Introduction

In recent years, the cryptocurrency landscape has witnessed significant transformation, particularly within the derivatives market. With over $4.1 billion lost to DeFi hacks in 2024, understanding the HIBT crypto derivatives market is crucial for investors seeking to safeguard their assets. This article delivers comprehensive insights, focusing on trends, challenges, and opportunities in the HIBT derivatives sector.

Understanding Crypto Derivatives

Crypto derivatives are financial contracts whose value derives from an underlying asset, typically a cryptocurrency. Just like how traditional financial markets operate, these derivatives allow traders to speculate on price movements without owning the underlying asset. There are several types of crypto derivatives:

- Futures Contracts: Agreements to buy or sell an asset at a predetermined future date and price.

- Options Contracts: Contracts that give the buyer the right, but not the obligation, to buy or sell an asset at a specific price within a specified time.

- Swaps: Contracts to exchange cash flows or assets between parties.

The Rise of HIBT in Derivatives Trading

The HIBT crypto derivatives market has gained tremendous popularity due to increasing demand for hedging strategies and speculative trading. According to recent data, the market’s trading volume has surged, attracting both retail and institutional investors. The growth can be attributed to various factors:

- Increased market volatility, prompting traders to seek out risk management tools.

- The simplicity and efficiency of trading derivatives compared to spot markets.

- Innovative platforms that provide user-friendly interfaces for trading.

Market Analysis: Key Trends

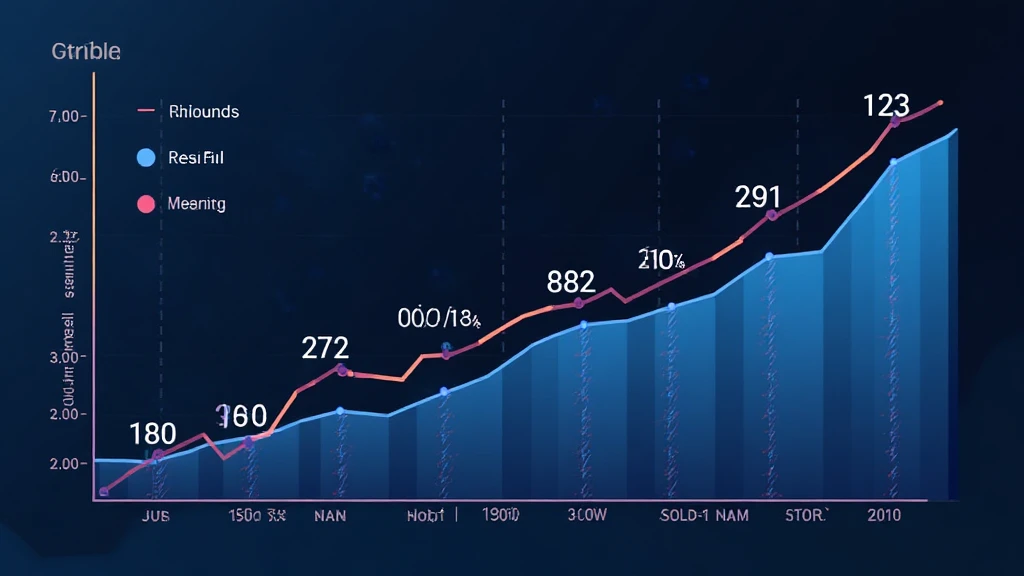

To provide a thorough analysis of the HIBT crypto derivatives market, we explore key trends and statistics that showcase its growth and evolution.

| Year | Trading Volume (in billion USD) | Open Interest (in billion USD) |

|---|---|---|

| 2022 | 5.5 | 1.2 |

| 2023 | 8.2 | 1.8 |

| 2024 | 12.6 | 2.5 |

As seen in the table above, both trading volume and open interest in the HIBT derivatives market have seen a sharp increase, suggesting growing investor confidence and participation.

The Vietnamese Market: A Case Study

Vietnam has emerged as a significant market for crypto derivatives. Recent statistics indicate a 30% growth rate in cryptocurrency adoption among Vietnamese users, driven largely by the younger demographic eager for investment opportunities. Terms like “tiêu chuẩn an ninh blockchain” (Blockchain Security Standards) are becoming increasingly relevant as these users seek safe ways to engage in derivatives trading.

Challenges in the HIBT Derivatives Market

Despite its growth, the HIBT crypto derivatives market faces several challenges:

- Regulatory Uncertainty: Varying regulations across jurisdictions can hinder market growth and create confusion among traders.

- Market Manipulation: The lack of oversight in some exchanges can lead to price manipulation, causing losses for traders.

- Security Risks: As seen with recent hacks, the security of trading platforms is a pressing concern for traders.

Conclusion

In conclusion, the HIBT crypto derivatives market is evolving rapidly, driven by market demand, technological advancements, and increased interest from investors. However, addressing the challenges of regulation, market integrity, and security is essential for sustaining growth. As traders become more knowledgeable, the focus will likely shift towards enhancing security measures and understanding the implications of new regulations on trading practices. This continuous evolution underlines the importance of staying informed about market trends and aligning trading strategies with the ever-changing landscape.

For further insights and resources on navigating the HIBT crypto derivatives market, visit HIBT, where you can find valuable guides and strategies to optimize your trading experience.

About the Author

Dr. Alex Thompson is a renowned blockchain researcher with over 15 published papers in the field. He has led audits on notable projects and continues to contribute to the advancement of crypto security practices.