Crypto Fear and Greed Index Today: Insights for 2025

In the ever-evolving world of cryptocurrency, understanding market sentiments is crucial. The crypto fear and greed index today serves as a compass, guiding investors through the volatility and unpredictability of the crypto market. According to recent reports, over $4.1 billion was lost to DeFi hacks in 2024, highlighting the need for informed investment decisions. This article explores what the fear and greed index reveals today and how it can impact your investment strategies in 2025.

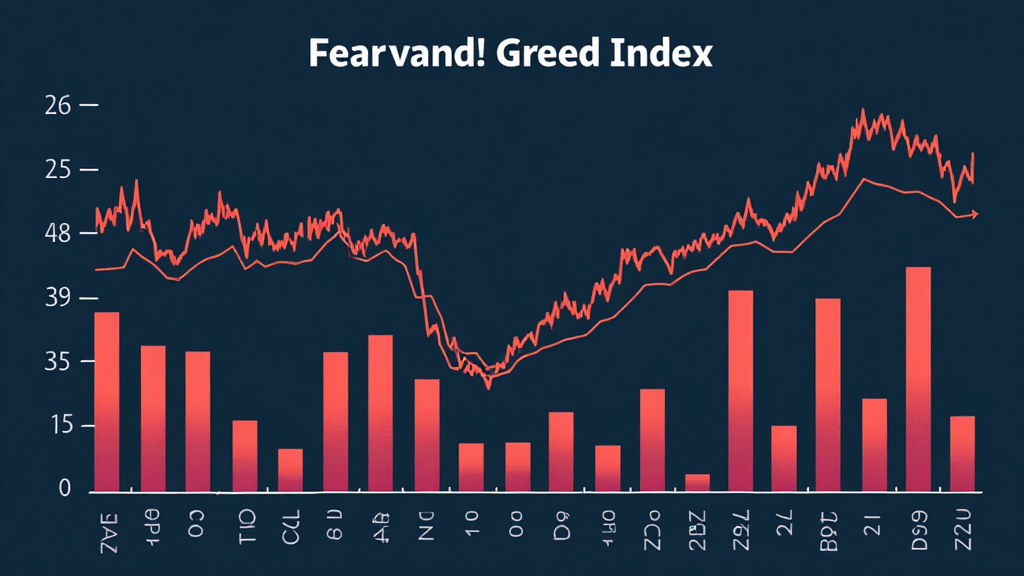

What is the Crypto Fear and Greed Index?

The fear and greed index is a tool designed to measure and quantify the emotional sentiment of cryptocurrency traders. It ranges from 0 (fear) to 100 (greed), providing insight into whether the market is currently in fear, extreme fear, greed, or extreme greed. When fear prevails, investors are more likely to sell off assets, leading to price drops. Conversely, high levels of greed can drive prices up as investors rush to buy, fearing they might miss out on a rising market. Understanding this index can help investors adopt a more strategic approach in managing their portfolios.

The Current State of the Crypto Market

As of today, the crypto fear and greed index leans towards fear, indicating that many investors are apprehensive about the market’s future. Factors contributing to this emotional state include regulatory uncertainties, recent hacks, and market corrections following all-time highs. For instance, Vietnam saw a 35% increase in crypto user growth rate over the last year, despite global market hesitations.

| Year | Global Crypto Market Growth | Vietnam User Growth Rate |

|---|---|---|

| 2021 | 200% | 25% |

| 2022 | 150% | 30% |

| 2023 | 180% | 35% |

| 2024 | -10% | Not available |

Source: Blockchain Research Institute

Why Fear and Greed Matter for 2025

As we look to 2025, the sentiment captured by the fear and greed index will play a pivotal role in shaping investment strategies. Here’s how:

- Risk Management: Investors can better manage risks by recognizing when emotions might cloud judgment. When the fear index is high, consolidating positions or taking profits might be prudent. Conversely, during periods of greed, it’s vital to remember the potential for corrections.

- Identifying Opportunities: The fear and greed index can signal good buying opportunities. When fear is high, prices drop, allowing savvy investors to acquire assets at lower prices.

- Strategic Planning: Utilizing the index helps investors align their strategies with market sentiment, increasing the chances of making informed decisions.

Regional Insights: Vietnam’s Unique Position

Vietnam is rapidly positioning itself as a significant player in the crypto landscape. As reported, the country saw a remarkable 35% growth rate in crypto users. This growth is fueled by regional demand for innovative financial solutions and an economy that increasingly embraces digital currencies.

This sentiment is echoed in local forums, where discussions around 2025’s most potential altcoins are active, highlighting a community driven by both fear and greed but ultimately striving for knowledge. Staying informed about local regulations and market trends is crucial for long-term success in this vibrant market.

Investing Strategies Using the Fear and Greed Index

Here’s a breakdown of how to leverage the fear and greed index for informed investment strategies:

- Dollar-Cost Averaging: This approach mitigates risk by spreading out investment amounts over time, allowing you to purchase more when prices drop.

- Regular Assessments: Continuously tracking the fear and greed index can help refine strategies and adjust to market changes.

- Educate Yourself: Understand the factors influencing market sentiments, such as regulatory news and global economic events.

Emotional Investing: Lessons Learned

History has shown that emotional investing often leads to poor decisions. For example, during the infamous peak in 2021, many investors bought in due to extreme greed, only to face massive losses when the market corrected.

Here’s the catch: maintaining a level-headed approach is essential. By using the crypto fear and greed index today as a tool, investors can counterbalance emotional decision-making. Remember to stay informed and regularly check the index as part of your investment toolkit.

The Road Ahead

As we move towards 2025, the landscape of cryptocurrency will continue to change at an unprecedented pace. Staying ahead means understanding emotional triggers and market dynamics. According to Chainalysis, 2025 will see a surge in institutional investment as regulations firm up, making crypto an integral part of the financial ecosystem.

Incorporating risk management and strategic planning into your investment approach will prepare you for the volatility ahead. Notably, consult with local financial advisors to stay compliant and make the most out of your investments. In Vietnam, the tiêu chuẩn an ninh blockchain (blockchain security standards) will be pivotal as regulations evolve.

This comprehensive understanding of the fear and greed index today and its implications for the future can bolster your readiness to seize opportunities while mitigating risks. With insights from crypto hub resources, remember to remain vigilant and proactive.

This content is for informational purposes only and is not financial advice. Please consult local regulations before making investment decisions.

Conclusion

In conclusion, the crypto fear and greed index today serves as a crucial tool for navigating the turbulent waters of cryptocurrency investment. By recognizing current market sentiments and aligning your investment strategies accordingly, you can position yourself for success in 2025 and beyond. As the market grows, so should your understanding and strategies. Remember the old adage: stay informed, stay invested.

Stay connected for further insights as we approach 2025 and continue to explore the depths of the crypto market for opportunities.

By Dr. Nguyen Thanh, a renowned blockchain researcher with over 20 published papers and leading various smart contract audits, this analysis aims to equip you with the necessary insights to thrive in the evolving crypto landscape.