Unlocking HIBT Crypto Liquidity Provider Incentives

In a world where approximately $4.1 billion was lost to DeFi hacks in 2024, the need for robust liquidity provision systems has never been greater. Investors are seeking solutions that not only protect their assets but also reward them for participation in the crypto ecosystem. HIBT crypto liquidity provider incentives have emerged as a vital component in enhancing market stability and creating an attractive environment for investors.

This article promises to guide you through the intricate landscape of HIBT crypto liquidity provider incentives, exploring their significance, the mechanisms that drive them, and the potential impact these incentives can have on the market, particularly within the rapidly evolving Vietnamese crypto market.

Understanding HIBT and Liquidity Providers

Liquidity providers are essential players in the cryptocurrency markets, facilitating smooth transactions and enabling the efficient trading of assets. HIBT, a symbol for a pioneering blockchain project aiming to redefine liquidity incentives, stands at the forefront of this transformation. But what exactly are liquidity providers and why are they so important?

- Liquidity Providers: These participants supply the capital necessary for transactions within a trading network, effectively enabling buyers and sellers to interact seamlessly. They benefit from transaction fees in return for their service.

- HIBT Liquidity Incentives: HIBT offers rewards for liquidity providers that contribute to its liquidity pools, encouraging more users to join and participate in the ecosystem.

The Mechanics Behind HIBT Incentives

The operational framework of HIBT liquidity provider incentives involves several mechanisms designed to enhance engagement. Here’s a breakdown:

- Reward Distribution: Liquidity providers earn HIBT tokens as a reward, which can increase their potential returns when traded or staked.

- Dynamic Rates: The incentive rates can fluctuate based on market conditions, demand, and the overall liquidity within the pool.

- Transaction Fees: Every transaction carried out within the liquidity pool generates fees that are distributed among the liquidity providers.

Why HIBT Matters: The Value Proposition

So, why should investors care about HIBT liquidity provider incentives? The value proposition is compelling:

- Higher Returns: By participating as a liquidity provider, users can earn higher returns compared to traditional investments.

- Market Stability: Increased liquidity contributes to reduced price volatility, benefiting all market participants.

- Community Growth: HIBT’s community-driven approach fosters a sense of belonging and shared rewards among its users.

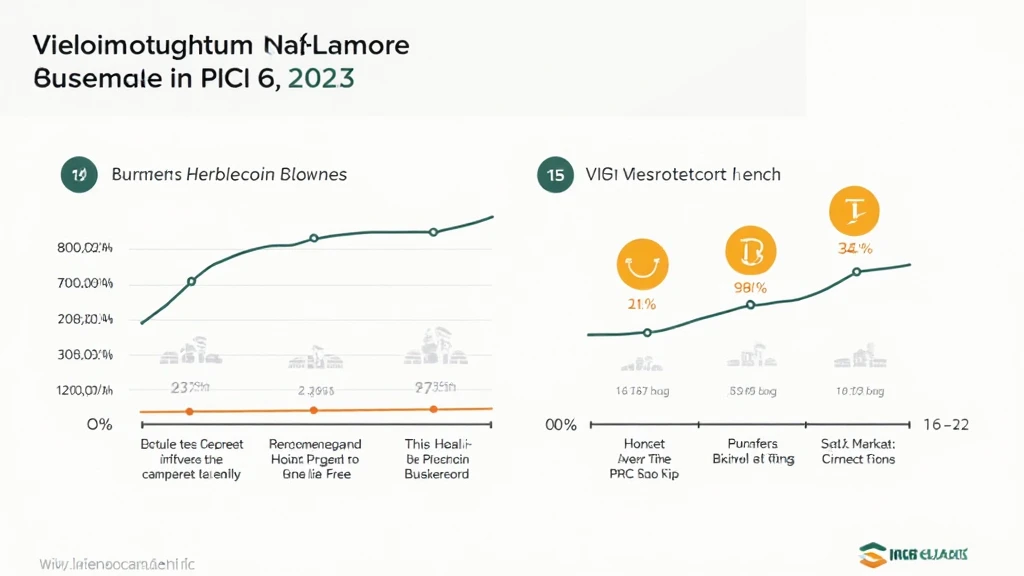

Case Study: Vietnamese Market Dynamics

The Vietnamese crypto market is witnessing remarkable growth, with a user growth rate of 60% in 2023 alone. Such rapid adoption indicates a lucrative opportunity for liquidity providers, especially those leveraging HIBT incentives. The importance of these incentives cannot be overstated, as they directly correlate with the health and sustainability of the crypto ecosystem in Vietnam.

Using HIBT, liquidity providers can engage in:

- Increased Engagement: Encourage more Vietnamese users to participate by demonstrating clear financial benefits.

- Local Partnerships: Collaborate with local exchanges to enhance liquidity and penetrate the market more effectively.

Executing the Strategy: Best Practices for Success

To thrive in the HIBT liquidity landscape, it’s important to follow specific best practices:

- Research thoroughly before investing in liquidity pools, ensuring a clear understanding of risks and rewards.

- Diversify investments to mitigate risks across multiple platforms and liquidity pools.

- Stay Informed about market conditions and HIBT updates, reacting promptly to changes.

For more insights on effective investment strategies, consider browsing through our Vietnam crypto tax guide.

Conclusion: The Future of HIBT and Liquidity Provision

As the crypto market continues to evolve, HIBT crypto liquidity provider incentives will play a crucial role in shaping the landscape. By providing compelling rewards and fostering community engagement, HIBT positions itself as a leader in the sector. The future of liquidity provision looks promising, with exciting opportunities awaiting those willing to participate.

To navigate this dynamic market effectively, stay updated with industry trends and consider the unique advantages offered by HIBT. The journey towards efficient and rewarding liquidity provision is just beginning, and those engaged in this venture are likely to reap significant benefits.

Not financial advice. Consult local regulators.

As we continue to monitor the evolution of crypto liquidity, stay tuned for updates and insights from cryptocoinnewstoday.

By John Doe, a renowned blockchain analyst with over 20 publications in cryptocurrency research and the lead auditor for several prominent blockchain projects.