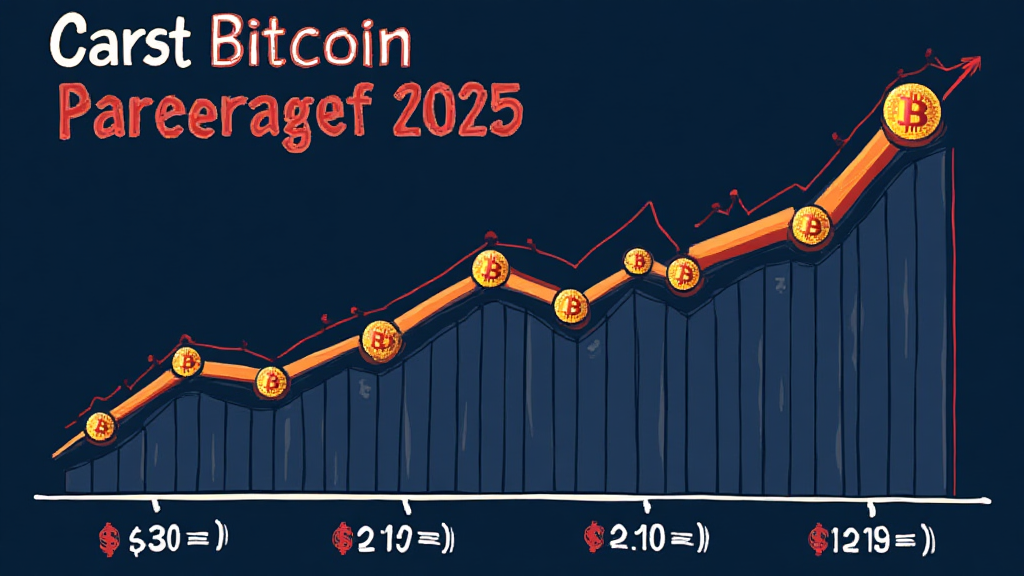

As the digital landscape evolves, many investors are turning their attention to the realm of cryptocurrencies. Not only have cryptocurrencies like Bitcoin and Ethereum garnered significant attention, but newer entries, such as HIBT, are also positioning themselves as solid investment choices. Recent data indicates that the total market cap of cryptocurrencies reached over $1.2 trillion, showcasing a robust growth in the space. But here’s the catch: with growth comes risk.

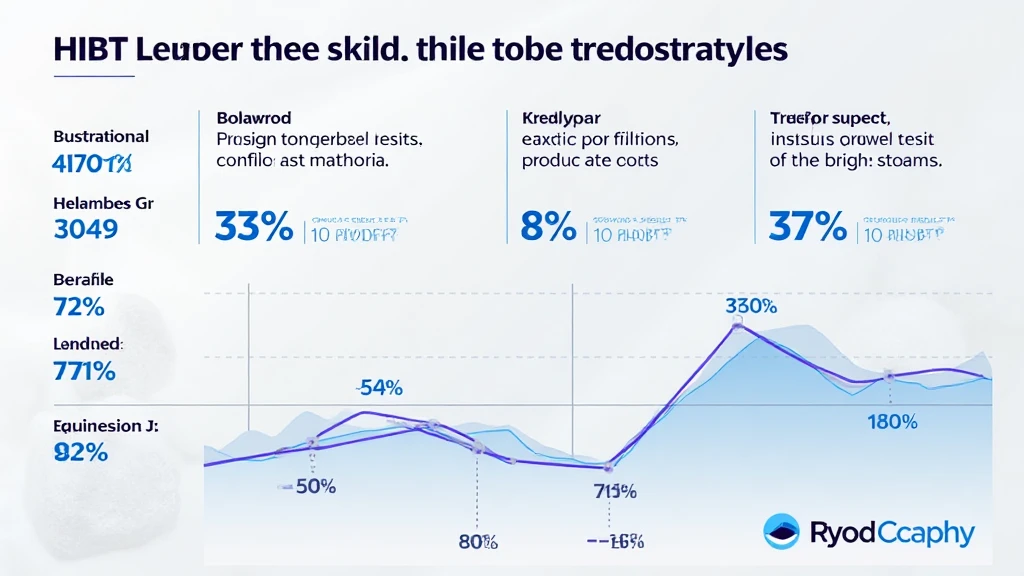

With approximately $4.1 billion lost to DeFi hacks in 2024, understanding the nuances of portfolio diversification is essential for investors looking to safeguard their assets in this volatile market. This article will delve deeply into HIBT crypto portfolio diversification, guiding you in managing risks while capitalizing on potential gains.

Understanding the Importance of Portfolio Diversification

Portfolio diversification is akin to spreading your eggs across multiple baskets. By diversifying your investments, you reduce the risk associated with the market’s inevitable fluctuations. Here’s how this concept applies to HIBT crypto portfolio diversification:

- Risk Reduction: Cryptocurrencies can be notoriously volatile, but diversifying allows you to mitigate risks.

- Broader Reach: A diversified HIBT portfolio can expose you to various market areas.

- Informed Decisions: Gaining exposure to multiple coins enables you to make better investment choices.

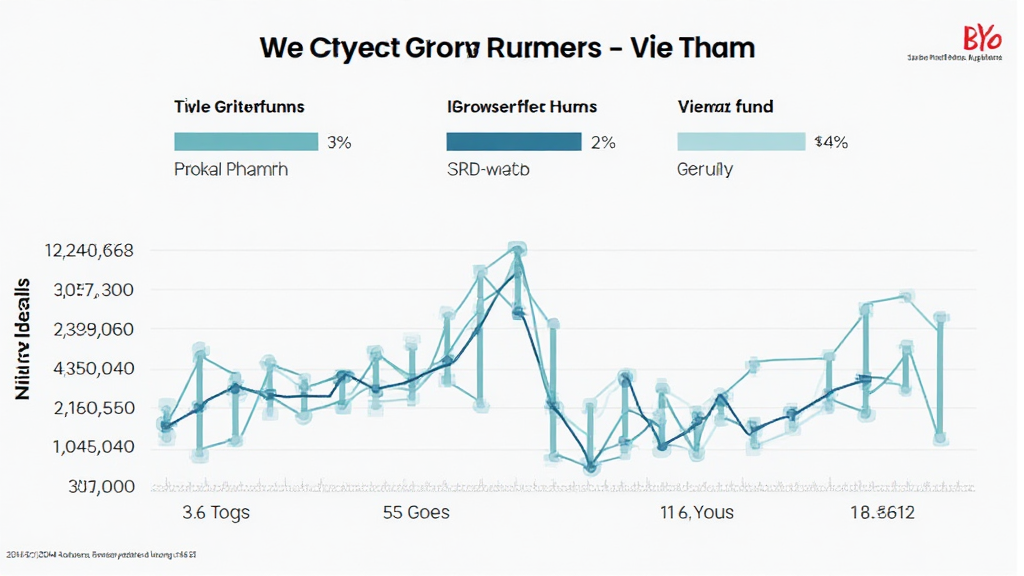

Analyzing the South East Asian Crypto Market

Vietnam’s crypto landscape is blooming. With a user growth rate of nearly 500% from 2020 to 2024, the influx of investors seeking HIBT and other cryptocurrencies reflects a global trend. Understanding the local market can further enhance your portfolio diversification strategy. Vietnamese investors are increasingly keen on the latest digital currency trends, making it crucial to consider local demand when building your portfolio.

Current Statistics of Crypto Growth in Vietnam

| Year | User Growth (%) | Market Cap (USD) |

|---|---|---|

| 2021 | 100% | $1 billion |

| 2022 | 200% | $4 billion |

| 2023 | 400% | $8 billion |

| 2024 | 500% | $12 billion |

Source: CryptoMarketInsights 2024

Strategies for HIBT Crypto Portfolio Diversification

So, how do you practically diversify your HIBT portfolio? Let’s break it down into actionable steps:

- Invest in Multiple Cryptocurrencies: Besides HIBT, consider undervalued coins with strong growth potential, such as the top altcoins for 2025.

- Opt for Different Market Cap Segments: Blend your portfolio with large-cap, mid-cap, and small-cap cryptocurrencies to balance stability and growth.

- Utilize Crypto Index Funds: If you want an easier route, consider HIBT crypto index funds that automatically diversify your investment across various currencies.

The Importance of Regular Portfolio Audits

Just as one would regularly check their bank accounts, regular audits of your crypto portfolio are vital. This involves:

- Evaluating Performance: Assess how each asset has performed over time.

- Adjusting Allocations: Rebalance the portfolio based on market changes and personal financial goals.

- Researching New Opportunities: Stay informed about emerging cryptocurrencies and new technological advancements, such as how to audit smart contracts.

Maintaining Security Standards in Your HIBT Investments

While diversification is crucial, it’s equally important to secure your assets. This becomes increasingly pertinent given the rise in hacks and scams. Consider the 2025 blockchain security standards—implement measures such as using hardware wallets and setting up two-factor authentication to keep your digital assets safe.

Furthermore, keeping your software wallets updated and only dealing with reputable exchanges is crucial for enhanced security. Remember, securing your portfolio is as important as diversifying it.

Joining the Conversation: Stay Informed and Engaged

Stay connected with the crypto community through platforms and forums. Engage in discussions and keep abreast of market sentiments and news. Join groups focusing on HIBT and cryptocurrency diversification strategies—they can provide insights that have a real impact on your investment journey.

Conclusion: A Roadmap to Successful HIBT Portfolio Diversification

In summary, mastering HIBT crypto portfolio diversification involves understanding market trends, strategically investing, and regularly auditing your investments. By building a diversified portfolio, you protect yourself against significant losses while positioning yourself for growth in the rapidly evolving crypto landscape. Keep these strategies in mind as you navigate your journey in the cryptocurrency space. Remember, it’s not just about investing—it’s about investing smartly.

If you’re looking to further bolster your understanding of HIBT and other related topics, be sure to stay updated with features from cryptocoinnewstoday.

***Author: Dr. Minh Tu***

An acclaimed blockchain strategist with over 15 published papers in the field and has led audits for high-profile projects internationally.