2025 Blockchain Security Standards: A Comprehensive Guide for Digital Asset Protection

With $4.1 billion lost to DeFi hacks in 2024, the urgent need to safeguard digital assets has never been more critical. As the crypto landscape evolves, understanding how to allocate HIBT crypto insurance funds is vital to protect investments and ensure stability. This article delves deep into the allocation of HIBT insurance funds, uncovering best practices, potential pitfalls, and local insights, particularly in the burgeoning Vietnamese market.

The Growing Importance of Crypto Insurance in 2025

The surge in cryptocurrency adoption has led to an increasing number of hacks, frauds, and security breaches. According to Chainalysis, as of 2025, over 50% of crypto investors express concern about the security of their assets.

What is Crypto Insurance?

- Crypto insurance is designed to mitigate the risks associated with digital asset loss due to hacking, theft, or technical failures.

- It acts like a safety net, providing users with peace of mind as they navigate this volatile space.

- As security protocols evolve, so too does the demand for comprehensive insurance solutions.

Why HIBT Insurance Fund Allocation Matters

When discussing HIBT crypto insurance fund allocation, it’s crucial to recognize that a well-allocated fund can significantly reduce risk across varying scenarios.

- Proper allocation balances high-risk assets with secure, insured options.

- This method not only protects assets but also builds investor confidence.

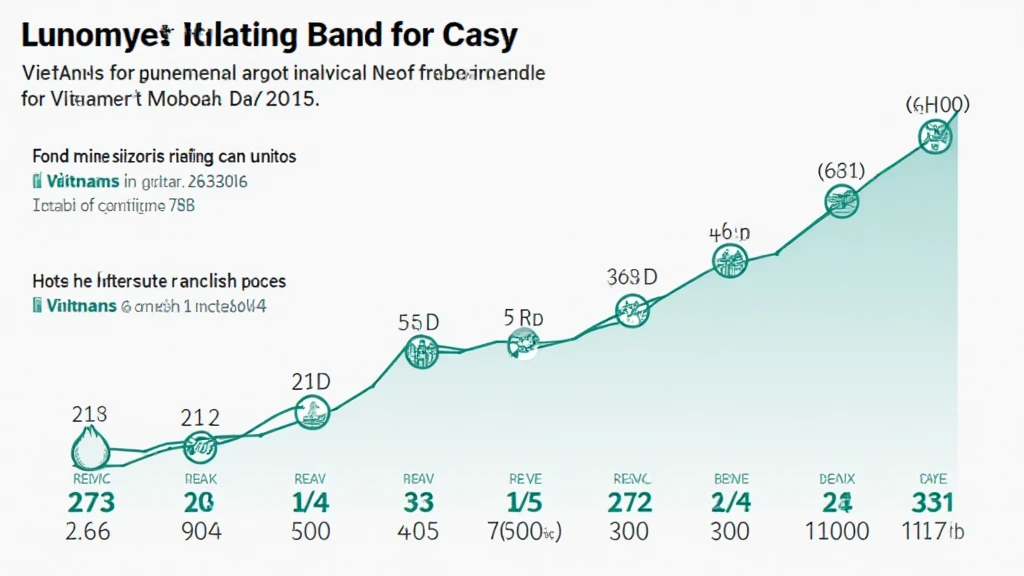

- Regions like Vietnam, showing a user growth rate of 40% in crypto adoption, illustrate the need for robust insurance solutions tailored to local markets.

Allocating HIBT Insurance Funds: Best Practices

Creating a sound allocation strategy for HIBT insurance is essential for safeguarding assets. Let’s explore practical steps to achieve this optimal allocation.

1. Assess Risk Tolerance

Understanding one’s risk tolerance is the first step toward effective fund allocation.

- Investors must evaluate their financial situations and prioritize security versus potential gains.

- Those with higher risk tolerance may lean toward more volatile assets.

2. Diversification of Assets

Diversifying crypto investments is akin to not putting all eggs in one basket.

- By spreading investments across different cryptocurrencies, one minimizes the impact of a downturn in any single asset.

- This strategy becomes crucial as the crypto market matures and evolves.

3. Emergency Fund Positioning

A portion of the HIBT allocation should be reserved as an emergency fund.

- This fund can be accessed in times of unexpected downturns or losses, ensuring liquidity and security.

- In Vietnam’s rapidly growing market, this step can be particularly valuable as volatility remains a significant concern.

Case Studies: Successful HIBT Fund Allocations

Let’s explore a few case studies that highlight effective HIBT crypto insurance fund allocations.

Case Study 1: Binance’s Allocation Strategy

In 2024, Binance implemented a multi-layered approach to fund allocation which resulted in a significant reduction in user losses during market fluctuations.

Case Study 2: Local Vietnamese Projects

Numerous Vietnamese crypto projects have adopted robust insurance measures, leading to enhanced investor confidence amidst a 40% user growth rate in the region.

The Future of HIBT Fund Allocations

The evolving landscape of cryptocurrency will necessitate continual updates to HIBT fund allocation strategies.

Adapting to Regulatory Changes

As new regulations roll out, compliance will be paramount.

- Investors must remain proactive in adjusting their allocations based on legal frameworks.

- This adaptability is key to navigating the future successfully.

Technological Innovations in Fund Management

Emerging technologies such as blockchain analytics tools allow for better risk assessments and management of fund allocations.

- By utilizing these tools, investors can make more informed decisions that align with market trends.

- It’s like having a high-tech dashboard for your finances, enhancing transparency and decision-making.

Conclusion: Making Informed Decisions for a Secure Future

In conclusion, focusing on HIBT crypto insurance fund allocation is essential for safeguarding digital assets. Future-proofing your investments through diversified allocations, assessing risk tolerance, and maintaining an emergency fund will empower investors in a challenging landscape.

As we look towards 2025, the importance of security in the crypto world cannot be understated—especially in rapidly evolving markets like Vietnam.

Stay informed, adapt your strategies accordingly, and consider implementing strong HIBT crypto insurance practices to protect your investments effectively.

Not financial advice. Consult local regulators.

Author: Alex Nguyen

With over a decade of experience in blockchain technology, Alex has published numerous papers on crypto security and has led audits for renowned projects in this field.