Introduction

With cybercrimes causing a staggering loss of over $4.1 billion to DeFi hacks in 2024 alone, the importance of robust security measures for Bitcoin exchanges cannot be overstated. In an era where digital assets continue to rise in popularity, ensuring the security of these platforms is paramount. This article delves into effective security standards for Bitcoin exchanges designed to protect users’ assets while highlighting critical statistics, actionable strategies, and industry insights.

The value proposition of this article lies in its comprehensive overview of Bitcoin exchange security measures, focusing on best practices that every user should know. Understanding these measures ensures not just compliance with the latest regulations but also significant peace of mind for investors.

Understanding the Importance of Exchange Security

Imagine storing your physical money in a bank vault; similar protection is required for your digital assets in a Bitcoin exchange. The decentralized nature of blockchain technology does provide a certain degree of security, yet centralized exchanges are vulnerable if not adequately fortified.

Current Market Viability

According to Chainalysis 2025, the global cryptocurrency market is projected to grow to $7 trillion by 2025, leading to an influx of users into the digital asset ecosystem. With Vietnam showing a remarkable annual user growth rate of over 30%, the demand for secure trading platforms will only intensify.

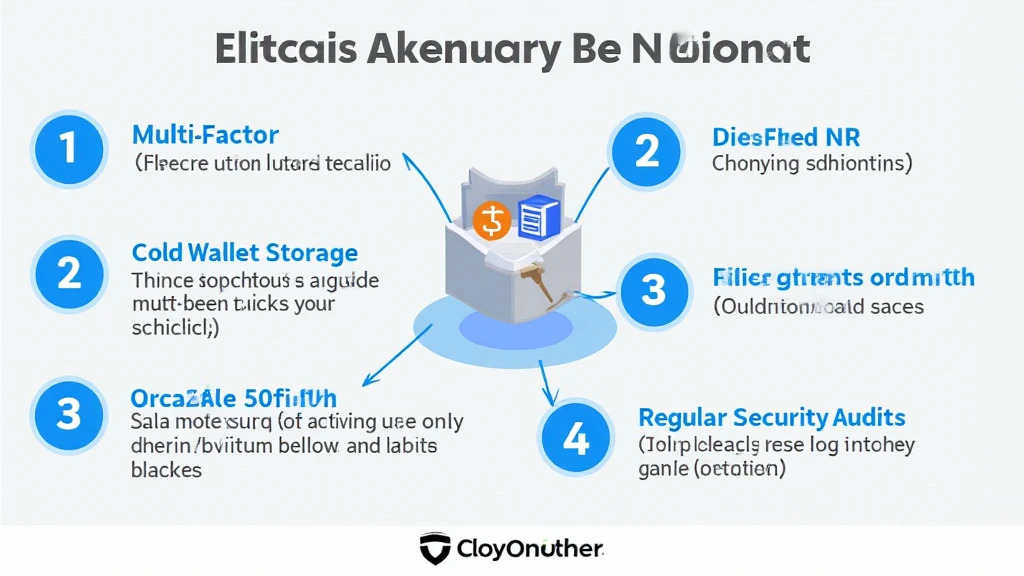

Key Security Measures for Bitcoin Exchanges

- Multi-Factor Authentication (MFA): Enhancing security by requiring multiple verification methods.

- Cold Wallet Storage: Storing the bulk of assets offline to prevent unauthorized access.

- Regular Security Audits: Performing frequent assessments to identify vulnerabilities.

- Encryption Protocols: Utilizing advanced encryption techniques to secure transactions.

Multi-Factor Authentication: A Must-Have

Multi-factor authentication is akin to having both a key and a fingerprint to access your virtual vault. It adds an additional layer, ensuring that even if one layer of security is bypassed, unauthorized access can still be thwarted. Bitcoin exchanges that frequently implement this security measure demonstrate a commitment to user protection.

Cold Wallet Storage: The Fortress Method

By using cold storage solutions akin to a bank’s vault that keeps physical cash secure, exchanges can significantly reduce the risk of hacks. Asset storage strategies like these mean hackers only have access to a small percentage of the assets stored in hot wallets.

Real-Life Data and Trends in Security Practices

| Year | Total Losses (in billions) | Causes |

|---|---|---|

| 2023 | 2.3 | Phishing, Hacking |

| 2024 | 4.1 | Smart Contract Exploits, Poor User Practices |

| 2025 (projected) | 5.75 | DeFi Vulnerabilities, Exchange Compliance Failures |

Regular Security Audits: Proactive Prevention

Conducting regular security audits is like having a health check-up for your exchange’s security framework. Well-executed audits will identify weak points and mitigate risks before they become expensive problems.

Encryption Protocols: Securing the Data Flow

By employing robust encryption protocols, exchanges can protect sensitive customer information from potential breaches. It’s vital to implement AES (Advanced Encryption Standard) for securing user data and transactions.

Emerging Trends in Bitcoin Exchange Security

As the cryptocurrency ecosystem evolves, so does the necessity for advanced security protocols. Here are some rising trends to keep an eye on:

- Decentralized Finance (DeFi) Audits: Increasing interest in auditing smart contracts has become a necessity to safeguard assets.

- Security Tokens and Compliance: Initiatives focusing on regulatory compliance will fortify exchanges against emerging threats.

- Blockchain Forensics: Monitoring and analyzing transactions to prevent fraud and money laundering.

Vietnam Market and Security Implications

The increasing interest from Vietnamese users adds another layer of urgency. Analysts expect that the Vietnamese crypto market will grow exponentially, pushing exchanges to adapt quickly and secure their platforms accordingly.

Efforts towards regulations, such as the tiêu chuẩn an ninh blockchain, will further enhance user protection and market stability.

Conclusion

As we head towards 2025, understanding and implementing effective Bitcoin exchange security measures becomes vital for both users and industry players. Secure platforms will gain user trust and ultimately thrive in this competitive space. By keeping up with advancements in security practices, such as multi-factor authentication, cold wallet storage, and regular audits, a safer trading environment can be ensured for all participants.

In essence, think of these protective measures as the fortifications that safeguard your digital treasures in the vast world of cryptocurrencies. Remember, investing in security is just as crucial as choosing the right assets.

For more insights on cryptocurrency security and trends, visit cryptocoinnewstoday.