Introduction

In the rapidly evolving world of finance, the rise of cryptocurrencies has brought with it a host of opportunities and challenges. With $4.1 billion lost to DeFi hacks in 2024, the need for robust mechanisms to manage and reconcile payments has never been greater. Bitcoin payment reconciliation serves as a critical process that ensures the accuracy and effectiveness of transaction records in this decentralized landscape. For businesses operating in this innovative sphere, understanding the intricacies of Bitcoin payment reconciliation is essential.

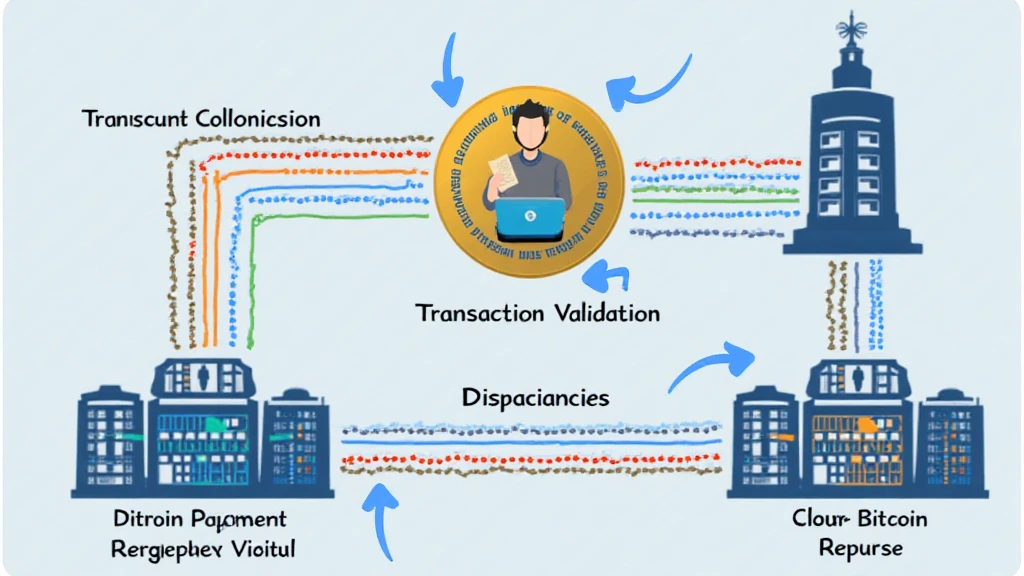

Understanding Bitcoin Payment Reconciliation

Bitcoin payment reconciliation refers to the process of verifying and matching Bitcoin transactions recorded in the blockchain with internal financial records. This critical procedure helps businesses identify discrepancies, prevent fraud, and maintain accurate financial statements. Here’s a deeper dive into what this entails:

- Transaction Validation: Each Bitcoin transaction needs to be validated against the blockchain to ensure its legitimacy.

- Record Matching: Businesses must compare their internal records to blockchain data to identify any mismatches.

- Reporting Discrepancies: Any discrepancies found should be reported and investigated to maintain financial integrity.

Why is Payment Reconciliation Important?

Just like a bank vault that protects physical assets, Bitcoin payment reconciliation acts as a safeguard for digital assets. Here are several reasons why this process is crucial:

- Fraud Prevention: By regularly reconciling transactions, businesses can uncover fraudulent activities early on.

- Financial Accuracy: Ensuring that recorded transactions match with blockchain entries helps maintain accurate financial statements.

- Regulatory Compliance: Many jurisdictions require businesses engaging in cryptocurrency transactions to demonstrate transparent financial practices.

Process of Bitcoin Payment Reconciliation

The process of Bitcoin payment reconciliation typically involves several key steps:

- Data Collection: Gather transaction data from both the blockchain and internal financial systems.

- Transaction Management: Identify each transaction’s status, whether it’s pending, completed, or disputed.

- Cross-Referencing: Cross-reference transaction records against payment confirmations from the blockchain.

- Discrepancy Resolution: Investigate any discrepancies and adjust records as necessary.

Challenges in Bitcoin Payment Reconciliation

While Bitcoin payment reconciliation is essential, businesses often face several challenges, such as:

- Volatile Prices: The fluctuating value of Bitcoin can complicate transaction value assessments.

- Blockchain Complexity: Understanding the blockchain’s technicalities can be daunting for many businesses.

- Regulatory Changes: The continually evolving legal landscape can create compliance challenges.

Best Practices for Effective Payment Reconciliation

To enhance the effectiveness of Bitcoin payment reconciliation, businesses can adopt the following best practices:

- Automated Systems: Utilizing software that automates reconciliation can minimize human errors and speed up the process.

- Regular Audits: Conducting regular checks and audits helps maintain transaction integrity.

- Training and Development: Invest in educating staff about cryptocurrency and reconciliation processes.

Local Insights: The Vietnam Market

As of 2025, Vietnam has experienced a staggering 150% increase in cryptocurrency users, reflecting the region’s growing interest in digital assets. This surge underscores the need for effective Bitcoin payment reconciliation strategies tailored to local businesses and users. In the Vietnamese market, regulations fluctuate, and local compliance practices must be assessed to ensure effective operations.

If you’re seeking additional insights, you might want to explore resources like hibt.com to enhance your understanding of reconciliation processes.

Conclusion

In conclusion, understanding Bitcoin payment reconciliation is vital for any business operating within the cryptocurrency space. By implementing effective strategies and best practices, businesses can achieve better financial accuracy, protect against fraud, and comply with evolving regulatory requirements. As we look ahead to future developments in this exciting landscape, the significance of efficient payment reconciliation continues to grow.

For further information on this topic, connect with cryptocoindaily. Not financial advice. Consult local regulators for compliance.

About the Author

Dr. Emily Tran is a blockchain researcher and cryptocurrency consultant known for her expertise in digital asset auditing. With over 20 published papers on blockchain technology and its applications, Dr. Tran has led numerous projects focusing on regulatory compliance and financial accuracy standards. Her contributions to the field make her a trusted voice in the cryptocurrency community.