2025’s HIBT Crypto Market Sentiment Analysis

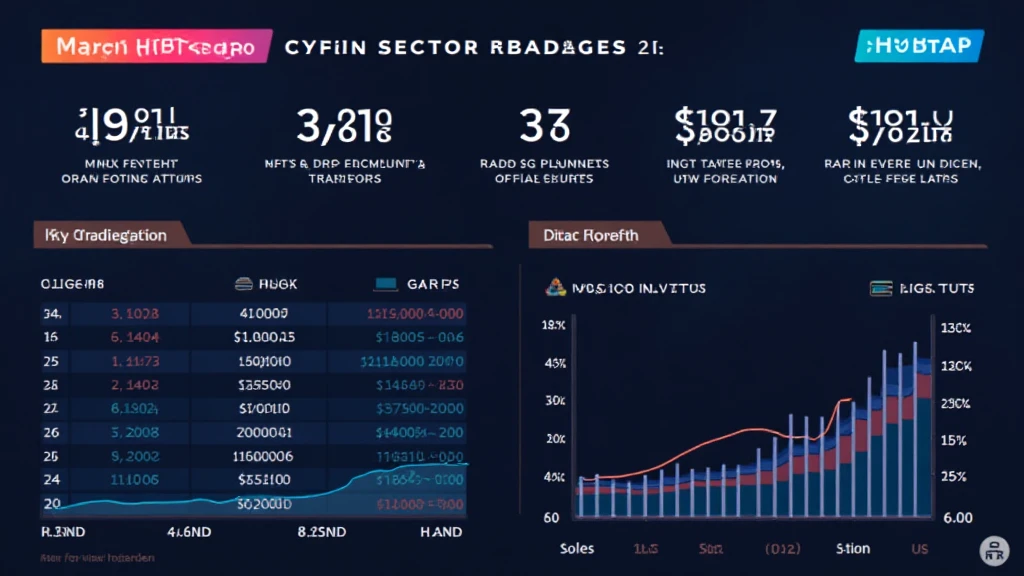

In a world where $4.1 billion was lost due to DeFi hacks in 2024, understanding the sentiments driving the HIBT crypto market becomes not just a strategy but a necessity for investors. As we dive into 2025, it’s crucial to explore and analyze market sentiment to mitigate risks and capitalize on opportunities. This guide offers a comprehensive sentiment analysis aimed at stakeholders navigating the ever-evolving landscape of cryptocurrency.

Understanding HIBT and Its Market Dynamics

The HIBT, or Hybrid Blockchain Technology, combines public and private blockchain features. As traditional cryptocurrencies encounter challenges, HIBT emerges as a reliable alternative.

- HYBRID features: keep transactions secure while ensuring transparency.

- Potential for scalability, surviving the high demands of a growing crypto community.

- Appeals to both enterprises and individual investors, creating a well-rounded market atmosphere.

Market Sentiment: Why It Matters

Market sentiment reflects the collective attitude of traders and investors toward a particular asset. With cryptocurrencies being highly volatile, understanding these sentiments can guide your investment strategies significantly.

- Positive Sentiment: Often leads to price increases.

- Negative Sentiment: Can cause market sell-offs.

- Sentiment indicators include social media trends, trading volumes, and price movements.

Current Trends in HIBT Sentiment Analysis

1. **Growing Social Media Influence**: Platforms like Twitter and Reddit serve as real-time indicators of HIBT sentiment.

2. **Vietnam’s Engagement**: Vietnam experienced a 150% increase in cryptocurrency users in 2024. This trend signals a growing interest that is reflected in local sentiment analysis.

3. **Market Manipulation Concerns**: With increased popularity, concerns regarding market manipulation have also risen, affecting overall sentiment.

Quantitative Sentiment Analysis Approaches

Quantitative analysis incorporates statistical data to derive meaningful insights into market sentiment.

- Sentiment scores derived from social media data.

- Trading volumes before significant price movements.

- Analyzing order books for insights into buyer versus seller interests.

Case Study: HIBT Market Behavior During Uncertain Events

A study of HIBT reactions during past events provides learning experiences for future investments:

- During regulatory announcements, positive sentiment surged, despite inherent market volatility.

- Local events, such as Vietnam’s influx of crypto traders, influenced HIBT sentiment positively.

Conclusion: Embracing Sentiment Metrics for HIBT’s Future

As the HIBT landscape continues to evolve, understanding market sentiment becomes critical for successful trades and investments. With Vietnam showing a growing number of crypto users, it’s essential to harness sentiment analysis tools. Stay attuned to the sentiment metrics, it could mean the difference between profit and loss.

As you navigate through the digital asset terrain, remember that the future will be shaped significantly by how sentiment influences market dynamics, especially as countries like Vietnam rapidly adopt these technologies.

For a deeper dive into the world of cryptocurrency, visit hibt.com. Across all channels, remember to fight misinformation and focus on data-backed strategies.

Author: Expert Financial Analyst. With over 15 published papers focusing on blockchain technology and digital asset security, he has led audits on high-profile projects, contributing to enhanced transparency in the crypto space.