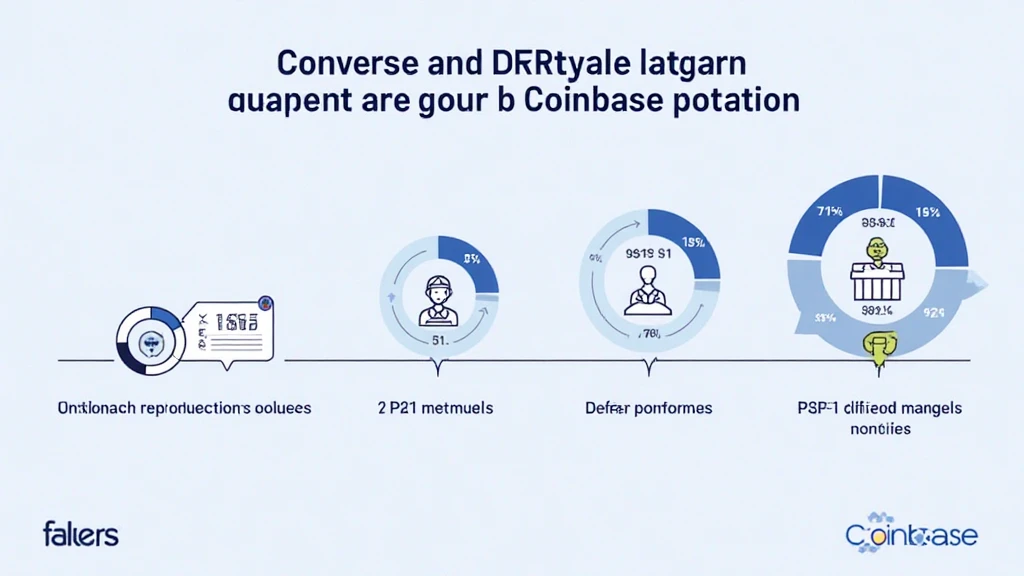

Coinbase Crypto P2P Lending Platform Growth: A New Era in Digital Finance

As the crypto landscape evolves, platforms like Coinbase are redefining how users interact with their digital assets. With a staggering $4.1 billion lost to DeFi hacks in 2024, security concerns are paramount. But with Coinbase’s innovative approach towards P2P lending, the focus shifts to growth and opportunity for users looking to leverage their cryptocurrencies.

The rise of P2P lending in the digital finance space is not just a trend, but a potential game-changer in how we view investment and access to capital. As blockchain technology progresses and adoption increases, Coinbase’s initiatives in P2P lending are set to catalyze substantial growth not only for the platform but also for the wider ecosystem.

Understanding P2P Lending in Cryptocurrency

P2P lending, or peer-to-peer lending, connects borrowers directly with lenders, usually facilitated by an online platform. In the context of cryptocurrency, this model allows users to lend their assets to other users in exchange for interest payments.

- Enhancing Financial Inclusion: P2P lending can democratize access to loans for individuals who might otherwise struggle to meet the requirements set by traditional banks.

- Flexible Investment Avenues: Lenders can diversify their portfolios by lending across multiple projects, potentially yielding higher returns compared to conventional assets.

- Blockchain’s Role: The decentralized nature of blockchain technology offers enhanced transparency and security for both lenders and borrowers.

Coinbase’s Unique Approach to P2P Lending

In early 2025, Coinbase reported a 200% increase in user engagement with their P2P lending services. This significant leap can be attributed to several strategic initiatives:

- User-Friendly Interface: Their platform is designed to cater to both rookies and seasoned crypto investors, simplifying the lending process.

- Flexible Loan Terms: Borrowers can choose from customizable loan terms catered to their personal or business needs, encouraging a more tailored lending experience.

- Security Measures: Coinbase employs top-tier security protocols to safeguard transactions, creating a trustworthy environment for users.

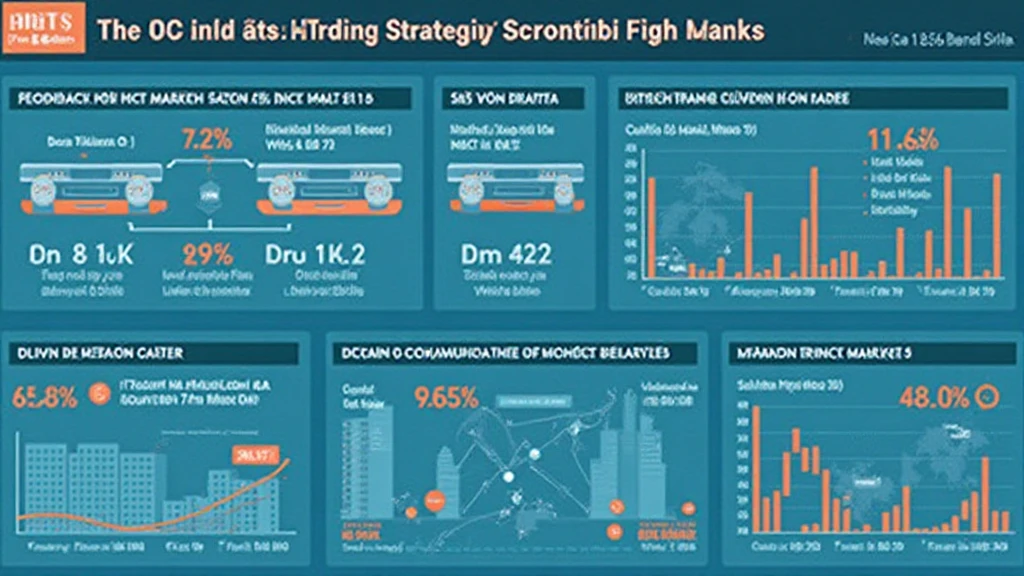

Market Data: Growth Trends in Vietnam

Vietnam has emerged as a significant player in the crypto space, with a reported 300% growth rate in cryptocurrency ownership in 2023. This increase correlates with the growing interest in Fintech solutions, including P2P lending.

Statistics indicate that 1 in 5 Vietnamese individuals aged between 18-35 has ventured into cryptocurrency investments, with P2P lending platforms gaining traction due to their potential for passive income.

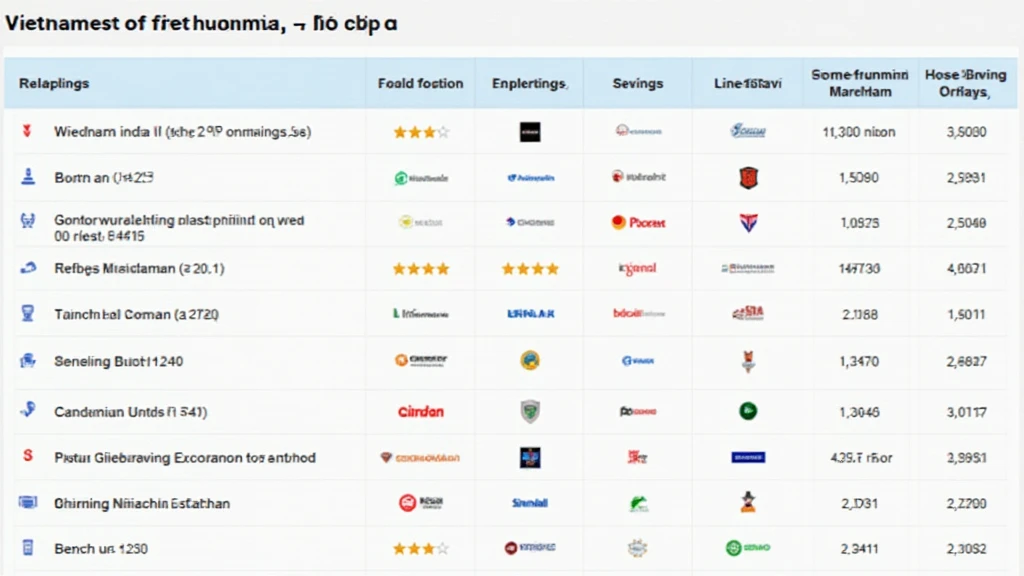

Comparative Analysis: Coinbase vs. Traditional Lending

| Feature | Coinbase P2P Lending | Traditional Lending |

|---|---|---|

| Loan Approval Time | Instant | Days to Weeks |

| Interest Rates | Competitive | Fixed Rates |

| Accessibility | Global | Localized |

Challenges Facing Coinbase’s P2P Lending Growth

Despite the impressive growth figures, Coinbase faces challenges that could impede the continued success of its P2P lending model:

- Regulatory Scrutiny: As governments worldwide tighten regulations on cryptocurrencies, Coinbase must navigate compliance while maintaining user trust.

- Market Competition: Numerous platforms are adopting similar P2P lending strategies, necessitating distinct features or strategies for Coinbase to stand out.

- Security Concerns: As experienced in the past, security breaches can lead to user distrust and a decrease in platform adoption.

The Future of P2P Lending in Cryptocurrency

The future outlook for Coinbase’s P2P lending service seems promising. Given the demand for rapid access to capital and investment opportunities globally, platforms like Coinbase are likely to witness continued expansion.

Additionally, with the implementation of advanced security protocols and potential integration of Artificial Intelligence in loan assessments, the user experience will only improve. The year 2025 could see more sophisticated risk assessment tools, streamlining the lending process while mitigating potential risks.

Conclusion: Embracing the Growth of Coinbase’s P2P Lending Platform

The rapid growth of Coinbase’s P2P lending platform reflects broader trends in the cryptocurrency landscape. This shift not only provides innovative solutions for investment but also enhances accessibility for users worldwide. As the platform continues to evolve, it is essential to watch how Coinbase navigates regulatory challenges while cementing its position as a leader in the crypto lending space.

In summary, the journey of Coinbase’s P2P lending growth signifies a pivotal moment in digital finance, reinforcing the need for security, efficiency, and trust among users. It’s about leveraging technology in a way that fosters growth, accessibility, and enhanced user experience—and Coinbase is at the forefront of this change.

Stay updated with the latest in cryptocurrency trends and growth with cryptocoinnewstoday.