Decentralized Exchanges DEX 2025: A Comprehensive Overview for Traders

In the fast-paced world of cryptocurrency, the rise of decentralized exchanges (DEX) has marked a significant shift in how we trade digital assets. As of 2024, a staggering $4.1 billion was lost due to hacks in DeFi platforms, underscoring the necessity for robust security mechanisms within these decentralized models. This article dives into the evolution and future of DEX, particularly towards 2025, addressing essential security standards and efficiency improvements.

Understanding Decentralized Exchanges

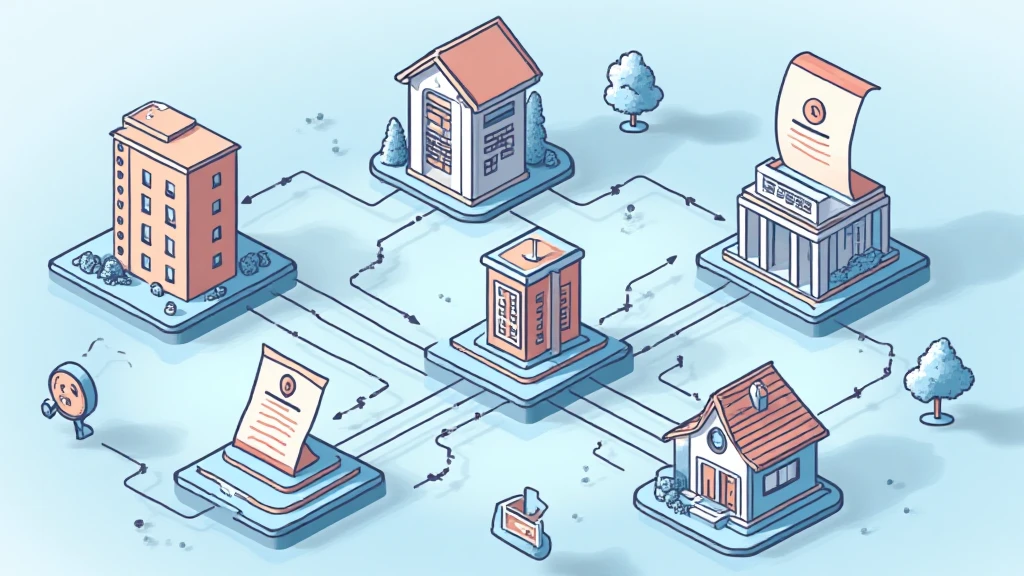

Decentralized exchanges operate without a central authority, allowing users to trade directly with one another. This peer-to-peer (P2P) system enhances privacy and reduces the risks associated with centralized platforms, where a single point of failure can lead to significant losses.

- Privacy: Users retain control of their private keys.

- Lower Fees: Reduced trading fees compared to centralized exchanges.

- No KYC: Users can trade anonymously.

Future Trends in DEX Until 2025

As we look ahead to 2025, several trends are emerging for decentralized exchanges:

- Increased Liquidity: Liquidity pools are becoming integral for DEX platforms, attracting more traders.

- Integration with Layer 2 Solutions: Improved scalability solutions will enhance transaction speeds and lower costs.

- Regulatory Compliance: As governments formulate regulations, DEX platforms may need to adapt, possibly retaining non-custodial traits while meeting legal requirements.

Security Improvements in DEX

Given the high susceptibility to vulnerabilities, security standards in DEX are paramount. Experts predict that by 2025, advancements in security protocols will include:

- Advanced Auditing Procedures: Tools like CodeSee will simplify comprehensive audits of smart contracts.

- Increased Use of Oracles: To ensure accurate data feeds while mitigating manipulation risks.

Furthermore, the incorporation of multi-signature wallets will increase transaction security, akin to the multi-layer protection employed by traditional banks.

Decentralized Governance Models

By 2025, many DEX platforms will likely adopt decentralized governance structures. Token holders will play a crucial role in decision-making, influencing everything from fee structures to feature enhancements. Such governance models foster community engagement, creating a more user-driven platform.

Challenges Facing DEX

As the landscape of decentralized exchanges evolves, several challenges remain:

- User Experience: While DEX provide unparalleled privacy, they often suffer from a steep learning curve for new users.

- Scalability Issues: High transaction volumes can overwhelm the networks, particularly on Ethereum‘s mainnet.

Localized Insights for the Vietnamese Market

In Vietnam, the cryptocurrency landscape is rapidly growing. As of 2024, the Vietnamese user base for cryptocurrency platforms has seen a 200% growth rate. This substantial increase indicates a burgeoning interest in decentralized exchanges as users seek more control over their digital assets.

Investors in Vietnam are now looking for platforms that integrate robust security features, rigorous audits, and community governance which underscores the need for platforms and projects to adapt to this local market.

2025 Prospects: The Optimal DEX Environment

The year 2025 may represent a pivotal turning point for decentralized exchanges. Here are some prospects:

- Enhanced scalability through Layer 2 solutions like Polygon.

- Integration of zk-Rollups to maintain privacy while enhancing throughput.

- Adoption of blockchain security standards that include the tiêu chuẩn an ninh blockchain necessary for building trust with users.

Conclusion: The Future is Bright for DEX

As we peer into 2025, the decentralized exchanges present a compelling strategy for the future of trading in cryptocurrency. Innovations in security, governance, and user engagement will position DEX at the forefront of the financial revolution. By remaining informed about industry developments, traders can leverage these sophisticated platforms to maximize their digital asset trading experiences.

Always remember to consult financial advisors and adhere to local regulations when engaging with cryptocurrency markets.

For the latest updates on cryptocurrency trends, stay tuned to cryptocoinnewstoday.

Author:

Michael Nguyen – A seasoned blockchain consultant, Michael has authored over 15 papers on blockchain technology and has led security audits for leading DeFi projects.